This article is from the Australian Property Journal archive

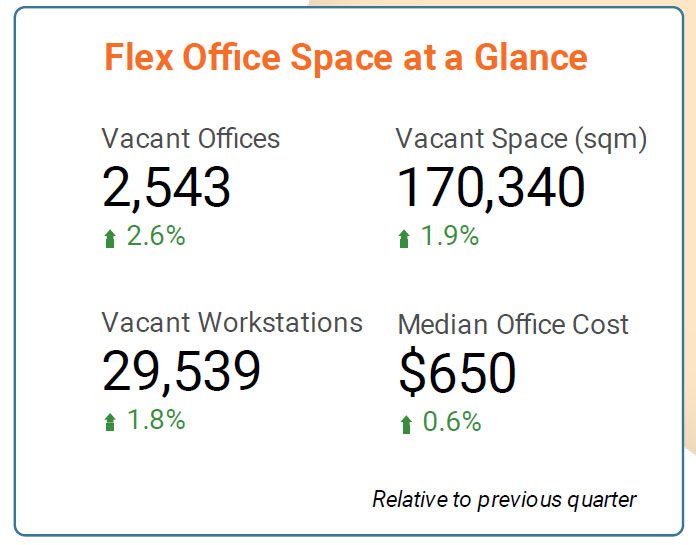

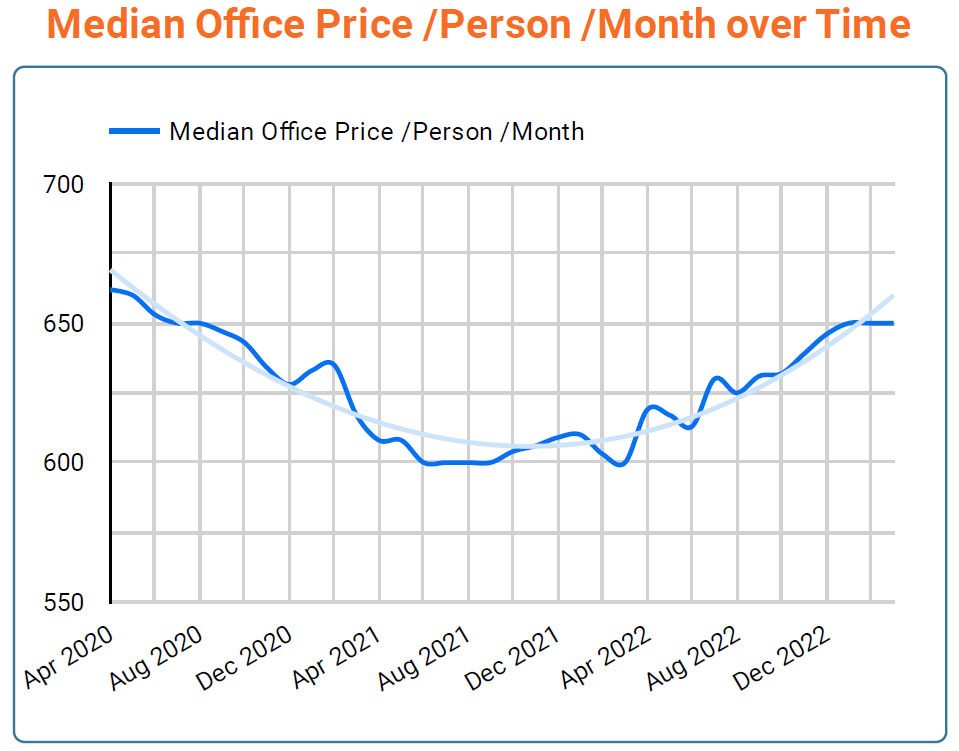

OFFICE space rents are holding steady against inflationary pressures and a 1.9% increase in available supply over the first quarter, with demand peaking over March.

According to Rubberdesk’s latest Flexible Office Space Report, available flexible office space was up by almost 2% with a smaller 0.6% increase to cost per desk bring the average national cost to $650.

Demand for office space increased in January, before peaking in March, particularly amongst businesses with under 60 employees.

“The uncertain economic and business landscape has prompted an increased interest in flex office spaces, driven by the favorable terms of one-year leases, low-security deposits, and the convenience of turnkey services and community amenities,” said Jim Groves, CEO and co-founder at Rubberdesk.

Research from The Instant Group’s 2023 Predictions also found that nearly three-quarters of flexible office operators globally are looking to increase their footprint this year.

Sydney’s CBD prices remained steady, with a marginal 0.8% quarter-on-quarter increase to $958 per desk, with larger offices for teams of 50 or more seeing a 23% rate increase to $982 per desk.

North Sydney rates fell over the quarter, dropping from $600 to $550 per desk, while Parramatta dropped 4.3% to $765 per desk per month.

Sydney’s CBD also saw a 15.5% increase in available flexible office space over the quarter, while outside the CBD supply remained relatively stable.

In Melbourne there was a marginal boost to demand, resulting in upward pressure on the market’s rates for the first time in the last 12 months, with the average desk rate growing 7.7% to $700 per desk.

However, growth in Melbourne’s fringe markets may have peaked, with areas outside the Central Business District such as Cremorne, Southbank, South Melbourne, and Richmond recording an average decline of 5%.

Vacant space in Melbourne grew 5.8% over the quarter to 38,120sqm.

Meanwhile Brisbane recorded a 31% decline in inventory, as rates rose 6.5% to $676 per desk. This comes after a new report from The Instant Group found demand for flexible space in Brisbane had grown by 8% in 2022 when compared to pre-pandemic levels in 2019.

Perth recorded its second consecutive quarterly increase, up 3.7% to $700 per desk, as vacant space fell 3.0%.

In Canberra, rates returned to growth after a dip over the latter half of 2022, recording a 9.6% uplift to $500 per desk, as vacant space grew by 0.7%.

Finally, Adelaide saw its fourth consecutive quarter of growth, with a 5.4% increase to $644 per desk, as vacant space fell by 3.0%.

“Based on the first quarter figures, I’m cautiously optimistic about the year ahead. There has been a notable influx of new premium flex office spaces entering the market, and demand from businesses has remained robust,” concluded Groves.