This article is from the Australian Property Journal archive

AUSTRALIAN asset managers’ total real estate assets under management (AUM) dropped 17.1% from 2022 to 2023, according to a new survey, with a reshuffle of the rankings seeing Charter Hall taking top spot as Australia’s largest real estate fund manager.

Total real estate AUM held by Australian asset managers stood at $279 billion, according to the latest Fund Manager Survey by industry associations ANREV, INREV and NCREIF, which collates and explores the real estate AUM of fund managers globally.

The figure was down from the $337 billion recorded a year earlier.

Despite some changes in the sample, all the managers who participated in last year’s survey saw their real estate AUM, decrease apart from The GPT Group who saw a minor increase of 0.5%.

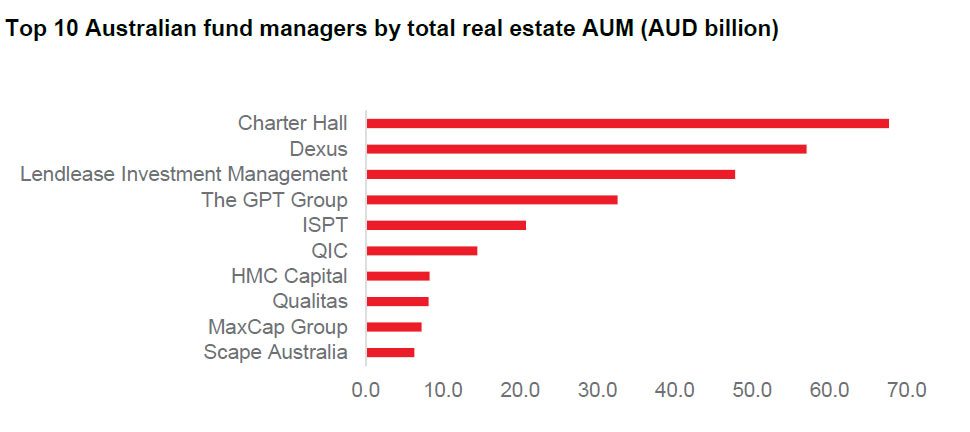

Charter Hall took top position as Australia’s largest real estate fund manager by AUM globally, totalling $68 billion in 2023.

Among the largest five managers, Lendlease Investment Management maintained third position with a reported $48 billion, Dexus is in second place, registering $57 billion, while the GPT Group is at $33 billion and ISPT at $21 billion.

There was no change in the ranking when focusing solely on AUM in the Asia Pacific region, with Lendlease Investment Management at $41 billion, reflecting Lendlease’s higher degree of diversification outside of the region.

In the global ranking of fund managers by Asia Pacific real estate AUM, Charter Hall and Dexus ranked fourth and fifth, respectively, while Lendlease is in ninth position and GPT is in tenth position. Logistics giant ESR secured the top spot, with $196 billion allocated to real estate in Asia Pacific, followed by GLP Capital Partners with $118 billion and CapitaLand just behind with $117 billion.

“Despite a challenging year marked by declining values and reduced capital raising, Australian asset managers’ real estate AUM still showed resilience in 2023, given Australia’s strong positioning as an established institutional real estate market with a high level of transparency which should continue to attract investors,” said Amélie Delaunay, senior director of research and professional standards at ANREV.

Declining office asset values has impacted the AREITs sector, particularly Dexus which sold 44 Market Street last year for $393.1 million, representing a 17.2% discount to book value.

Meanwhile a recent CBRE report found Australia faces the largest funding gap in the Asia Pacific region.

CBRE’s The Debt Funding Gap for Asia Pacific Real Estate report shows Australia faces a funding gap of US$4.6 billion, followed by Mainland China at US$2.9 billion.

And the market has not bottomed out. CBRE predicts Australian office markets are expected to record further capital declines in 2024.

Despite the limited capital raising, CBRE said investors are keeping their powder dry, as available capital for commercial real estate remains elevated. Approximately 41% of unallocated real estate capital worldwide is targeting opportunistic and value-add strategies.

Total real estate AUM worldwide was $4.1 trillion in 2023, marking a second year of contraction from the 2021 peak of $4.7 trillion.

The total AUM of the top 10 managers exceeded US$2.1 trillion. Blackstone topped all comers, with more than US$520 billion (around $783 billion) in real estate AUM, followed by Brookfield Asset Management, Prologis, MetLife Investment Management, and UBS.

Accounting for 82% or US$3.4 trillion, non-listed real estate represents the largest share of the total real estate AUM. More than half (US$2.0 trillion) is invested through non-listed real estate funds.

By style, globally core represents 67% of the total AUM of fund managers, with the lowest percentage being in Asia Pacific at 52%, as opportunistic strategies represent 36% of the fund managers’ AUM in the region.