This article is from the Australian Property Journal archive

THE outlook for industrial property continues to be positive thanks to e-commerce and technological changes, according to Goodman Group, which posted a first half year operating profit of $421.3 million, up 8.5% on 1H17.

Operating earnings per share (EPS) of 23.3 cents, up 7.9% on 1H FY17. The group has upgraded its forecast FY18 EPS to 46.5 cents, up 8% on FY17, with forecast full year distribution of 28.0 cents per security, up 8% on FY17.

CEO Greg Goodman said the group’s deliberate strategy to reposition its portfolio into global gateway cities is paying off.

“In the last five years, we have sold over $11 billion worth of assets to focus on core markets, moved 80% of the $3.5 billion development workbook into Partnerships and reduced gearing from 19.4% to 6.4%% – all while delivering 7.6% p.a. EPS growth over this time.

“The $3.0 billion in asset sales transacted in the half, substantially concludes the portfolio repositioning programme into global gateway cities, where increasing urbanisation, rising consumerism and changes in technology, are creating increased competition between residential, higher intensity industrial, e-commerce and data centre uses.

“This is driving rents and land prices in locations where supply is already constrained and is increasing the value of our 17.4 million sqm under management which saw $1.2 billion in valuation uplift in the first half,” he added.

Goodman said the outlook for industrial real estate continues to be positive as the macro trends impacting the sector continue unabated.

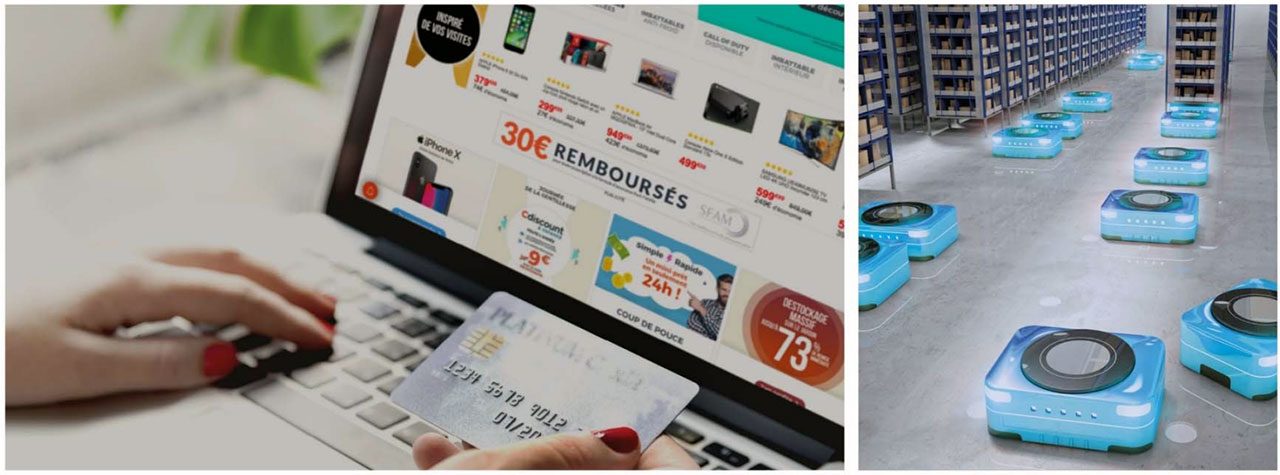

“E-commerce and technological solutions are driving change in all forms of consumer service fulfilment, and will continue to transform supply chain and space requirements.

“We are taking a long-term view of the cities we operate in and are adapting to help our customers take advantage of the opportunities that changes in technology and urbanisation will bring,”

“Increasing urbanisation, rising consumerism and changes in technology, are creating increased competition between residential, higher intensity industrial, e-commerce and data centre uses, driving rents and land prices in areas where supply is already constrained.

“Scarcity of sites in infill areas close to urban centres and consumers, combined with competing demand for quality locations, is creating land use intensification. We are increasingly seeing a shift towards multi-storey industrial facilities or changes of use to commercial and residential.

“Given the strong first half performance and sustained momentum into the second half, forecast FY18 operating EPS has been upgraded to 46.5 cents (up 8% on FY17) with forecast full year distribution of 28.0 cents per security (up 8% on FY17).” Goodman concluded.

Australian Property Journal