This article is from the Australian Property Journal archive

RUPERT Murdoch’s property listings portal and media company REA Group has seen strong year-on-year listings growth as Australia moved into its spring selling season, and another record reach for its flagship site.

National listings for the September quarter were 7% higher than the prior corresponding period, and listings reached their highest volume for the month of September since 2015, as detailed by its research arm PropTrack this week.

“The Australian property market remains healthy supported by high employment, immigration levels, stable interest rates and strong buyer demand,” CEO Owen Wilson told the company’s annual general meeting.

High listing volumes over the last year have predominantly been driven be the strength in the Sydney and Melbourne markets. This continued in the September quarter, with Sydney listings up 11% year-on-year and Melbourne listings up 9%.

Smaller capital city markets have also shown strength with higher first quarter listings in Brisbane, Adelaide and Perth.

CoreLogic has similarly reported that freshly-advertised housing stock levels are their highest in three years.

“Despite the increase in the volume of stock available, properties are continuing to sell which indicates demand for housing remains robust,” Wilson said.

“With more stock on the market buyers now have a lot more choice, and this should result in the moderation of house price growth.”

This is backed by a new leading indicators index devised by Capital Economics that combines several factors to capture the balance of supply and demand in Australia’s housing market, and which this week suggested that house price growth will continue to slow over the coming months.

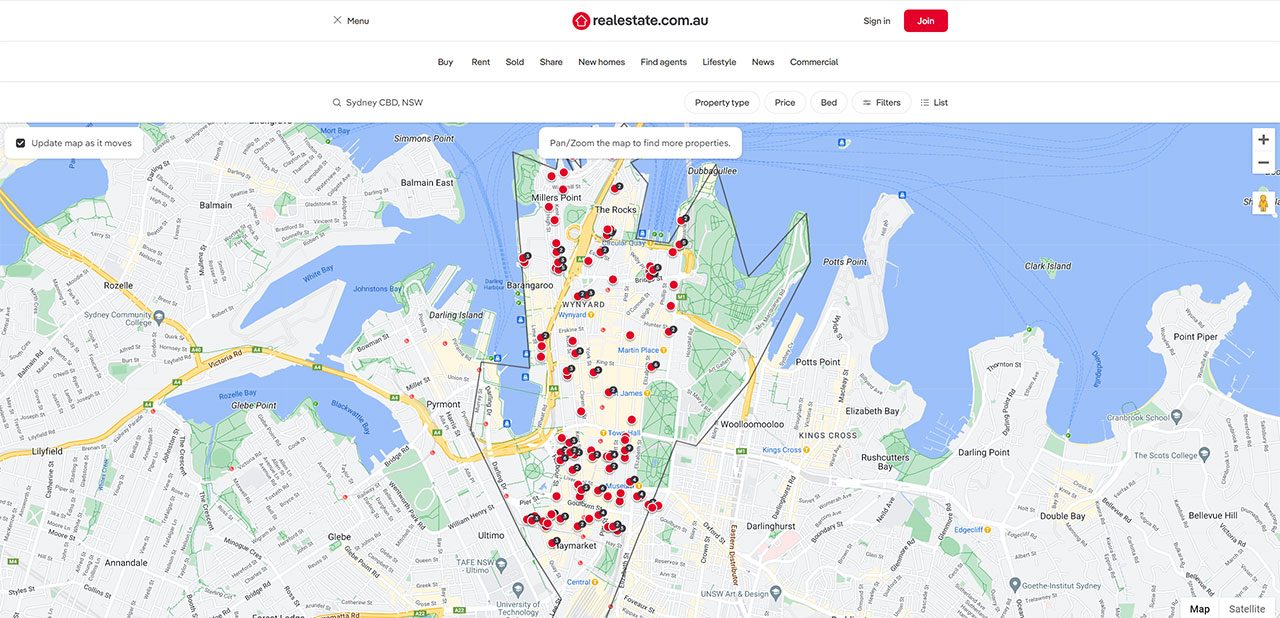

REA Group’s flagship portal, realestate.com.au, reached a record audience for the second consecutive month in August, with over 12 million people visiting the site.

“That’s almost 5.3 million more people than our nearest competitor, which is the widest audience gap under the Ipsos Iris measurement,” Wilson said.

“We will not overpay”

Chairman Hamish McLennan told the meeting that the outcome of takeover talks with UK-based platform Rightmove was “disappointing”.

REA Group in recent weeks walked away from its $12 billion acquisition efforts after Rightmove rejected its fourth non-binding offer.

“While the outcome was disappointing, it was critical that REA maintain its longstanding, disciplined approach to capital management and mergers and acquisitions.

“We will not overpay and in this case, the lack of engagement from the Rightmove board, despite the benefits of our offer, prevented us from having constructive discussions on price and making a firm offer.”

REA Group first publicly confirmed its global expansion plans at the start of September, with a $9 billion bid, which grew to $11.9 billion by the time of its third offer. At the time, London Stock Exchange-listed Rightmove had a market value of $8.5 billion, having posted a revenue of $706 million last year, while returning a $512.8 million profit.

In recent weeks, REA Group announced an investment in fast growing fintech, Athena Home Loans. On completion, the group will acquire a 19.9% share in the digital lending business.