This article is from the Australian Property Journal archive

POSITIVE sentiment emerging is turning the Brisbane and Perth office markets around following the resources sector downturn.

New research from JLL shows the national CBD office market vacancy rate was down by 1.0% over 12 months to 11.4% at the end of the first quarter of 2017.

JLL’s head of research – Australia, Andrew Ballantyne said the office sector is a barometer of business confidence levels across corporate Australia.

“Multiple reasons exist for optimism on the office leasing markets – economic growth is positive, a number of companies surpassed profit expectations in the half-yearly reporting season and job advertisement surveys have trended higher.

“From a demand perspective, Melbourne is the standout performer with strong net absorption recorded. Sentiment has turned positive in the resource-dependent markets of Brisbane and Perth and we have seen tangible signs of recovery in both markets,” Ballantyne said.

Colliers International data registered a 16% increase in total office area and 41% increase in total enquiries over the 12 months to Q1 2017, its Office Demand Index’s strongest start to a calendar year since 2009.

It also showed a 30% increase in the number of deals and a 56% increase in the area transacted over the same period, equating to 39 more deals and 63,000sqm more space.

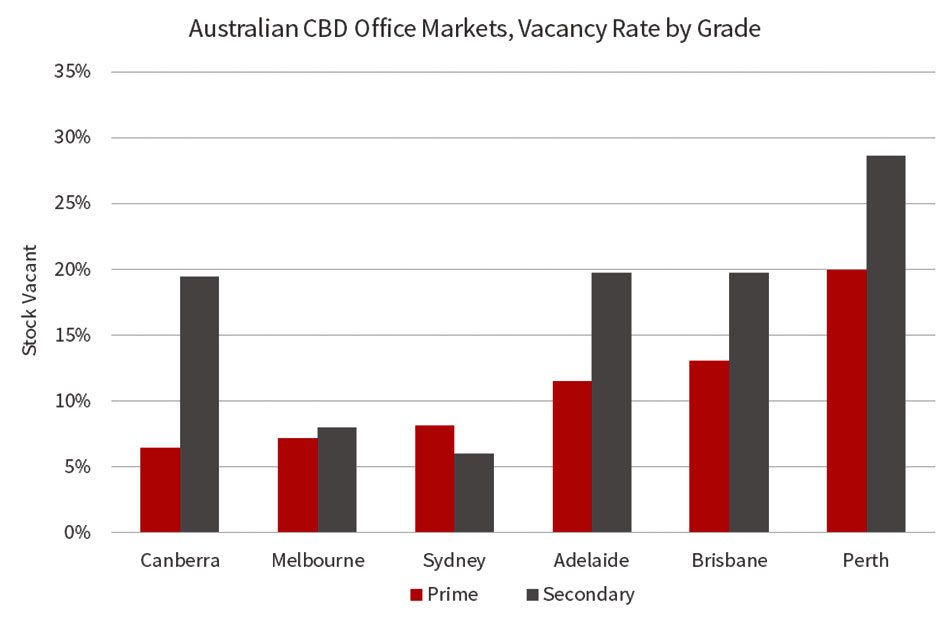

JLL found Brisbane’s CBD saw 9,800sqm of net absorption in the quarter as vacancy fell to 16.4%.

JLL’s head of office leasing Australia Tim O’Connor said prime gross effective rents were flat, providing further evidence that Brisbane is at the trough of the rental cycle.

“We are closely watching for a reversal in interstate migration trends and the affordability of Brisbane house prices relative to Sydney precipitating migration into SE Queensland. Population growth increases the demand for services and is positive for leasing enquiry and activity,”

Meanwhile, the 15,200sqm of net absorption seen in Perth was second only to Melbourne in the quarter. Vacancies fell to 23.3% as the gap widened between prime and secondary grade rates.

“Higher commodity prices have positively impacted sentiment in the Perth CBD office market. We have seen a sharp reduction in sub-lease availability as miners and their service providers withdrew space, while the value proposition of the CBD has stimulated centralisation activity,” O’Connor said.

Ballantyne said landlords in Brisbane and Perth would be closely watching the improvement in leasing market activity to assess the depth and quality of enquiry, ultimately looking for opportunities to scale back incentives.

He said Melbourne CBD’s 36,800sqm of net absorption was its best numbers since 1978. Vacancy fell to 7.5%.

“Melbourne is a microcosm of corporate Australia and the broad-based industry sector take-up in the Melbourne CBD is reflective that the net balance of Australian companies are in expansionary mode,” Ballantyne said.

Prime gross effective rents were up 4.2% over the quarter and jumper 14.3% over the year, as landlords also pulled back on incentives.

Sydney outpaced Melbourne’s rental growth over both periods, at 7.3% and 22.6% respectively.

Net absorption in the quarter was at 2,200sqm, affected by a lack of contiguous space.

Vacancy is down to 7.3% and is set to fall further with strong enquiry and activity across space within International Towers Sydney at Barangaroo South.

CBD sectors Core, Midtown and South all returned tight vacancy rates of 5.9%, 3.6% and 1.4% respectively, whilst similar numbers were seen outside of the CBD at Sydney Fringe with 3.3%, Parramatta at 3.6% and Sydney South at 6.3%. Parramatta’s numbers are the lowest since 1990.

“A shortage of contiguous space options in Sydney and Melbourne will lead to higher tenant retention rates over 2017 and 2018. Tenants will need to explore the potential for pre-commitment if they want to secure office space that supports the growth objectives of their organisation,” Ballantyne said.

Canberra vacancies were flat at 11.7% overall, but its prime grade vacancy is the lowest across CBD office markets at 6.4%, and the lowest since the second quarter of 2008.

“While Canberra does not experience the same rental volatility as Sydney and Melbourne, limited options in Civic and Barton is exerting upward pressure on rents.” Ballantyne concluded.

Prime gross effective rents were up by 1.4% in the quarter and by 2.4% over 12 months.

A modest fall in the Adelaide CBD’s vacancy to 16.7% came on the back of firmer demand for better quality assets, with prime vacancies at 11.5% and secondary vacancies at 19.7%.

Australian Property Journal