This article is from the Australian Property Journal archive

UNLISTED property funds continued to perform in the last quarter of 2020, despite ongoing lockdowns and border closures.

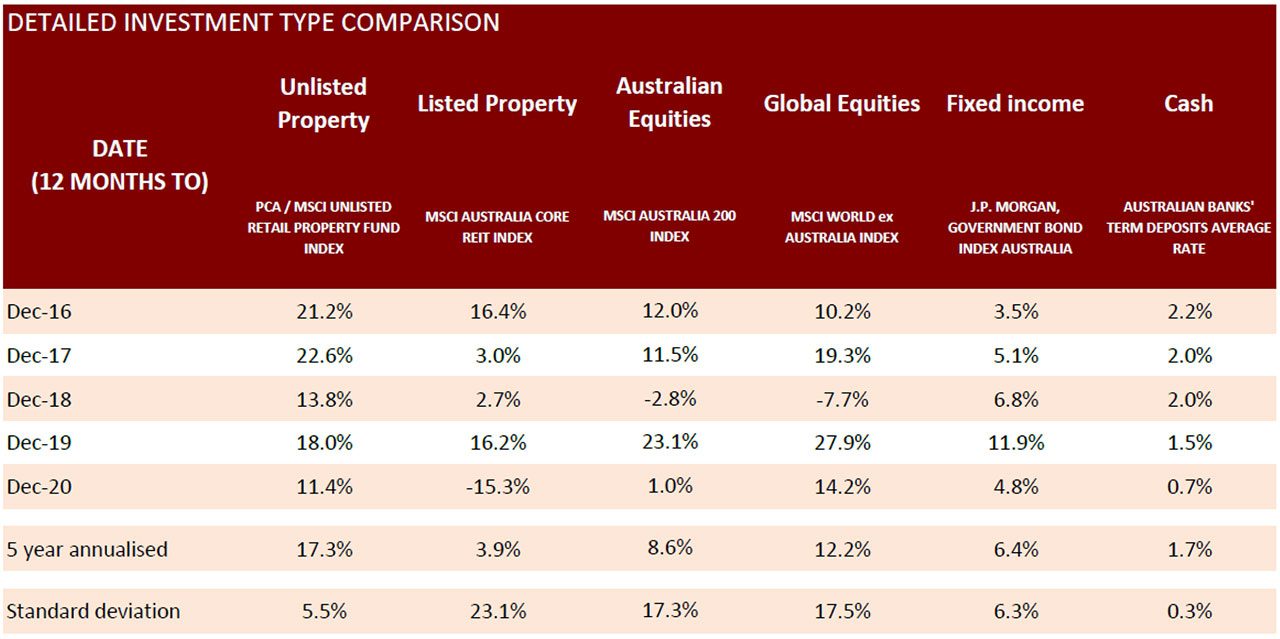

In the 12 months to 31 December 2020, unlisted property funds delivered an 11.4% return, according to data reported by Zenith Investment Partners, Australian Unity, MSCI, the Property Funds Association and the Property Council of Australia.

“Outlooks remain bifurcated both across and within sectors, with renewed optimism for the economic outlook dependent on the deployment of COVID-19 vaccines,” said Dugald Higgins, head of real assets and listed strategies for Zenith Investment Partners.

Throughout this 12-month reporting period, Australian equities returned 1.0%, due largely to cooperative policies during the second half.

“Despite green shoots, however, risks remain around the impact of tapering or removal of stimulus programs on real estate markets in the current environment,” added Higgins.

Meanwhile, A-REITS posted a -15.3% return in the same period, heavily impacted by the tumultuous nature of the 2020 period.

“The figures are showing different facets of the property sector are recovering at varied speeds,” said Damian Diamantopoulos, portfolio manager REITS and head of research, property for Australian Unity.

Direct property delivered 0.1%, while fixed income delivered 4.8% down from 11.9% in 2019.

“While retail grapples with cautious consumers and evolving retailer models, and office continue to face challenges as businesses innovate and space requirements remain uncertain, industrial and logistics have emerged a winner,” said Diamantopoulos.

Cash again declined over the year, delivering 0.7%, down from 1.5% in 2019.

“The sector continues to benefit from elevated demand from online retail penetration during the pandemic, which has accelerated many of the longer-term secular trends in the sector,” concluded Diamantopoulos.