This article is from the Australian Property Journal archive

AN offshore Asia-based buyer is believed to have acquired the Illoura House site on Melbourne’s St Kilda Rd for more than $70 million, with intentions to use the building as an office play rather than take on approved plans for an apartment and hotel tower.

The sale comes as Singaporean group UEM Sunrise lists the former police complex nearby at 412 St Kilda Rd in favour of progressing with the Zaha Hadid-designed Mayfair residential project with 152 apartments.

CBRE’s Mark Wizel, who marketed Illoura House with Lewis Tong and Josh Rutman on behalf of Chinese-backed Woodlink, was unable to provide details of the buyer or the price, but said the building would be refurbished and re-leased.

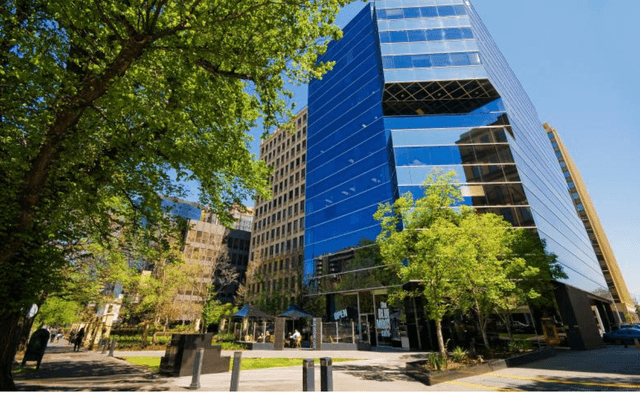

Illoura House, at 424-426 St Kilda Rd, has a net lettable area of 12,659 sqm over six levels with basement parking for 144 cars, on 4,645 sqm of land with three street frontages.

The property sold with an approval for an 18 level mixed-use building with 163 apartments and 176 hotel rooms, and was subject to an in principal deal with hotels giant Marriott that would have become the first Marriott Executive Apartments offering in Australia.

“The property lends itself well to refurbishment and re-leasing in Melbourne’s increasingly tight office market and so it makes perfect sense for the purchaser to proceed on that course,” Wizel said. “Obviously the buyer is also well aware of the property’s potential as a long term investment and redevelopment prospect down the track given the exceptional location.”

CBRE research showed prime effective rents grew to $347 per sqm, and further growth is expected over the next few years as high CBD rents continue to push tenants into fringe locations.

St Kilda Rd’s seven-year annual growth rate is 5.4%, outperforming similarly-sized markets of Macquarie Park (3.4%), Parramatta (5.2%), and Southbank (3.8%).

Woodlink had secured agreements with the building’s remaining tenants to allow refurbishment to commence almost immediately.

Spokesman for Woodlink, Anthony Tarros, said, “We are pleased with the sale in a challenging residential market but we are buoyed by the strength of the Melbourne commercial office and hotel market and after receiving several off market approaches we opted to sell 424 St Kilda Rd.

“We are delighted with the outcome and will now focus on acquiring new commercial assets and delivering our other projects.”

UEM Sunrise is hoping for as much as $100 million for number 412, just four years after paying $58 million for the 12-level, and will have to refund contracts for the nearly 40% of Mayfair apartments sold off the plan.

Cushman & Wakefield research showed the St Kilda Rd office precinct has seen capital values rise by between 90% and 115% over five years.

Shijizhuang-based Runjiang Investment acquired the nine-level office tower at 509 St Kilda Rd for $163 million through private investor Michael Xie, nearly double vendor John Beville’s investment on the asset in four years.

KKR and local partner Vantage Property Investments recently sold their a 10-storey office building tower at 420 St Kilda Rd to an offshore buyer for at least $92 million, barely 18 months after paying Singapore’s Chip Eng Seng $68.84 million – which itself had paid only $45.28 million to Yong Quek in 2013.

Late in 2017, Perth-based syndicate Lester Group offloaded 324 St Kilda Rd for $42 million after buying it only four years earlier for $22 million. Further down the boulevard, Lian Beng Group and KSH Holdings sold the 596 St Kilda Rd site for $34 million, with approval for a 19-storey, 170-apartment development, less than two years after acquiring the site for $25 million.