This article is from the Australian Property Journal archive

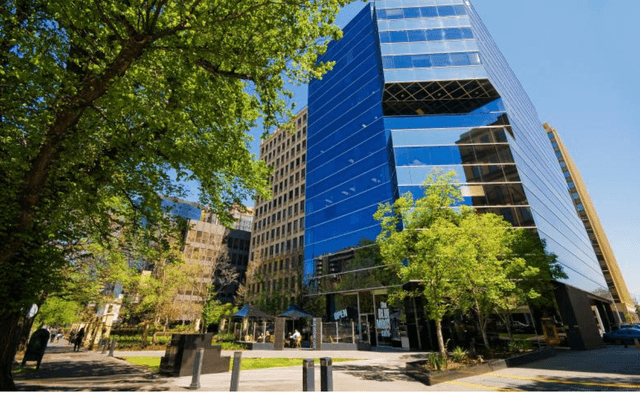

THE Abacus Property Group and Heitman joint venture have sold an office building at 484 St Kilda Rd in Melbourne to a UBS and Grocon JV for $94 million.

UBS Grocon Real Estate bought the A-grade 15-level building after it was put on the market in March. Knight Frank’s Paul Henley and Stephen Imrie and JLL’s Victorian directors of sales and investments Robert Anderson and James Kaufman were the selling agents.

The building comprises 20,366 sqm of space plus 224 car parking bays and is 98% leased to a number of tenants with a weighted average lease expiry of 3.5 years.

The current net passing income is $7,192,000 p.a.

Abacus said since the acquisition, the joint venture has maintained a high occupancy with significant tenant retention and achieved substantial improvements in rental rates across new and retained leases.

Abacus and Heitman bought the property in November 2011 for $68 million with a 94% occupancy rate.

“These activities have positioned the property as an institutionally attractive and superior asset within the submarket,” Abacus said.

The St Kilda Rd precinct is currently in hot demand.

Last week Vantage Property Investments bought an office building at 11 Queens Rd for $27 million, from Denison Funds Management. Earlier in the year, Singapore’s International Healthway Corporation bought 541 St Kilda Rd from APN Property Group and 553 St Kilda from Montgreenan Holdings for $45 million. And Fort Street Real Estate Capital’s unlisted Australian Property Opportunities Fund bought 390 St Kilda Rd for $56.0 million.

Last week IGR Property Group put the Victoria Police complex at 412 St Kilda Rd on the market. The property is tipped to sell for around $60 million. IGR bought the 21-level office building five years ago for $42 million from the ING Office Fund. CBRE are selling the asset.

Property Review