This article is from the Australian Property Journal archive

A FULLY leased four-level Hobart CBD building has traded for around $2.65 million, at a 4.15% yield that sets a new benchmark for freestanding retail assets in the capital in 2019.

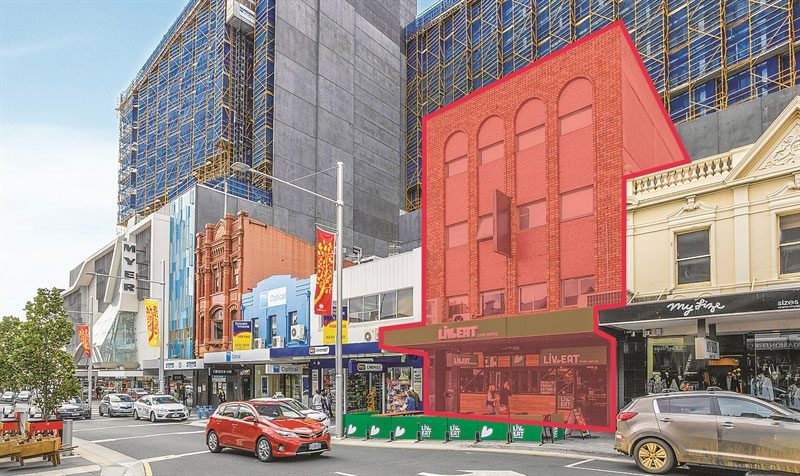

Knight Frank’s Richard Steedman and Matthew Wright sold 118 Liverpool Street.

The agents said the sale price of the 554 sqm building reflected a lettable area rate of circa $4,785 per sqm, and land rate of $12,504 per sqm.

“This asset was hotly contested with multiple final offers lodged at the closing of our expressions of interest campaign,” they said.

“The number of enquiries and subsequent final round offers further shows how strong the market remains for retail assets with quality lease covenants.”

Health food operator Liv-Eat has a secure lease until January 23 with two seven-year options.

The building is centrally located in the city, near the entrance to the new Myer store, and was marketed with value add potential through rental growth or redevelopment of the upper levels.

Australian Property Journal