This article is from the Australian Property Journal archive

FORECASTS see the Brisbane CBD office market vacancy rate tightening through to the middle of 2024, with no new supply and tenant demand ongoing, prompting landlords to refurbish older buildings due to high construction costs.

According to Knight Frank’s latest Brisbane CBD Office Market Report, the CBD market hasn’t seen any new construction since early 2022, when 80 Ann Street was completed.

This lack of new product, beyond refurbishment, is expected to hold until late-2024, when 205 North Quay is anticipated for completion.

“The lack of supply means that net absorption directly translates into a fall in the vacancy rate with sustained reduction expected through to mid 2024,” said Jennelle Wilson, report author and partner, research and consulting at Knight Frank.

“There are also likely to be withdrawals of smaller buildings for refurbishment or potential redevelopment, with likely candidates including 41 George Street in 2023, and 150 Charlotte Street and 140 Elizabeth Street in the second half of 2024.”

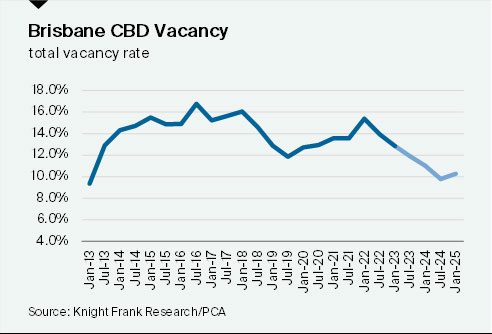

Wilson added that the vacancy rate is expected to fall below 10% for the first time in more than ten years in 2024, before a surge in new supply and refurbished space, which will keep the rate in double digits through to 2027.

The disparity in rates across different grades is also increasing, with premium grade assets seeing high rental growth as a result of its 5.9% vacancy.

Meanwhile, the A grade vacancy rate is at 17.9%, while B grade has fallen below 10% for the first time since mid-2012.

At the same time, prime gross face rents were up to 7.2% to $853/sqm in the year to April 2023, while incentives averaged 41%, with face rents expected to grow to 4.9%.

“Incentives are expected to remain a significant part of the market, but there may be some falls from the current 41 per cent average to 39 per cent in 2025 and 2026,” added Wilson.

Mark McCann, head of office leasing Queensland at Knight Frank, noted tenant competition was resulting in strong rental growth for best-in-class assets, as confidence and activity surged with high net absorption over the last 12 months.

“We saw positive net absorption of 87,000 square metres-plus in 2022, which was the highest annual net absorption for six years; the result of growth across corporate tenants plus continued strong growth amongst small to medium enterprise tenants,” said McCann.

“This strength was in contrast to the major southern capitals where exposure to financial and TMT tenants saw more muted results.”

McCann added that underlying general growth in Brisbane is expected to maintain positive momentum, though changes in the economic environment may lead to moderating net absorption in the market.

“Queensland’s economy is strong and Brisbane is thriving, bolstered by the significant infrastructure investment, inwards migration and 2032 Olympics,” added McCann.

“The extent of the existing infrastructure spend, in addition to the Olympics 2032 capital works program provides an exciting platform to the Brisbane office market to outperform other states over the next 10 years.”

Tenant activity in the Brisbane CBD has also been rising over the last year, reflecting strong confidence against more challenging economic conditions.

Over March, there was a significant increase in activity, with 22 briefs released, the greatest level over the last year, and almost double March 2022’s 12 briefs.

While the number of tenant briefs for Q1 2023 totalled 45, compared to 37 at the same time in Q1 2022.

“The continued increase in construction costs is stifling the prospect of new developments in the CBD, providing an opportunity for existing assets to leverage market conditions with capital upgrades to accommodate future demand,” said McCann.

“Amid a strong preference for fitted spaces, landlords are adopting strategies such as refurbishing existing fitouts to offset high construction costs and promote sustainable building practices.”