This article is from the Australian Property Journal archive

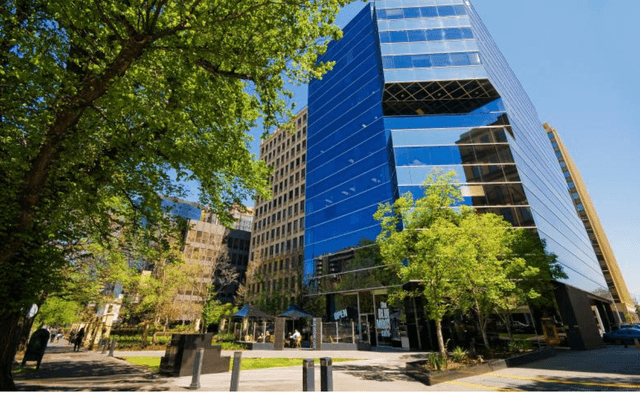

THE St Kilda Road and Southbank office markets have seen a sharp increase in vacancy rates over the past six months, but there is light at the end of the tunnel.

According to Colliers International’s St Kilda Road and Southbank Office Market Indicators Report, the sharp rise in vacancies was driven by the completion of South Wharf and tenant relocating to the Docklands.

The vacancy rate on St Kilda Road increased from 8.9% mid 2009 to 11.3% at the start of 2010.

Research manager Amita Mehrotra said although it is likely that rental growth will be subdued over the next six months, she expects they will begin to rise again towards the end of the year as tenant demand picks up and vacancy declines.

Investment sales director Nick Rathgeber said St Kilda Rd and Southbank generally follow the trends of the CBD in terms of yields and activity, with a six to nine month lag.

“This will be the case again in this cycle, and we expect this time the growth will happen to a greater degree than in the previous cycle, given the economic outlook for Melbourne and decreasing quantity of stock in the St Kilda Rd region,” he added.

Southbank vacancy also rose from 5.8% mid 2009 to 11.1% at the start of 2010, but unlike St Kilda Road, tenant demand remains strong with net absorption remaining positive for 2009. South Wharf added 21,450 sqm to total office stock in the Southbank market and was well received towards the end of construction in late 2009, despite depressed economic conditions during marketing.

Associate director of office leasing Ben Christie said the movement away from St Kilda Road during this time was not due to tenants being unhappy with the location.

“Most tenants are very happy with the area and want to stay, however for corporate tenants who are growing or expanding, the area just doesn’t offer and abundance of the kind of contiguous space and large floor plates that they are after.

“Many of the new tenants relocated from St Kilda Road and the suburbs to Southbank, driven by competitive deals, as well as the availability of significant amounts of car parking close to the CBD,” he added.

Colliers International’s research found net face rents dropped between 2009 and 2010 in St Kilda Road.

Christie said the area now offers exceptional value for money relative to similar space in the CBD and fringe. Research shows A-Grade rents now range from $250-$280 per sqm, a decline from $260-$290 per sqm, compared to Melbourne CBD rents of $357-$416 per sqm.

Southbank also experienced a drop in net face rents with A-Grade face rents declining from $330-$395 per sqm to $320-$385 per sqm. Mehrotra said the rate of decline is fairly marginal and she predicts it will begin to increase again towards the end of 2010.

Yields have softened considerably since early 2009 with A-Grade yields ranging from 8.75-9.75% along St Kilda Road and 7.50-8.25% in Southbank. B-Grade yields have reached 9-10% along St Kilda Road and 8.75-9.75% in Southbank.

Rathgeber said the decrease in supply would mean an increase in demand pressures from tenants and ultimately deliver significant yield compression in 2012. With the completion of South Wharf, there are no new projects expected to be completed for at least the next two years in either Southbank or St Kilda Road.

The only change to total supply will be the conversion of 470 St Kilda Road (Becton building) to residential, which will thereby reduce total stock in St Kilda Road by 6,500 sqm and contribute to a decline in the vacancy rate in 2011.

Christie said whilst there is a lot of talk of residential conversions in the St Kilda Road precinct, the buildings that are being converted and/or knocked down to make way for residential development are buildings that no longer hold much value in the current office market.

“They are generally two to three storeys at most, with floor plates of around 500 sqm or less, which render them dated and almost obsolete in meeting major tenant demand,” he added.

Meanwhile Rathgeber noted that institutional investors continue to sell down their assets in the St Kilda Road precinct, as they deem them non-core, whereas private investors are embracing the market. Last year, investment activity remained stable, with a total of five transactions totalling $137.8 million, following total sales of $97.25 million in 2008. The only purchasers have been private investors while property funds have been the main vendors.

Australian Property Journal