This article is from the Australian Property Journal archive

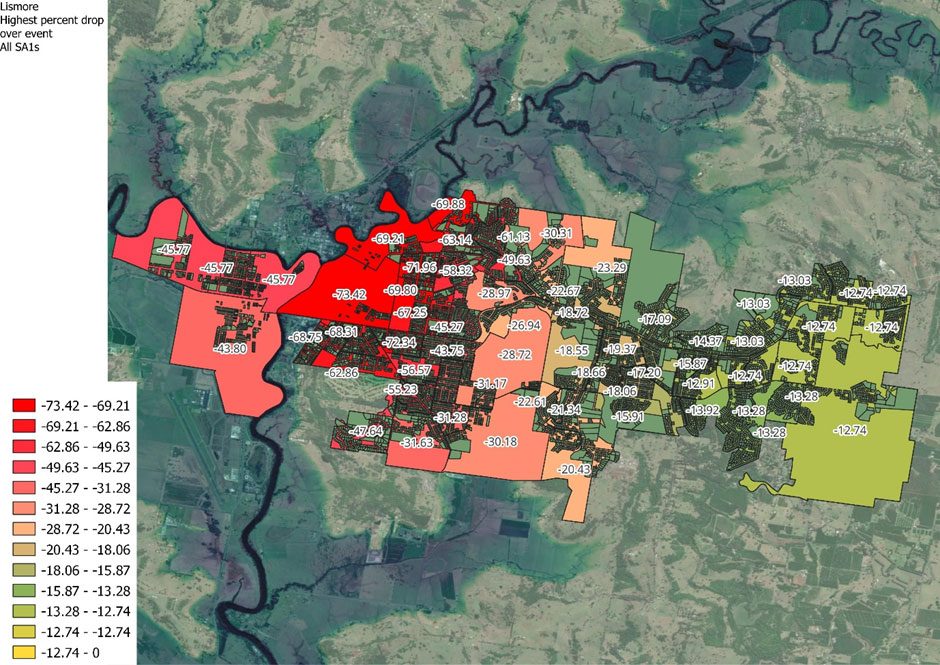

REGIONS impacted by major climate events have struggled to recover, with land values in Lismore, New South Wales cut in half since the 2022 floods.

According to the latest analysis by PointData, land values impacted by significant climate events can potentially fall to levels that threaten saleability and in turn increase the risk of arrears and foreclosure.

Additionally, financial institutions and insurers are reportedly increasingly applying insurance “no go” zones and severe loan-to-value ratio restrictions.

“The combination of climate events and a market slide can be devastating on householders, and also puts the financial sector at significant risk,” said George Giannakodakis, founder at PointData.

“An example of this played out in the 2022 Lismore Floods, where low lying properties were hit by both the flood event in early 2022, and later by the impact of rising interest rates, leading to properties on average losing as much as 60% in flood affected areas, and a further 13% as a result of interest rate increases.”

While the state government released the Lismore Flood Recovery Planning Package to support the region, this only resulted in a small recovery.

With North and South Lismore property values were still down around 30% on average at the end of 2023.

“The flow on impact is that entire postcodes or suburbs are often then classified as ‘no go’ zones by banks and insurers, as the risk of further flooding, or climate related events remains,” added Giannakodakis.

Analysis from the Climate Council found extreme weather and climate change will leave one in 25 homes in Australia uninsurable by 2030, with that number rising to one in seven in the country’s 10 most at risk electorates when it comes to climate impacts.

While research found millions of dwellings built before the introduction of regulations for housing energy performance are not suitable for the current climate, with the problem worsen as the impacts of climate change become more apparent.

Broad “no go” loan and insurance postcodes, or area wide applications of risk, often lack the nuance to reflect the level of climate impact at an individual address or property.

PointData recommends a property level assessment of building risk across all residential properties.

This includes mitigation approaches via building codes embedded in planning overlays for new builds and future development.

In addition to recommending a climate adjusted loan-to-value ratio for banks to precisely inform the financial sector of future risks at a property level.

“As an industry, we need to find solutions that spread the risk of climate-related events to mitigate the potential for ‘climate ghettoes’. Innovation and technology should be at the centre of the solution to enable protections for homeowners, while mitigating the risk for banks and insurers,” concluded Giannakodakis.