This article is from the Australian Property Journal archive

DESPITE high profile retailers going into voluntary administration, shopping centre vacancy rates across Australia have not ballooned, instead vacancies have tightened with Sydney and Melbourne falling below 3%, according to JLL.

JLL research shows that the average retail vacancy rate across Australia fell from 4.0% in June 2017 to 3.6% in December 2017.

Brisbane improved markedly, falling from 5.5% to 4.5%.

However it was Sydney that led the way with vacancy rates falling from 3.0% to 2.5% over the period, followed by Melbourne, which declined from 3.1% to 2.9%.

Adelaide improved from 5.1% to 4.8% and Perth from 5.3% to 5.1%

JLL’s head of retail, property & asset management, Tony Doherty, attributed the decline in vacancy to more realistic landlord expectations.

“Landlords are acutely aware of the changes in the retail industry and the impact that it is having on retailer decision-making. Centre owners are taking a proactive approach to retailer engagement strategies to ensure occupancy rates are maintained.

“Despite some retailers such as Oroton and TopShop Australia unfortunately going into voluntary administration and others strategically closing stores in 2017, our research shows that shopping centre vacancy rates actually decreased over the second half of 2017. Store closures associated with retailers which went into voluntary administration were lower in 2017 than they were in 2016, so there was slightly less vacancy pressure in that regard,”

“Nevertheless, owners and managers of shopping centres are having to work hard to attract and retain retailers and are actively trying grow their exposure to innovative retailers which will remain relevant in the fast-changing new retail environment,” Doherty said.

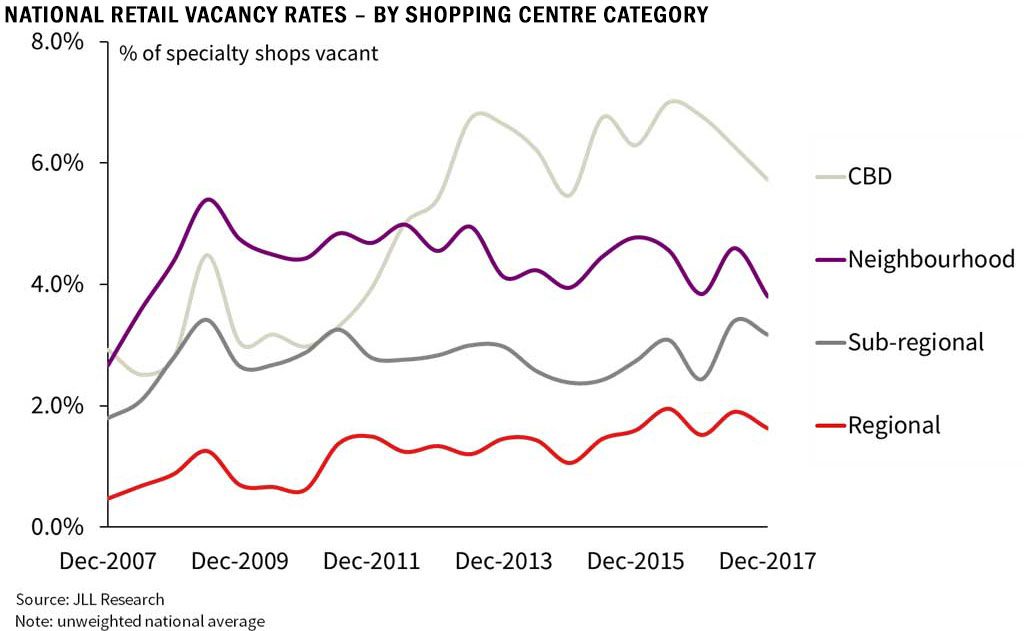

Neighbourhood and sub-regional centre vacancy rates have been relatively stable since 2009. The regional category has been trending up slightly over a long-term view, but remains within the 1-2% range, notably below the other major shopping centre sub-sectors. Growth in pop up retailers has helped keep the vacancy rate lower, particularly around the Christmas trading period.

Neighbourhood centres saw the biggest improvement, falling from 4.6% to 3.8%.

The CBD shopping centre vacancy rate declined from 6.3% to 5.7%, regional dipped from 1.9% to 1.6% and sub-regional from 3.4% to 3.2%.

Looking ahead, head of retail research Andrew Quillfeldt said the impact of store rationalisation strategies by some retailers such as Specialty Fashion Group and growing ecommerce penetration in Australia will accelerate the rate of divergence in the retail sector in 2018.

“There is still relatively positive demand for space within high quality shopping centres, but vacancy is more concentrated in secondary quality centres.

“The economic powerhouses of Sydney and Melbourne recorded the lowest retail vacancy rates in 2017. Some of the lead indicators for wage growth also point towards a recovery, which would be supportive of retail spending and retailer sentiment,” Quillfeldt concluded.

Australian Property Journal