This article is from the Australian Property Journal archive

INDUSTRIAL rents are heading for their second highest-ever year of growth in 2023 – behind only last year – with some Sydney precincts currently tracking at more than 20% growth, but more balance is tipped to return to the market in 2024.

Gross State Product (GSP) weighted prime net face rents increased by 4.2% quarter-on-quarter nationally over the September quarter, substantially above average quarterly growth, according to new data from JLL. It follows similarly strong rental growth of 4.4% and 4.5% 4.4% in the March and June quarters respectively.

Rental growth in 2023 year-to-date has reached 13.6% over the first three quarters. The only year to surpass this is 2022, which peaked at 22.9% year-on-year, marking the strongest annual growth since JLL began tracking the market in 1989.

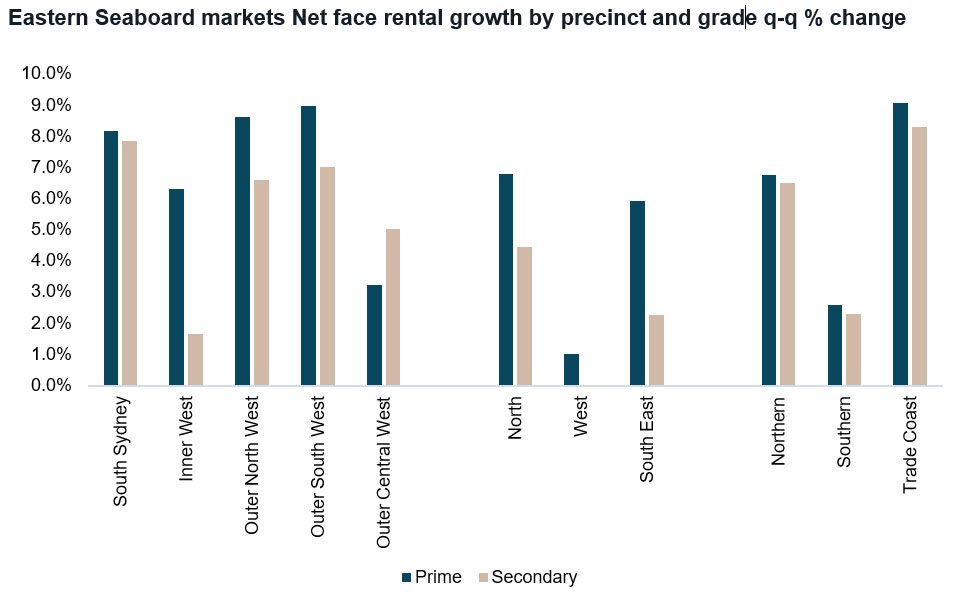

Sydney precincts recorded the steepest rises in prime net face rents over the quarter. South Sydney increased by 8.2% during the quarter to $344 per sqm and is now sitting at 27.4% annual growth. Rents in the outer north west lifted 8.6% and 21.0% quarterly and annually respectively, and by 9.0% and 23.3% in the outer south west.

Secondary assets net face rents also grew strongly in these precincts, ranging between 6.6% in the quarter in outer north west and 7.7% in south Sydney.

Brisbane’s northern and Trade Coast precincts recorded strong prime and secondary growth for the quarter, up 6.8% and 10.7% quarterly and yearly in the northern precinct and by 9.1% and 24.2% in the Trade Coast.

Conversely, rental growth in the southern precinct slowed, at 2.6% over the quarter and 13.4% yearly.

In Melbourne, rental growth in the north (up by 6.8% quarter-over-quarter, 27.2% year-over-year) and south east (5.9% and 16.7%) continues to show strength, while prime asset rental growth in the west has moderated.

“Strong rental growth is reflective of ongoing still tight market conditions in most eastern seaboard precincts. Demand is moderating as rising inflation challenges downstream customer demand, and as many businesses return to the ‘just in time’ inventory management model reassessing occupancy requirements now that supply chains are normalizing,” said JLL’s head of strategic research – Australia, Annabel McFarlane said.

“However, to date the supply response has been slow to respond to strong rental growth and low availabilities.”

Adelaide’s prime market performed well, with most precincts experiencing quarterly rental increases. These ranged from 3.4% in the inner west/east to 11.2% in the outer north.

Rental growth in Perth and Adelaide’s secondary market has stalled.

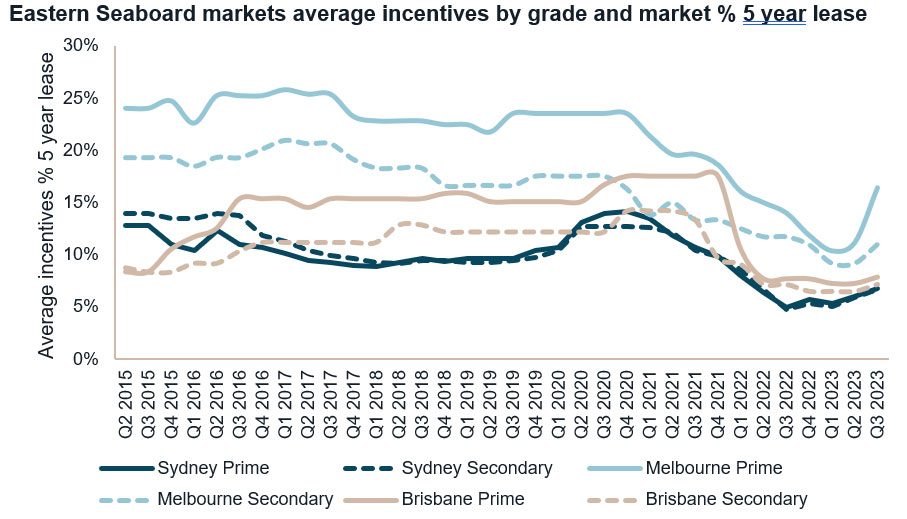

McFarlane expects conditions to ease for tenants over the last months of 2023 and 2024, rental growth rates to moderate and incentives to cycle up. JLL is tracking 2.5 million sqm of stock under construction nationally, and a new record for quarterly supply, 1.15 million sqm, is expected to complete over the last three months of 2023.

“Pre-commitment levels are building but still relatively low at 40%, meaning a return to a more balanced market for 2024,” McFarlane said.

Gross take-up in the September quarter was 533,320 sqm, below the quarterly average and lower than the heightened levels recorded in the June quarter of 819,100 sqm. It also fell short of the 15-year quarterly average of 606,100 sqm.

National supply picked up to 454,740 sqm in completions, following two previous quarters of below-average totals.

Meanwhile, as demand moderates and supply picks up landlords and developers are increasing incentives from their record lows to secure tenants.

The most significant change in average incentives was recorded in Melbourne’s north where incentives reached a record low of 8% in early this year and are now sitting at 20%. Average incentives are in single digits across all Sydney precincts but have increased very slightly in some precincts.

Incentives in Brisbane precincts remain well below historical average and range between 7% and 8%, depending on precinct.

“We have seen enquiry levels moderate and some pushback on steep rental increases. Those groups that require expansion space are increasingly looking for short-term leases in nearby premises and pushing longer-term decisions down the road, responding to an uncertain business environment” said JLL’s head of industrial & logistics – Australia, Peter Blade.

Sublease is increasing in key markets as opportunistic occupiers tap into positive rental reversion potential for underutilized space. Whilst not all these options are great, typically the offered sublease rentals under-cuts the rental levels available for direct leased space.

“Tenants now have more choice and landlords and developers need to compete harder to secure leases. Developers are opting to secure preleases at an early point in the building construction period. We expect this trend to continue,” Blade said.