This article is from the Australian Property Journal archive

DESPITE COVID-19 and a $16 billion revenue blow to the higher education sector, Singaporean Wee Hur Holdings has a snapped up a BP service station in Sydney’s Redfern for $46.1 million, with plans to a develop a purpose built student accommodation (PBSA) facility.

Wee Hur has acquired 104-116 Regent St Redfern from energy giant BP Australia in a deal negotiated by Savills’ Stuart Cox, Neil Cooke and Johnathon Broome.

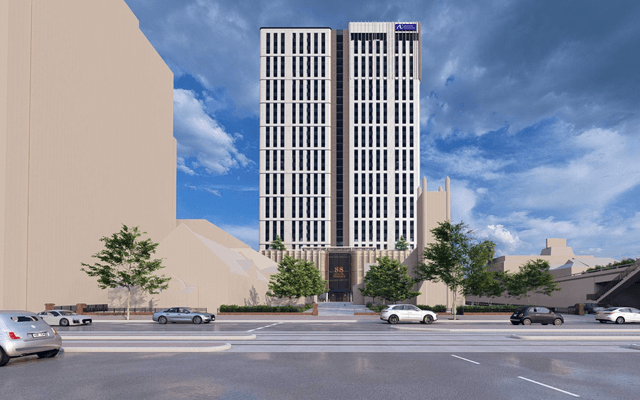

The 1,366 sqm site has three street frontages and offered a Floor Space Ratio of 7:1 with 18-storey height limit with a 20% PBSA bonus FSR available.

Wee Hur, through a new fund, intends to raise approximately $50 million to developing the property into a PBSA facility with approximately 384 beds, subject to receiving development approval.

The group said the property is located near two major international universities and is in close proximity to public transport infrastructure. The property is adjacent to two other PBSA sites that the group already owns via its subsidiary, at 13-23 Gibbons St Redfern and 90-102 Regent St Redfern.

The acquisition will bring the total number of beds in PBSAs managed by the group in the catchment to approximately 1,300 beds.

“The acquisition is in line with the group strategy to venture into Australian-focused purpose-built student accommodation and fund management business.” Wee Hur said.

The acquisition is a major vote of confidence for the student accommodation sector which reeling from coronavirus and travel restrictions. Wee Hur began ramping up activity in the sector two years ago.

Australian universities grew their international student base by 79% over the decade 2019, to more than 360,000, according to the Department of Education, while revenue per student rose by over 50% in the 10 years to 2019.

However, a Universities Australia report estimates Australian unis could lose $16 billion by 2023 because of the pandemic.

Revenue losses for the remainder of 2020 are also likely to increase, now estimated at between $3.1 billion and $4.8 billion. Previously UA had estimated the shortfall at between $3 billion and $4.6 billion.

Approximately 5,600 full time jobs have been lost and another 17,500 casual and research positions are expected to go, equivalent to 9.5% of Australia’s higher education workforce.

Some unis have taken to selling their property holdings to free up capital, including Western Sydney in Kingswood and RMIT in the Melbourne CBD and Swinburne.