This article is from the Australian Property Journal archive

AUSTRALIA’S commercial property market is showing promising signs of recovery, with investor confidence buoyed by a stable interest rate environment and prospect of cuts on the horizon, with more deals tipped to be cut this year than in 2023.

According to the latest Australia Capital Trends report from MSCI, transaction volumes reached $8.2 billion in the September quarter, an 11% increase compared the same period in 2023.

Year-to-date figures are up 12% compared to the same period in 2023, totalling $23.8 billion, suggesting that 2024 is likely to surpass last year’s results, especially given nearly $2.9 billion of transactions are pending settlement.

While the numbers suggest positive momentum, volumes remain 30% below the five-year average, underscoring that a full recovery is still in progress.

Ben Martin-Henry, MSCI’s head of Pacific real estate research, told Australian Property Journal that over the last few months there has been less discussion about seeing rate rises, which has given investors a “bit more confidence in the market”.

The Reserve Bank has hinted at possible reductions in early 2025, which Martin-Henry said is providing stability in borrowing costs and narrowing the pricing gap between buyers and sellers.

MSCI Price Expectations Gap analysis showed the buyer-seller pricing gap for Sydney offices has reduced to -6.7%, down from -21.6% at the end of 2023, in a sign that valuation adjustments are aligning with market expectations.”

“So, if we do see a rate cut, I would expect that confidence to increase and for momentum to continue, and that certainly seems to be the case in the last few months – in the second half of this year, we have seen transaction volumes really pick up, and that’s how cycles play out.”

Core property sectors, including office, retail, and industrial, have seen a notable increase in investment. Collectively, they recorded a 34% year-on-year increase. The office sector, in particular, has experienced significant activity, with transaction volumes up 61% from the September quarter of 2023.

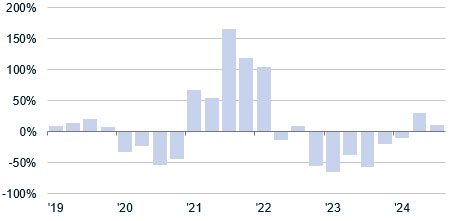

Year-On-Year Change in Deal Volume

Transaction Volumes by Sector

| Q3’24 Volume | YTD’24 Volume | ||||

| $b | YOY | $b | YOY | ||

| Office | 2.8 | 61% | 7.2 | 48% | |

| Industrial | 2.6 | -2% | 7.7 | 16% | |

| Retail | 2.1 | 24% | 6.9 | 43% | |

| All Commercial | 7.5 | 23% | 21.8 | 34% | |

| Hotel | 0.3 | -38% | 1.0 | -51% | |

| Apartment | 0.0 | -96% | 0.5 | -78% | |

| Seniors Housing & Care | 0.3 | 148% | 0.5 | 22% | |

| Income Properties | 8.2 | 11% | 23.8 | 12% | |

| Dev Site | 0.9 | -59% | 5.9 | 13% | |

| Grand Total | 9.1 | -5% | 29.8 | 12% | |

Key transactions, such as PAG’s acquisition of 367 Collins Street in Melbourne at a 26% discount from its June 2022 valuation, reflect improved investor confidence, Martin-Henry said.

“We’re seeing a lot more transactions in the office sector, and that’s not necessarily because of stability in the interest rate environment. It seems to be that a lot of investors are trying to get out of the office sector, or at least get them off their books in order to recycle capital into something else, and what we’re seeing is other investors take advantage of these discounts that are on offer,” he told Australian Property Journal.

“We’ve certainly seen that with some of the larger transactions in the office sector, such as 5 Martin Place and 52 Martin Place in Sydney, 367 Collins down in Melbourne, that they have gone at significant discounts, and I think that’s what’s really driving the office sector at the moment.”

Martin-Henry suggested Sydney’s office sector could be one to watch over the coming year. Sydney offices experienced quarterly yield compression of 4 basis points.

“Whilst this change might be seen as marginal — potentially just a rounding error for some — the fact that it has arrested a seven-quarter trend of expansion is notable,” he said.

“Offices are transacting at the previous book value, which for most will be in June of this year, and that compression immediately indicates that we’ve hit the bottom of the cycle of the Sydney office market. This could potentially signal the start of a recovery for Sydney offices.”

He said Perth and Brisbane have “pretty much already bottomed out”, while not having seen nearly as much decline as the Sydney office market.

“The real question is the Melbourne office. I suppose that’s probably the biggest question mark we have at the moment, because we saw further yield expansion in the Melbourne office sector,” he said.

The industrial sector has maintained resilience, recording year-to-date growth of 16% despite a slight dip in the September quarter.

Retail has also performed well. September quarter volumes up 24% year-on-year, totalling $2.1 billion. Year-to-date retail transactions have reached $6.9 billion, marking a 43% increase from the same period last year. Whilst grocery-anchored centres have driven retail activity in recent years, the demand has broadened to include regional, major, and super-regional centres, driven by population growth and anticipated rate cuts in 2025.

Foreign investment is showing a mixed recovery. Overseas investors deployed nearly $3 billion in the September quarter, down slightly from 2023, but year-to-date levels remain steady at $7.1 billion. Whilst this matches 2023 levels, last year’s total was the lowest since 2012. Overseas capital accounted for 35% of September quarter volumes, the highest quarterly share this year. US investors led the way, contributing nearly a third of overseas capital. European investors also expanded their investments significantly.

Martin-Henry told Australian Property Journal that a lot of foreign investors he speaks to “love the fundamentals that Australia offers – very strong population growth, pretty solid economy”.

“Australia tends to lag the rest of the world in terms of valuations. So we saw the UK and Europe, for example, and the US move a lot sooner, so their valuations came down. So last year, offshore investors didn’t avoid Australia, but they didn’t invest as heavily as they had previously, and I suspect it was because that relative value just wasn’t there.

“But this year, with the valuations adjusting, the relative value has come back, and overseas investors have long been attracted to Australia again, because of strong fundamentals, population growth, pretty stable government, pretty stable economy. So I would expect to see an increase in volumes.”