This article is from the Australian Property Journal archive

AS his Victory Offices sat on the brink of administration, the ASX-listed co-working spaces operator’s CEO Dan Baxter took a hit on an abandoned mansion project in Melbourne’s ritzy inner suburb of Toorak.

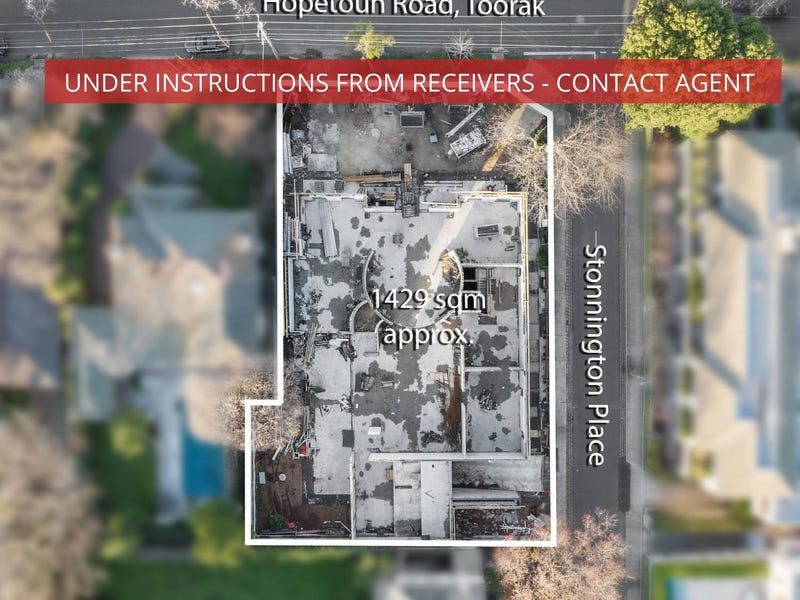

Developer Landream pounced on 17 Hopetoun Road, paying $12.25 million for the 1,433 sqm block according to the Financial Review – well below the initial asking price of more than $15 million and, below the $14.75 million Baxter paid for the property in the middle of 2018.

The listing had been with Abercromby’s since July. Small business lender Bizcap appointed insolvency firm Mackay Goodwin in August as receivers and managers for Baxter’s Mishmak Holdings, through which he held the property.

The only completed works on the site have been the concrete pour for the basement. A five-bedroom home on the site was knocked down last year for a planned five-level mansion featuring a cinema room, two grand staircases and a two-level basement with a pool, gym, sauna and wine cellar, and to 14 car parks.

Baxter has tipped in $15 million of his own money into Victory Offices in a bid to keep it alive, but administrators DV Recovery Management were appointed on Wednesday after it struggled with the impacts of the pandemic on the office market and workplace arrangements.

Victory – headed by former Victorian premier Steve Bracks until May – listed in 2019 with 21 co-working venues and a market capitalisation of more than $80 million after an initial public offering at $2 share. It share price has plummeted since, sitting at just 4.2c before the company went into a trading halt before the administration announcement.

It found itself locked out of offices last year in Sydney’s EY Centre at 200 George Street and at Collins Place and Bourke Place in Melbourne amid disputes over unpaid rent. Eviction at Investa’s 420 George Street and then termination of its sublease at 300 Barangaroo Avenue followed this year, before Bracks stepped down followed by non-executive director Kelly Humphreys and chief financial officer Keith Pollocks leaving their posts.

Baxter and his wife Manisha stepped in to run the business, which posted a $50.1 million loss in September.

Landream, meanwhile, has boutique projects in the Melbourne suburbs of Brighton and Malvern East, and is working on a mixed use development in Pyrmont on the edge of the CBD. In July, along with joint developer Macrolink, it tipped the retail component of the Opera Residence development near Sydney’s Opera House to the market with expectations of more than $50 million.

Two years ago, Landream sold a Melbourne CBD site on which it had planned to build a Mandarin Oriental Hotel designed by renowned late architect Zaha Hadid for about $200 million to US real estate firm Hines.