This article is from the Australian Property Journal archive

WHILE hybrid working has become the new normal, full-time working from home is likely to become increasingly rare in Australia and New Zealand, as a consensus is gradually reached on workplaces in the fallout from COVID.

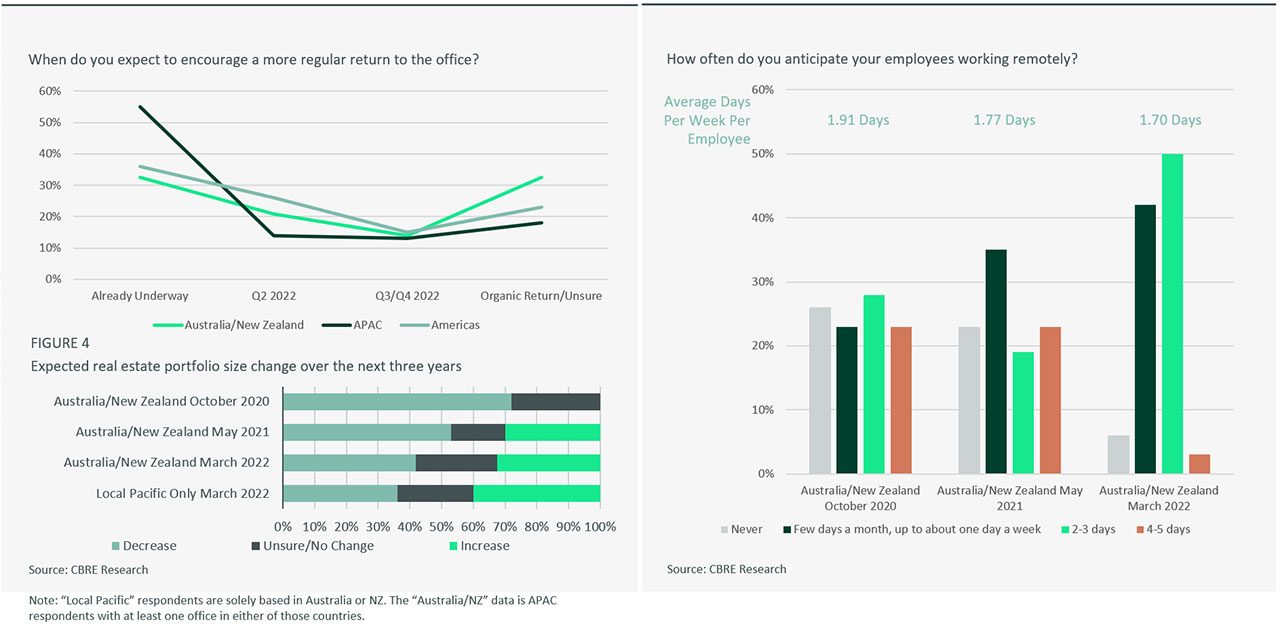

CBRE’s latest Occupier Survey, undertaken in March and April and Australia emerged from the Omicron wave, showed more than one-third of respondents are now actively encouraging staff to return, and a further 35% expected to follow suit by the end of this year.

Most respondents expect employees to work from home for some of the time, and the average days per week per employee has dropped slightly from 1.9 days in October 2020 to 1.7 days.

“Less than 10% of Australian and New Zealand respondents expect employees to never – or entirely – work from home, which is a clear shift since early in the pandemic when there was a lack of consensus on hybrid working,” said CBRE’s head of office and capital market research, Australia, Tom Broderick.

Of the Australian capital cities, Adelaide led office occupancy in April, according to the Property Council, despite a small dip to 59%, followed by Brisbane (51%) and Perth (45%). The major markets of Sydney and Melbourne continued their rebound from single-digit figures early in the year with modest rises over the month to 42% and 36% respectively. Canberra fell from 45% to 39%.

Occupiers are also re-examining their office footprints. One-third of Asia-Pacific respondents with at least one office in Australia and New Zealand now expect to expand, and for companies solely based in this region, 40% are leaning towards expansion, while 36% are leaning towards contraction. The national CBD office vacancy rate declined in the March quarter, recording a fourth successive quarter of positive net absorption, according to JLL.

The CBRE survey also pointed to changes in the way office space is being used. Unassigned seating is set to accelerate, with 58% of respondents having already implemented this or are expecting to bring this in over the next two years.

Pacific occupiers overwhelmingly want more collaboration space in their offices (+84%) and space for socialising (+51%), while respondents identified more individual quiet rooms for video calls a priority, which would combined with increased worktech investment, and a wish to increase desk sharing ratios.

Shift to ESG considerations

Most occupiers are now factoring ESG considerations into their real estate decision-making processes. Nearly one-quarter (24%) of Australia and New Zealand respondents said ESG would be the essential criteria for selecting a new office, while only 9% indicated they had no concrete plans to move to more ESG-credentialed buildings.

“With many major corporates making net zero emissions commitments, the trend to target ESG-friendly office buildings with higher NABERS ratings has accelerated,” said Darren Nugent, regional director, advisory & transaction services – office occupier, Pacific for CBRE.

Only about 13% of respondents said most of their office space was in this style of building. Discounting the small number of respondents with no concrete ESG-related office plans, almost 80% are looking to move into ESG-credentialed buildings in the future.

RICS research shows more than half of property players believe that green and sustainable buildings achieve a rent and a price premium. More than one-third believe that the rent and price premium stands at up to 10%; around 15% judge it to be higher still.

Landlords across the Asia-Pacific, having lagged their Australian peers, are beginning to consider ESG factors in greater numbers as the prospect of a “green penalty” from tenants looms on the horizon.