This article is from the Australian Property Journal archive

ABACUS Property Group has forecast a strong profit result for FY17 underpinned by stronger than expected earnings from its residential and land projects.

Abacus expects to report a statutory profit in the range of $275 million to $290 million and an underlying profit in the range of $182 million to $187 million for FY17.

This is compared to the statutory profit of $185 million and an underlying profit of $124 million for FY16.

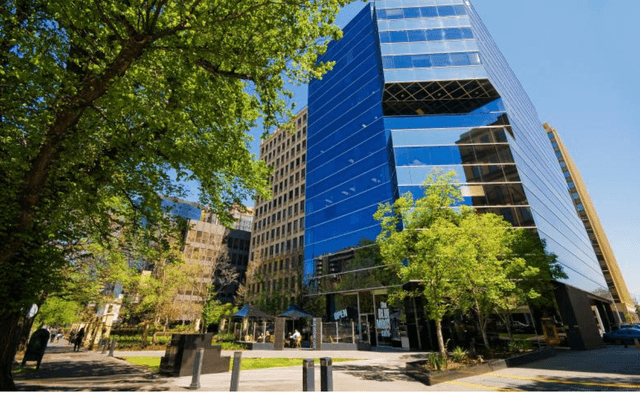

Managing director Dr Frank Wolf said Abacus’ strong performance is attributed to a number of factors including a $75 million valuation gain, transactional profits from the sales of World Trade Centre in Melbourne, Browns Rd in Clayton and 50% interest in Westpac House in Adelaide, and stronger than expected transactional profits from the realisation of the Group’s residential and land projects.

Abacus also reaped strong performance fee income from the realisation of properties held via the third party capital platform.

“We have seen the realisation of a number of projects during the year that while expected are nevertheless pleasing to deliver to the market.

“The performance of these transactions should provide confidence on Abacus’s ability to deliver on its strategies while driving outperformance” Wolf said.

Abacus will release its results on 18 August 2017.

Australian Property Journal