This article is from the Australian Property Journal archive

CANBERRA’S resilient office market has seen yet another major investment sale, with Sentinel Group adding the nation’s control centre for the COVID response to its portfolio for $83 million.

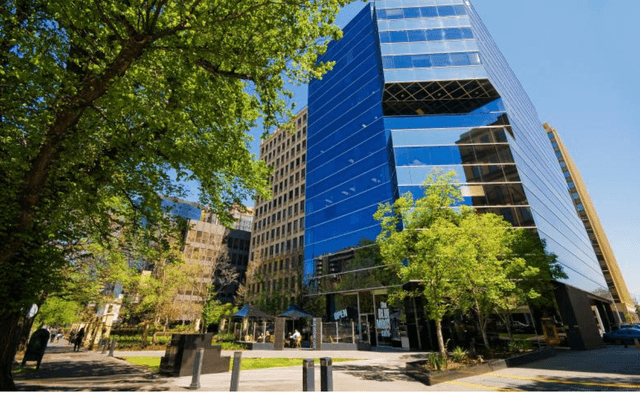

All 16,755 sqm within the 14-level, A-grade building Scarborough House is occupied, almost entirely by the Department of Health.

Sentinel bought the property for a 7.7% yield from Centuria Capital in a deal negotiated through JLL’s Tim Mutton and Luke Billiau, and Colliers’ Paul Powderly and Matthew Winter. It has a triple A-rated cashflow and a weighted average lease expiry by income of around four years.

The building rises 14 levels from 8 Atlantic Street, Phillip, in the Woden Town Centre. It will be part of the Sentinel Regional Office Trust, which also includes office buildings in Townsville, Cairns, Brisbane, Darwin and Newcastle.

Sentinel also owns Tuggeranong Homeworld in Canberra’s south, which it acquired for $31 million in 2014.

Scarborough House has a 5-star NABERS Energy and 3.5 star NABERS Water rating, and underwent a base building upgrade and refurbishment in 2005.

Sentinel executive chairman and chief investment officer, Warren Ebert, said Scarborough House represented a highly desirable investment opportunity.

“Nationally, there continues to be strong investor demand for quality office assets, which has been driven by low interest rates and pent-up investor demand,” he said.

JLL data shows the strong positive net absorption in the government-dominated Canberra office market has seen its vacancy rate tighten from 8.2% down to 7.6% over the quarter, the lower headline vacancy figure in almost 12 years.

ASX-listed Irongate Group tapped investors to partially fund its $74 million acquisition of the A-grade Canberra office building home to the federal government’s Australian National Audit Office, while Charter Hall has just acquired the Services Australia office in Canberra for $306 million.

On the sell side, Centuria Capital held the property within a single asset, closed-ended unlisted property trust that delivered an average income yield of 8% per annum to investors. It paid a 8.35% distribution in FY21, increasing to 8.50% during FY22 until settlement of Scarborough House.

Meanwhile, the Centuria Government Income Property Fund (CGIPF), which launched at the beginning of this month, has now closed its $133 million capital raise for the $224 million acquisition of an A-grade office building in Melbourne’s inner west.

More than 90% of the Footscray building is leased to Victorian government departments and agencies including City West Water, State Trustees Limited and the Treasury and Finance Department.

Jason Huljich, Centuria joint CEO, said quality assets backed by resilient government tenants form a key acquisition strategy across the Centuria Group, which has $6.7 billion of office assets under management across its platform, of which 28.5% by income are leased to local, state or federal governments.

Ross Less, Centuria’s head of funds management said, “Canberra benefits from a high proportion of public sector employment. Other markets, such as Victoria, are increasing their public sector workforce, which has a knock-on effect for the office market and reinforces our investment strategy for our Footscray office acquisition, which is CGIPF’s single asset.”

The Victorian government is using the Footscray building as the first of five government work hubs for the public service in metropolitan Melbourne areas, to allow workers to be in close proximity to their homes.

Knight Frank’s Paul Kempton brokered the off-market 1 McNab Avenue sale.