This article is from the Australian Property Journal archive

HIGHER returns on residential property investments have been achieved in dozens of towns below 50,000 than in a number of capital cities across Australia since the year 2000.

Research from Propertyology analysing regional locations for price growth in the past 20 years shows Goulburn led all comers with 8.1% average annual median growth.

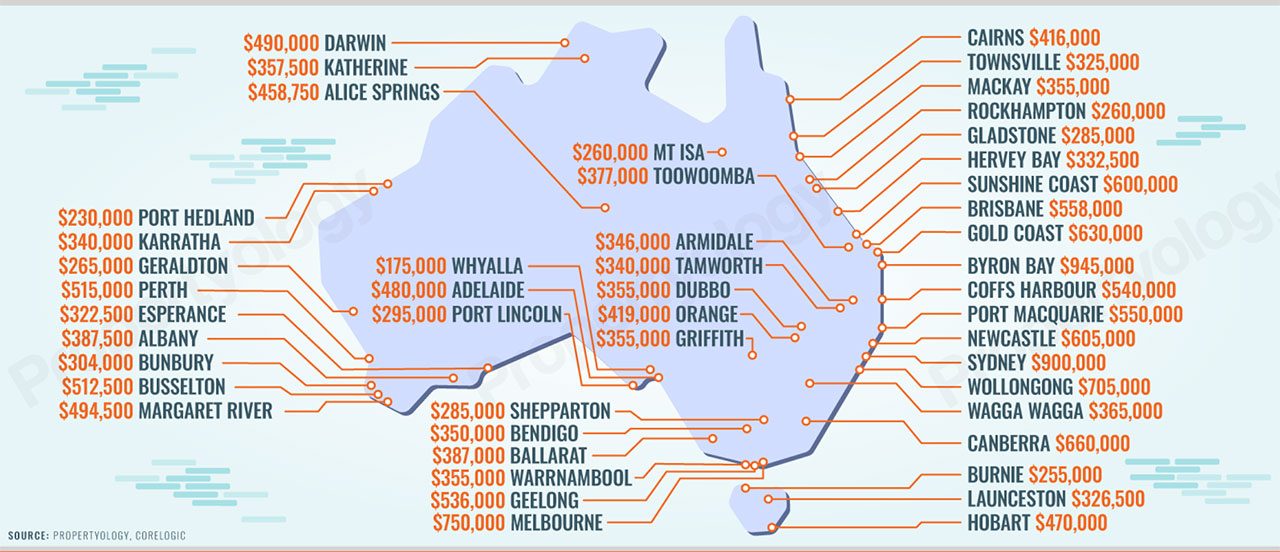

Topping their respective states and territories were Alice Springs (6.1%), Busselton (6.4%), Goondiwindi (6.3%), Launceston (7.5%), Port Augusta (6.9%) and Strathbogie (7.4%).

“A regional town with a population of only 23,000 has Australia’s third highest median house price. Other towns with populations as small as 7,000 people have also proven to be far less volatile than Australia’s biggest cities over the past two decades,” managing director Simon Pressley said.

“One third of our nation’s total population live outside of a capital city. Those eight million-plus people are close to double the population size of New Zealand or Ireland and it represents about two thirds of the population of each country in Scandinavia.”

Pressley said every one of the regional areas analysed in the study produced strong average annual price growth over the period because of a number of economic and market fundamentals, including housing affordability.

Strathbogie, two hours north of Melbourne, has a population of 10,700 people and its annual growth rate 5% rental yield are both superior to Adelaide, Brisbane, Perth and Sydney over the time period.

In the New South Wales region of New England, Armidale boasts Australia’s highest ratio of residents employed within the education sector and has a median house price of $340,000, which has tripled over the past 20 years, and a 5.2% median rental yield.

Melbourne and Sydney both have rental yields of 3.1% for houses and 3.9% for units. Queensland’s Mt Isa has a rental yield of 8.0%, clear above Brisbane’s 4.0% and 5.1% yields for the respective markets.

Pressley said Propertyology’s research has shown that the most volatile property markets are often the expensive ones, or ones which lack economic diversity, or locations with a big construction industry workforce that have a tendency to be overstimulated during the good years to create oversupply problems.

Locations with more affordable housing also reduced the property investment risk, Mr Pressley said, as smaller deposits are required.

“This means that buyers are able to enter property markets sooner and can expand their portfolios more quickly.

“Logic also suggests that the starting price has a lower height to fall from. The second line of defence is the value and reliability of the income which the asset produces – this determines how much the owner needs to contribute of their own money each year.”