This article is from the Australian Property Journal archive

JAPARA Healthcare is hoping for nearly $20 million from two aged care facilities in Melbourne’s bayside region as it continues to selldown its Victorian sites with leaseback agreements.

The listings follow Japara’s sale in March of a 71 bed facility in Springvale for $13.38 million on a yield of 5.6%, with a new 6% lease to wholly owned subsidiary Japara Aged Care Services Pty Ltd, as well as the divestment of a vacant site in south west Geelong for $4.6 million.

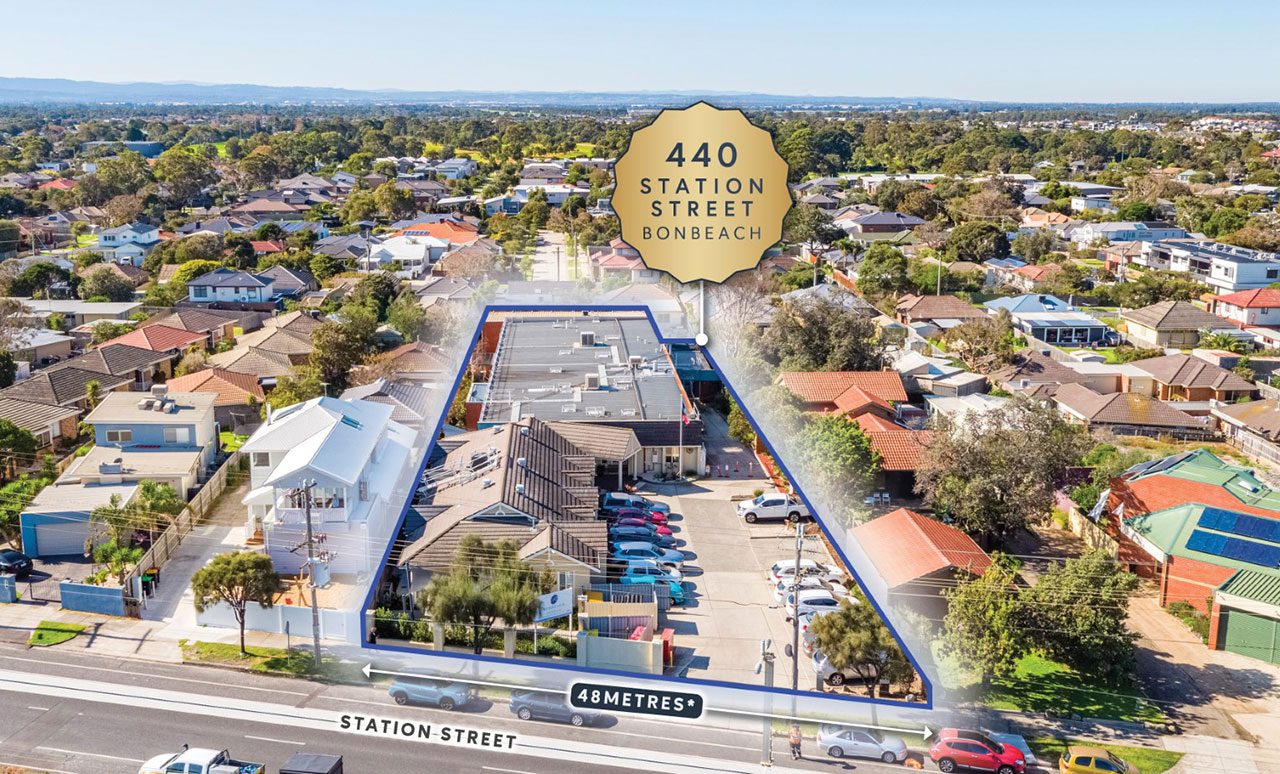

About $10 million is expected for a 65 bed aged 440 Station St in Bonbeach, offered with a brand new six year lease with three options of four years each options to a wholly owned subsidiary. Net annual rental is $600,000 per annum plus GST and outgoings.

A significant refurbishment was completed in 2018 and the 2,120 sqm building sits on 3,066 sqm of land with general residential 2 zoning.

Further south on the Mornington Peninsula, the newly refurbished 58 bed facility at 12-16 Capel Ave in Capel Sound is tipped to fetch above $8.75 million.

On 4,290 sqm of land with general residential 1 zoning close to Rosebud Plaza and Rosebud Hospital, the 2,200 sqm building is also offered with a brand new six year lease with three options of four years net rental of $525,000 per year, plus GST and outgoings.

Savills is marketing the Bonbeach and Capel Sound properties as sole agents, through Julian Heatherich, Mark Stafford and Benson Zhou.

In Parkdale, Savills is marketing another aged care asset alongside Amicum on behalf of a local private. More than $8.6 million is anticipated for a 60 bed aged care home that comes with a 15 year lease with two further five year options and net annual rental of $517,000 plus GST and outgoings. The land tax exempt property at 43-45 Herbert St offers a high quality building of 1,960 sqm on 2,004 sqm, also with general residential 2 zoning.

Stafford said aged care facilities provide the ideal investment due to their nondiscretionary use and significant forecasted industry growth.

“The aged care industry is a non-discretionary service that is vital to the Australian community. As the population profile in Australia continues to increase, so too does the requirement for these services, as such Government funding to the sector continues to grow.”

According to the Australian Institute of Health and Welfare, in 2017, there were 3.8 million Australians aged 65 and over, accounting for 15% of the total population. By 2057, this is projected to be 8.8 million, and 12.8 million people by 2097.

Federal government expenditure on residential aged care is expected to rise to $24 billion by 2021, an annual increase in excess of 5.4% in the last five years.

Zhou said many aged care operators are major national and listed companies with significant financial backing, unlike comparable investments, offering a higher level of security for investors.

The significant size of the landholdings and the favourable zoning also offer long term development potential, with the properties suited to alternative, residential development, and townhouses, the agents said.