This article is from the Australian Property Journal archive

THE National Australia Bank has defied expectations, breaking ranks with the other big three banks by declaring it will keep its variable rate for home loans on hold, in a bid to rebuild community trust following revelations at the Royal Commission. Although NAB’s decision could win over customers from its competitors.

The NAB has decided not to follow in the footsteps of Westpac, ANZ and Commonwealth Bank, which raised their loan rates this month.

NAB’s standard variable rate will remain at 5.24% compared to CBA’s 5.37%, ANZ’s 5.36% and Westpac’s 5.38%.

| ANZ | CBA | NAB | Westpac | |

| Standard variable rate | 5.36% | 5.37% | 5.24% | 5.38% |

| Monthly repayment | $1,677 | $1,679 | $1,655 | $1,681 |

| Annual repayment | $20,124 | $20,148 | $19,860 | $20,172 |

| Source: Ratecity | ||||

Based on a $300,000 standard variable, owner-occupier, principal and interest loan.

NAB CEO Andrew Thorburn said, “We are listening and acting differently. We need to rebuild the trust of our customers,”

“By focusing more on our customers, we build trust and advocacy, and this creates a more sustainable business,”

Thorburn said the decision benefits more than 930,000 NAB customers.

“If NAB had increased its SVR by 15 basis points, the average home loan customer with a $300,000 loan would have paid an extra $28 each month, or $336 a year, on their repayments. A customer with a $500,000 home loan would have paid an extra $47 each month, or $564 per year, on their repayments,” he added.

Last week the corporate regulator ASIC commenced proceedings in the Federal Court against NAB’s wealth management division over the fees for no service scandal.

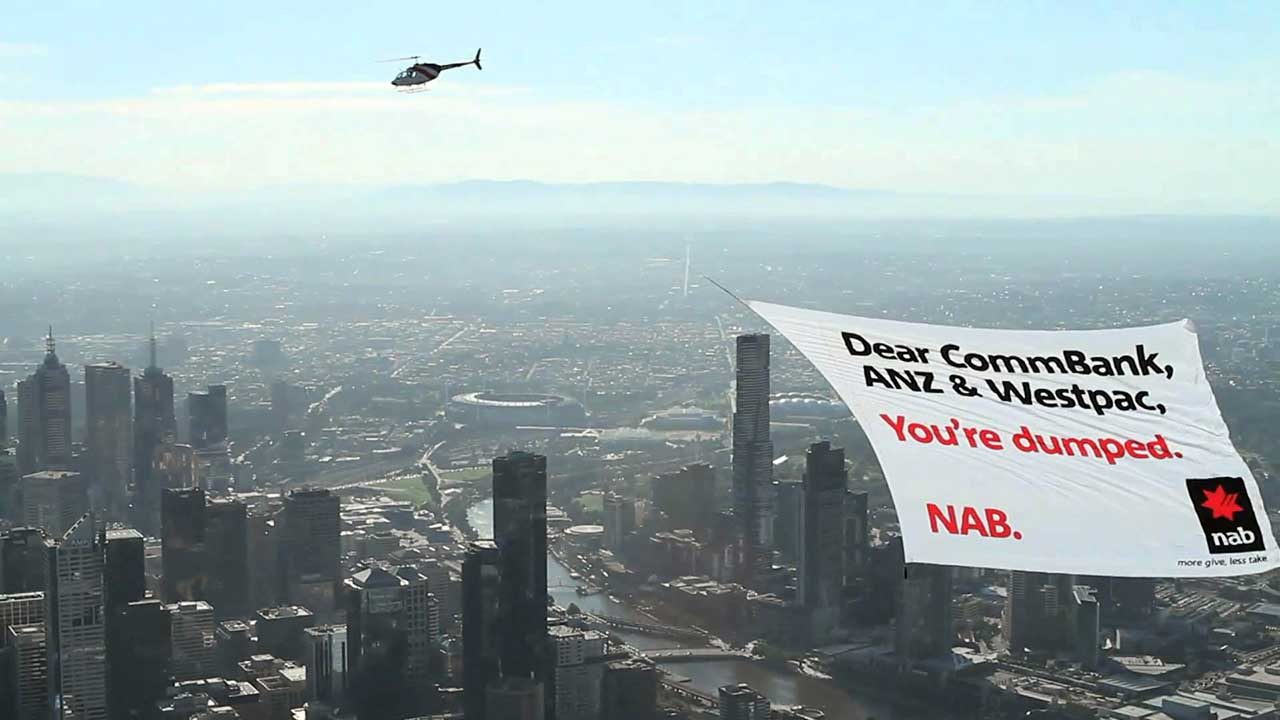

RateCity research director Sally Tindall said the move is reminiscent of the NAB’s ‘breaking up’ with the other three major banks campaign in 2011.

“Today’s move benefits almost one million NAB customers and potentially even more if people choose to switch to NAB.” Tindall said.

Australian Property Journal