This article is from the Australian Property Journal archive

WHILE the pace of the housing downturn has been slowing since September, 2023 still presents the risk of a re-energised decline.

According to CoreLogic’s latest annual Best of the Best Report, two distinct characteristics of capital growth trends across 2022 standout, the diverse way the housing markets have been impacted by headwinds and the slowing decline in recent months.

This after national value declines slowed to -1.0% in November from the monthly falls of -1.6% seen in August.

“More expensive markets tended to see sharper declines, while the more affordable segment of the market where buyers typically do not have to extend themselves as much to buy into, saw greater resilience to increases in interest rates,” said Eliza Owen, head of research at CoreLogic.

The report also showed a sharp shift in Australia’s housing market from 2021 to 2022, with Kaytlin Ezzy, economist at CoreLogic, defining the two years as moving from strength to resilience.

“Last year’s Best of the Best celebrated some of the strongest annual sales turnover and value growth on record. This year’s report examines some of the most resilient markets as we move through one of Australia’s fastest interest rate tightening cycles in history,” said Ezzy.

The year to November saw national housing values tumble by 3.2%, led by capital city dwelling declines of 5.2%, against regional dwelling value rises of 3.3%.

This reflects an estimated total value decline in residential real estate from $9.6 trillion in December 2021 to $9.4 trillion in November 2022.

Since November 2021, estimated annual sales have also fallen by 13.3%, for around 535,000 dwellings sold.

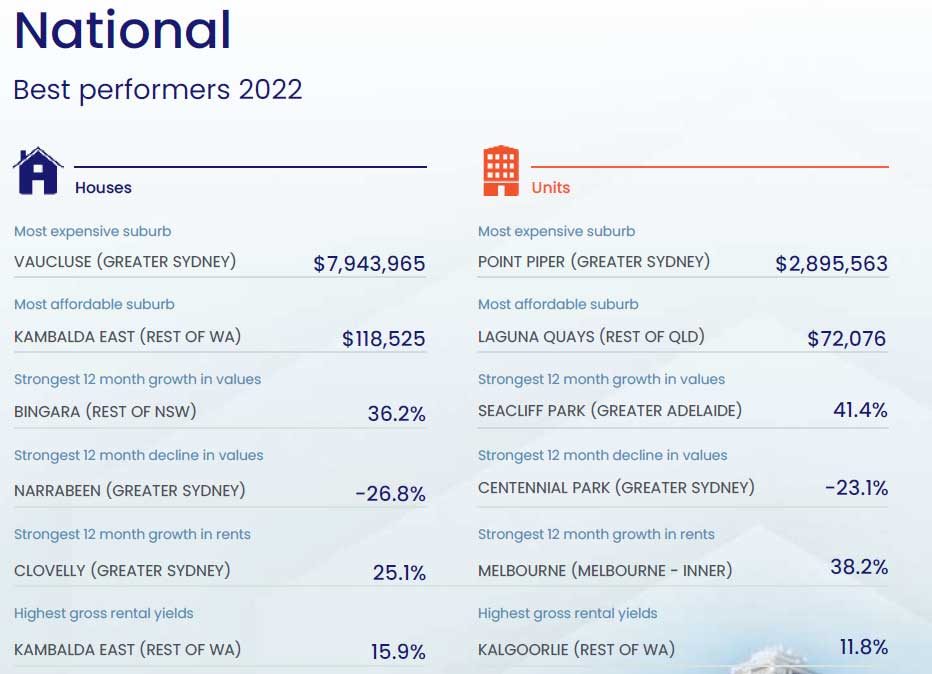

Suburbs in the nation’s most expensive saw the greatest declines over the year, with Sydney’s City and Inner South, Northern beaches and Eastern suburbs regions dominating falls for both houses and units.

In Narrabeen, Surry Hills, and Redfern houses saw the most significant declines in value over the year, down more than -25%. With unit values in Centennial Park and Mona Vale down by -23.1% and -20.8% respectively.

Though Narrabeen recorded the greatest decline over the 12 months period, down 26.8%, NSW also saw the strongest growth in value in Bingara, which saw a 36.2% bump.

This in addition to Clovelly, NSW which saw the greatest rental growth for houses at 25.1%, while WA’s Kambalda East saw the highest gross rental yield at 15.9%.

“At the other end of the scale, Adelaide suburbs dominated the list for strongest annual appreciation in value across both property types, with house values across Davoren Park rising by 34.7%, and unit values in Seacliff Park 41.4% above the levels recorded this time last year,” said Ezzy.

“Adelaide’s resilience has been a consistent feature of the housing market in 2022. While down -0.9% from the July peak, dwelling values across the city are still 13.4% above the level recorded this time last year. Adelaide’s relative affordability and persistently low advertised stock levels have helped insulate it from the worst impacts of rising interest rates.”

While NSW claimed the country’s most expensive suburb for the year, with Vaucluse at $7,943,965, WA had the most affordable suburb at $118,525.

The report’s outlook for 2023 anticipates the rate of decline to pick up steam again as interest rates continue to rise.

“With expectations that the bulk of the rate tightening cycle occurred in 2022, housing value declines could find a floor in the new year. However, the extent of the floor in values could be further weighed down by mortgage serviceability risks, particularly for those rolling out of record-low fixed mortgage rates through the second half of year,” said Owen.

“But unemployment levels remain at historic lows, which plays a role in serviceability, helping to keep a lid on mortgage arrears. On top of that, strong rental markets and improving affordability from the point of falling values, may entice investors and first home buyers into the market, underpinning a recovery in buyer activity in the second half of 2023, when the cash rate stabilises.”