This article is from the Australian Property Journal archive

VALAD has paid $277.3 million to buy a portfolio of retail depots and packaging plants operated by Carter Holt Harvey.

Valad has bought the properties on a sale and leaseback arrangement. The portfolio is being acquired on a yield of 7.1% with a nine year lease plus two six year options to Carter Holt Harvey.

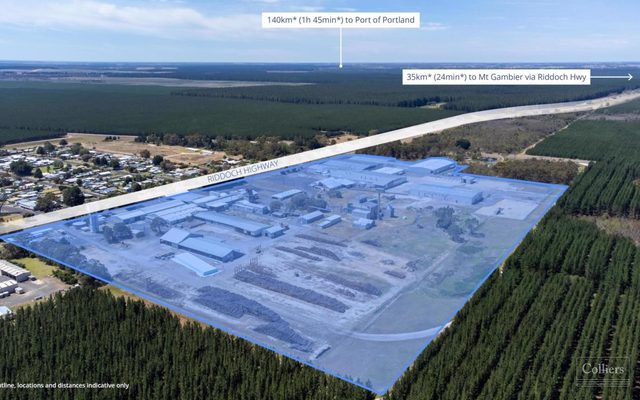

The portfolio consists of 15 Carters retail warehouse depots in New Zealand, 10 packaging plants and an office property in Auckland. Five of the packaging plants are in Australia and five development sites on the North Island of New Zealand. Whilst the 15 retail warehouse depots are located throughout the North Island with two are located on the South Island, in Christchurch and Invercargill. The packaging plants include carton printing and manufacturing operations, with two of the assets being in New South Wales, one in Victoria, one in Queensland and one in South Australia.

The packaging plants and Auckland office property will be acquired on behalf of Valad Property Trust for $160.3 million, whilst the $48 million portfolio of Carters depots are earmarked for a new Valad managed fund. The development sites were acquired for $69 million on behalf of Valad Funds Management Limited.

Purchase of the New Zealand assets is subject to approval by the Overseas Investment Office.

Valad’s head of real estate investment capital transactions Mark Frinsdorf said the Carter Holt Harvey transaction represents a unique opportunity for Valad Property Trust to secure a significant industrial portfolio in two national markets that continue to show steady and consistent growth.

Frinsdorf said the Carter Holt Harvey portfolio will be managed and enhanced to take advantage of its considerable development potential.

“Through the ‘tenant is king’ approach, we will develop a strong relationship with Carter Holt Harvey and work with them to improve the quality of the portfolio and unlock any value-add opportunities,” he added.

Frinsdorf said that the property markets in New Zealand and Australia are forecast to remain strong.

“In particular, the New Zealand property market has bounced back this year, showing considerable resilience with declining vacancies and rising rents.” he concluded.

The packaging plants include carton printing and manufacturing operations, with two of the assets being in New South Wales, one in Victoria, one in Queensland and one in South Australia.

Valad’s chief operating officer Jeff Locke said the group remains on the lookout for great opportunities like this locally and abroad.

“While our recent deal with Scarborough in the UK and Europe has received a lot of attention, the Australasian market remains a core operation for Valad and we will continue to allocate significant resources to this part of the world,” he added.

Yesterday, Valad also successfully completed an entitlement offer raising $1.2 billion from the issue of 621,154,332 million new securities which were issued at $1.92 per security.

Proceeds from the offer will be used to repay debt raised to fund the acquisition of Scarbourgh, a pan European property and funds management platform with operations in 11 countries.

Under the terms of the acquisition of Scarborough, the vendors agreed to re-invest approximately $140 million of their sale proceeds into Valad by subscribing for securities in Valad at the offer price.

The total number of securities on issue following the offer and placement is 1,522,247,001.

Australian Property Journal