This article is from the Australian Property Journal archive

AT a time of rental crisis, Brisbane apartment completions and commencements have fallen to long-term lows and the city faces a substantial shortage of supply of apartments in the coming years, as project costs, diminishing purchaser capacity and sentiment all prevent new developments from getting out of the gates.

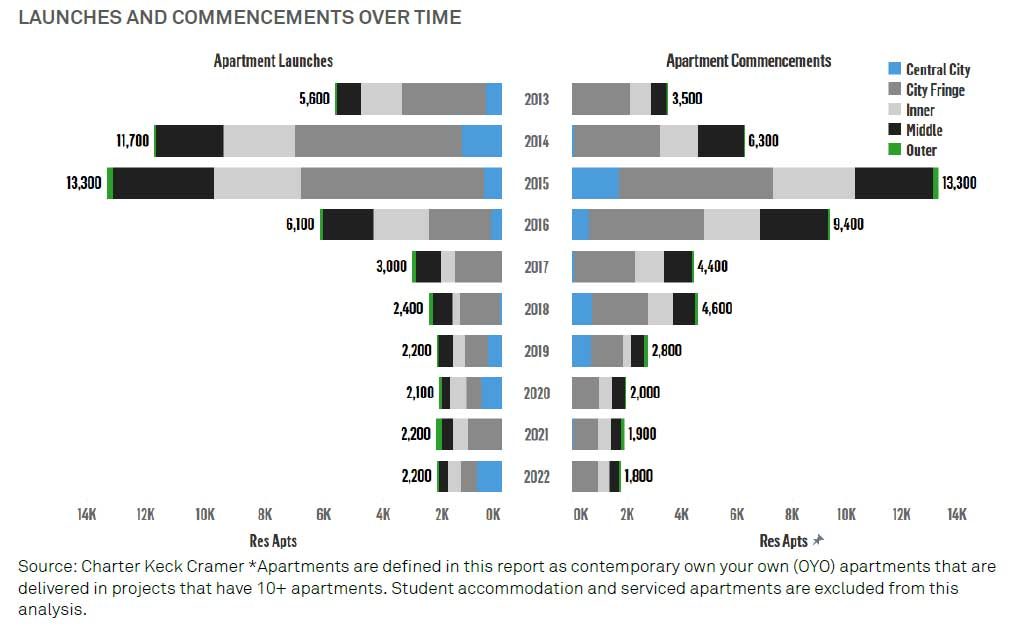

According to Charter Keck Cramer’s latest State of the Market report for Brisbane’s build-to-sell (BTS) and build-to-rent (BTR) market, construction commencements dropped to 1,800 in 2022, a decrease of 86% from the peak of 13,300 in 2015.

Meanwhile, completions fell to 1,300 – the lowest level since 2010 – marking a 41% fall on the previous year.

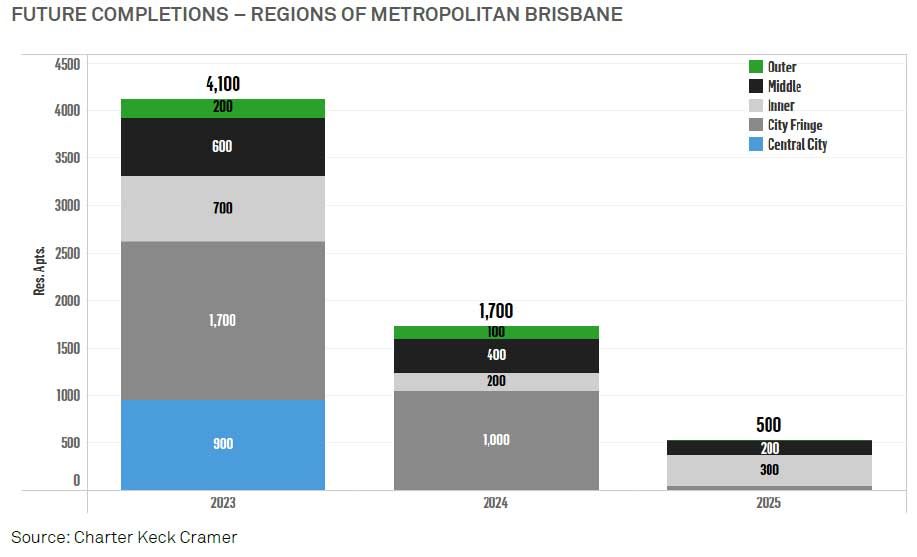

There are approximately 4,100 apartments due to complete this year, with a further 600 forecast for completion in 2024. There are also 1,100 apartments marketed and that may be delivered in 2024 and a further 500 apartments marketed that may be delivered in 2025.

“Given the low supply of apartments over 2020-2022 combined with the strong population growth forecast for Brisbane over the next few years, the BTS market is expected to remain in short supply relative to demand,” said Richard Temlett, Charter Keck Cramer director, research and strategy.

“This imbalance may be exacerbated further if projects are delayed due to the economic environment, higher interest rates and the rise in construction costs.”

“The BTS apartment market is anticipated to continue to remain slow for the first half of 2023 and until there is more certainty with interest rates.”

The shortfall is occurring as Brisbane faces a rental crisis. According to SQM Research, Brisbane’s vacancy rate fell in January to just 0.8%, while the CBD has a vacancy rate of just 1.4%.

The city fringe region will be the most active this year, with 1,700 apartments expected to complete, followed by the central city region with 900 apartments. The city fringe will continue to be the most active market in 2024, accounting for almost 60% of all apartment completions.

There was a total of 2,200 BTS apartments launched for sale to the market, in line with the past five years but significantly lower than 2015. There are 2,672 BTS apartments currently being marketed and 4,725 under construction, but given requirements to reach pre-sales targets before attracting construction finance the figures are likely to be revised downwards.

“Pre-sales are anticipated to begin to pick up from the point at which interest rates stabilise (assumed mid to late-2023) and will start to accelerate when the interest rate cycle moves into a cutting phase,” Temlett said.

“Pre-sale performance may improve sooner should the government take action and incentivize the investor market.”

Temlett said the BTR apartment market is quickly emerging in Brisbane with two projects totalling 289 apartments completed and a further five projects with 1,400 apartments currently under construction.

There is a further 3,500 BTR apartments across 10 projects at the early stages of the development process, however, it continues to be very challenging to get projects to stack up as well as to secure funding for construction, Temlett noted.

“Given the strong rental growth in Brisbane, it is anticipated that those developers that are able to proceed with construction will benefit from little direct competition in the marketplace and achieve strong rental returns and premiums.

“The fundamentals to support BTR in Brisbane exist and with over 35% of the population renting, there is a substantial opportunity for BTR to supply rental accommodation that will be unable to be supplied by the BTS market in the short to medium-term.”

Property giant Lendlease is set to finally enter the Australian BTR, striking a partnership with QuadReal Property Group to deliver an apartment building with 443 residences at Brisbane Showgrounds, while projects underway include Pellicano’s Berwick House in Fortitude Valley.