This article is from the Australian Property Journal archive

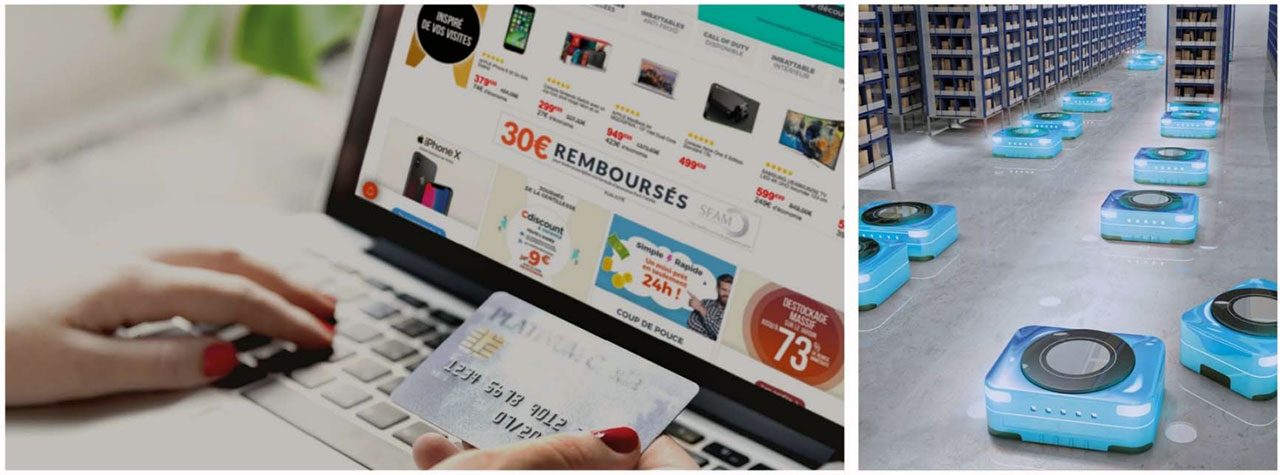

GOODMAN Group reaffirmed it is looking towards healthy gains in the 2018 financial year as the e-commerce boom reshapes the industrial property market, as well as the retail sector.

In its first quarter update Goodman maintained its forecast of 6% growth in operating earnings for the 2018 financial year, to 45.7 cents per security.

CEO Greg Goodman said the macro environment is favouring logistics real estate.

“E-commerce is expected to grow by more than 60% by 2020 and companies are continuing to look for supply chain efficiencies as consumer expectations around product delivery and availability rise,” he said. “Warehouse proximity to consumers has become a critical factor in reducing delivery time and cost. In this shifting consumer landscape, having the right footprint matters,”

Total assets under management of $33.9 billion is “concentrated in quality locations in major urban centres”, and its strategy to rotate assets and reposition its portfolio “to focus on key locations close to consumers is delivering tangible results, with excellent occupancy rates and higher rental returns”.

Goodman’s established relationship with Amazon has it as builder and owner of the retail behemoth’s warehouses in the US and throughout the world.

Amazon’s first official site in Australia, however, is a 24,000 sqm “fulfilment centre” in Pellicano’s M2 Industry Park in Dandenong South in Melbourne’s south-east. The site is positioned close to major road arterials the Monash Highway, EastLink and the South Gippsland Highway.

It has long been rumoured that Amazon will open their first Sydney site at the Oakdale Industrial Estate in Eastern Creek. During the week it emerged that Goodman had acquired a 2.29-hectare cleared industrial site on Corish Circle in Sydney’s southern suburb of Banksmeadow; although Goodman has looked past its strata development potential, it was reported that the group intends to lease the site long-term to a concrete company.

In Urban Property Australia and Situs RERC’s recently released joint report Amazon: The Disruptor, UPA’s managing director Sam Tamblyn said the rise of Amazon as a powerhouse is the perfect example of a marriage of retail and industrial industries, technology and logistics.

He said Amazon’s biggest challenge in Australia will be logistics.

“The cost of shipping between its largest cities areas is likely to challenge Amazon’s delivery model as well as raise costs, especially with oil prices rising again. Failure to offer quick deliveries may leave it more prone to competition from physical retail chains offering low-priced goods.”

Goodman’s portfolio occupancy increase 98% over the quarter, 900,000 sqm of new leasing reflecting $116 million of property income per annum and positive rental reversions of 3.2%, as WALE improved slightly to 98%.

Goodman sold $1.25 billion worth of assets in the quarter, across Australia, China and most notable in the UK, home to the Arlington Business Parks Partnership that it sold for $800 million to TPG Real Estate.

Its development pipeline currently totals $3.5 billion across 76 projects throughout the four regions. The Americas accounts for 24% of work in progress, up from 13% one year ago. All of its work in the region has been undertaken in partnerships, for 77% globally.

The group has also undertaken $3.5 billion of liability management initiatives in quarter.

“These activities have extended our debt maturity profile for the long term, to ensure we have the ability to continue to invest and deliver through the cycle.” Goodman said.

Australian Property Journal