This article is from the Australian Property Journal archive

AN additional 350,000sqm of space will be needed each year to keep up with Australia’s current rate of online sales activity.

According to CBRE’s latest industrial and logistics market outlook for 2021, 2020 marked a strong year of growth for the sector, though as online retail continues to drive growth, occupiers may struggle to meet demand.

“We are already seeing the average occupier warehouse footprint increasing to account for a wide-ranging rethink of inventory strategy, after many groups were caught with not enough stock during the pandemic,” said Cameron Grier, regional director of Pacific, industrial and logistics for CBRE.

The sector is expected to remain elevated for 2021, with investors looking to capitalise on demand and landlords looking to see an increase in solid rent growth, as their occupier base inevitably grows.

Throughout 2020, industrial and logistics assets accounted for 38.3% of all transactions, a rate which will only increase if investors do indeed reweight their portfolios.

APAC investors surveyed indicated that in 2021 industrial and logistics is in fact their preferred sector of investment, outranking the typically dominant office market.

Of the new space need to be developed to meet demand, much of it will be comprised of traditional warehousing, though there will also be an increase in last mile hubs, repurposed retail facilities and parcel lockers.

“Traditional warehousing will continue to be sought after, but we can also expect to see an influx of last mile hubs, repurposed retail facilities and parcel lockers, given learnings from recent supply chain bottlenecks and a general maturing of the e-commerce trade in Australia,” said Kate Bailey, head of I&L research for CBRE.

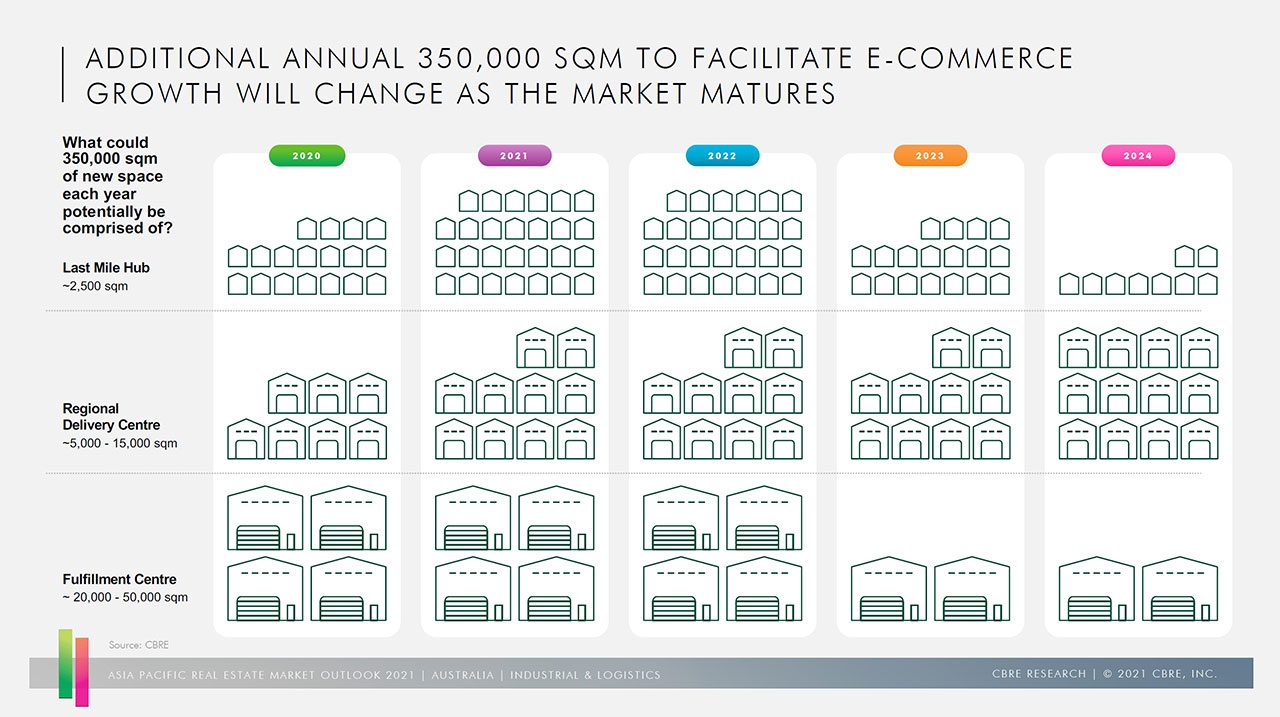

CBRE proposes that through to 2024, approximately 2,500sqm of last mile hub space will be needed each year, 5,000qm to 15,000sqm of regional delivery centre space and 20,000sqm to 50,000sqm of fulfilment centre space will needed.

Space requirements for reverse logistics supply chain is also expected to require around 20% more space and labour capacity than forward logistics, which will only add to demand.

“Reverse logistics is creating opportunities for many Third Party (3PL) operators, which drive large volume of demand for industrial real estate,” added Grier.

“A positive returns policy is a competitive differentiator for retailers to retain customers – so, getting the reverse logistics equation right is critically important.”

The report also highlights that rising freight costs, an impact of COVID-19, could impact locational decisions of logistics operators. During the pandemic containerised freight costs, as measured by the Shanghai index, have nearly tripled in the year to January 2021.

Recently Cushman & Wakefield research director Tony Crabb told the Australian Property Institute REIV conference that Melbourne’s industrial land supply will run out in 5-15 years.

According to Crabb, between 2000-01 and 2017-18, a total of 2,423 hectares of industrial land was rezoned and currently 9,211.4 ha are occupied and 6,562.5 ha vacant zoned land currently remains.

The industrial land that was zoned for alternatively use, approximately 50% for residential or mixed-use purposes, which means they are unlikely to be returned to industrial or employment use.

“In the last three years the west has seen a 43% take up of land, which is not surprising due to its proximity to ports, whilst the south has seen a 23% take up,”

The west has 1,810.5 ha vacant zoned land remaining or 15 years and south has 502.6 ha or five years, according to the Victorian government’s data.

But Crabb warned that it could be sooner.

He said online shopping is a structural shift and it is not going to back.