This article is from the Australian Property Journal archive

DEVELOPER Risland Australia, formerly Country Garden, has won a court battle against Bradcorp over a $297 million land purchase it did not to proceed with.

The Supreme Court of New South Wales this week dismissed Bradcorp’s damages claim and ordered the company to pay damages to Risland which, together with costs and interest charges, is likely to exceed $30 million.

Bradcorp launched legal action against Risland in March after the Chinese-back developer decided not to exercise its option in November 2018 to acquire land at North Wilton in south-west Sydney.

Risland claimed that Bradcorp had failed to satisfy a range of conditions precedent to enable the land to be developed.

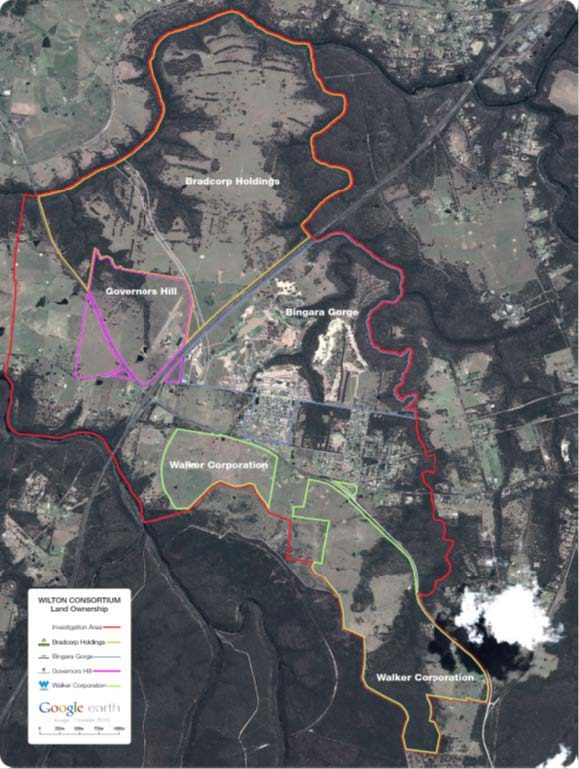

The $297 million proposed acquisition involved a large parcel of land, 870 hectares, near Wilton which is currently rural, but is to be developed as part of the expansion of Wilton into a large satellite town.

Risland had call option fees of $29.7 million paid to Bradcorp of which $9 million was released to Bradcorp whilst the remaining $20.7 million was held by HWL Ebsworth. After Risland decided not to proceed with the purchase, Bradcorp claims it was entitled to retain them as part of its damages, even if it is not entitled to damages for repudiation.

On the other hand, Risland claims that it is entitled to recover the fees.

Risland claimed Bradcorp failed to satisfy a number of conditions, the first related to the zoning. The land was still zoned for rural use but Bradcorp was seeking to have it rezoned. The condition required that the land be rezoned so that at least 5,350 residential lots could be produced by subdivision. The land was rezoned in November 2018. The issue between the parties is whether the rezoning satisfied the minimum lot requirement specified.

Bradcorp has owned the land since 1999. It is located about 80 kilometres south west of the Sydney CBD. The land forms part of what is known as the Wilton Growth Area, which is one of a number of what are called Sydney Region Growth Centres. These are areas that have been identified by the State Government as locations for development to accommodate Sydney’s increasing population. The policy is reflected in the State Environmental Planning Policy (Sydney Region Growth Centres) 2006 (“Growth Centres SEPP”).

The second condition related to an existing mining lease, and required that certain rights under the lease (in effect, rights to conduct mining under the land) be surrendered. The court found that happened, but the steps to make it happen only took place at the last minute. The dispute is whether, having regard to the terms of the option agreements, it happened in time.

The third condition concerns access to the property from the Hume Motorway, which passes next to it. The parties also disputed about whether this condition was satisfied.

In the judgment, Justice Partker concluded that first condition was satisfied but the second and third were not prior to their deadlines.

“The Mining CP was not satisfied prior to 5.00 pm on 30 November 2018 but it was satisfied prior to the purported exercise of the Put Option on 4 December 2018;

“The Rezoning CP was satisfied prior to 30 November 2018; but the Access CP had not been satisfied by 4 December 2018 (or indeed prior to 5 pm on 30 November 2018) and as a result Bradcorp’s purported exercise of the Put Option was invalid;

“In the result, Bradcorp’s claim has failed and must be dismissed.” His Honour said.

A spokesman for Risland said Bradcorp repudiated the option deed by its own conduct.

“We are disappointed that Bradcorp was unable to present the land in a way which would have enabled it to be developed in accordance with the required approvals and our vision.

“We remain very interested in investing and developing areas around Australia, including the Wilton region.” Risland said.