This article is from the Australian Property Journal archive

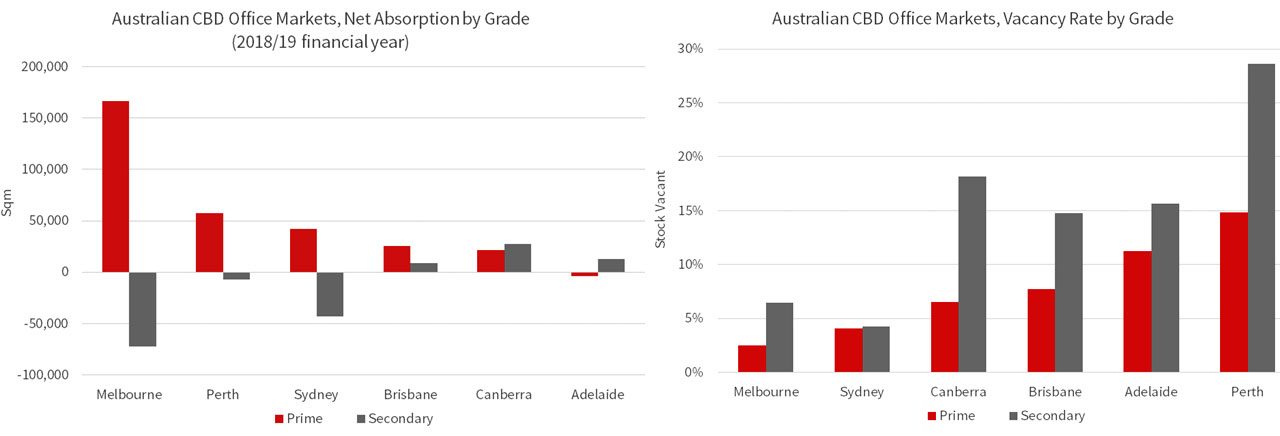

THE national CBD office market vacancy rate fell by 1% to 8.3% over the 2018/19 financial year driven by positive net absorption of 234,800 sqm. However, the short-term economic outlook has softened which will create opportunities and challenges for owners in the year ahead, according to JLL.

JLL head of research Australia Andrew Ballantyne said the short-term outlook for the Australian economy has softened over the past six months.

“Business confidence is fragile and we expect some organisations will adopt a more cautious approach to headcount growth over the 2019/20 financial year.

“However, a moderation in leasing activity is expected to be short-lived with global equity markets responding positively to recent discussions on the US-China trade war and the RBA easing monetary policy to stimulate the domestic economy,” he said.

Sydney CBD recorded an increase in sub-lease availability to 35,100 sqm or 0.70% of total stock over 2Q19 – but remains well below the long-term average of 1.0% of total stock.

The vacancy rate remains tight 4.1% in 2Q19 – well below the 25-year average of 8.3%.

Head of leasing Australia Tim O’Connor said Sydney is highly sensitive to changes in the global economy.

“Sub-lease availability was virtually non-existent over 2017 and 2018 as the Sydney CBD office market tightened. No one single factor is behind the increase in sub-lease availability. M&A activity, the ability to achieve greater efficiencies and some organisations scaling back headcount expansion plans in the short-term were all contributing factors to an increase in sub-lease availability in Q2.

“The Sydney CBD still has a number of technology firms, flexible space providers and professional services firms in expansion mode. Nearmap and Nutanix expanded their footprint over the quarter,” O’Connor said.

Cushman & Wakefield said Sydney’s CBD office market is well positioned to weather the softening economic conditions, despite tenant demand having already peaked.

C&W research show landlords have continued lifting face rents given limited supply additions and with average incentives being at their low point. Prime gross effective rents have grown 9% year-on-year to $1,040 per sqm.

B-grade gross effective rents are now $835 per sqm, up 11% year-on-year. Land revaluations have pushed up statutory outgoings, in some cases by 10% to 20%.

Some landlords are increasing their incentives, indicating average prime grade incentives have bottomed out at 20%.

The next major round of office stock is tipped to push Sydney office vacancies up to 6.3% by December 2021, according to m3property, but rents will continue on their growth path.

Sydney second city has a growing office pipeline that could see 85% more stock could be added by 2024, according to C&W.

Melbourne CBD recorded 93,700 sqm of net absorption over the 2018/19 financial year and vacancy (3.8%) remains at levels last recorded in the late 1980s. The market moves into the 2019-2021 development cycle with a high level of pre-commitment (75%) and strong enquiry for backfill space.

O’Connor said Melbourne has a diverse demand profile and the expansion of the education sector is having a positive impact on the market with Monash University increasing their footprint in the CBD, while TMG College Australia opened a third campus.

The Brisbane CBD and Perth CBD markets remain in the recovery phase.

Brisbane recorded 9,300 sqm of net absorption in 2Q19 and 34,200 sqm over the 2018/19 financial year. The vacancy rate fell to 11.0% in 2Q19 with the prime grade sector of the market is significantly tighter at 7.7%.

Ballantyne said the improvement in the Queensland economy has stimulated employment growth and fresh leasing enquiry.

He added that prime grade space availability is starting to tighten, and the next phase of the recovery should see a reduction in stubbornly high leasing incentives.

Perth recorded net absorption of 6,700 sqm in 2Q19 and 49,700 sqm over the 2018/19 financial year, however vacancy remains elevated at 20.4%. The spread between prime (14.9%) and secondary (28.6%) grade continues to widen as the flight to quality continues.

C&W’s latest Marketbeat report, shows prime gross effective rents grew by 1.3% over the March quarter to be 3.0% higher than the same time 12 months earlier.

Rising face rents underpinned the growth. Average premium gross face rents increased by 2.5% over the quarter, while A-grade gross face rents rose by 0.7%, and by 1.3% for B-grade assets.

Incentives were generally steady over the quarter. Prime incentives average 37%, although B-grade incentives increased slightly 43% as the flight to quality continues.

Cushman & Wakefield said supply will remain muted over the next three years, although the growing pipeline included QIC’s “Triplets” and 80 Ann St, and potential other projects at 360 Queen Street, 62 Mary Street, 343 Albert Street and the Waterfront Precinct.

Ballantyne said the rally in commodity prices has improved sentiment in the Perth CBD office market with iron ore prices up almost 60% in 2019.

“While commodity prices are expected to ease over the second half of 2019, mining sector profitability has improved and their service providers are in expansion mode,” he added.

Adelaide CBD recorded positive net absorption of 9,000 sqm over the 2018/19 with the vacancy sitting at 14.0%. Prime gross effective rents are starting to move higher with an increase of 5.4% recorded over the 2018/19 financial year.

Ballantyne said the headline numbers only partly reflect the improved sentiment in the Adelaide office market.

“The expansion of the defence sector will flow through to increased activity from their service providers and we are now seeing national flexible space providers reviewing options in the Adelaide CBD,”

Meanwhile Canberra will see increased leasing enquiry levels as the post the federal election. The vacancy rate was 11.0% in 2Q19 and remains very tight in the A grade sector of the market (6.5%).

Looking ahead O’Connor said the uncertain economic outlook will create opportunities and challenges for owners over the 2019/20 financial year.

“Parts of the economy are in expansion mode and those organisations will seek to grow their real estate footprint. However, some organisations have scaled back headcount expansions and may relinquish excess space creating additional competition for owners holding direct vacancy in their portfolio.” O’Connor said.