This article is from the Australian Property Journal archive

A RUN of three record quarters for commercial property transactions came to an end in the June quarter, as deal volumes dropped 33% from a year earlier amid mounting economic pressures, according to MSCI Real Assets.

The fall was driven by industrial sector deals dropping by 63% year-on-year, according to the latest Australian Capital Trends report, down to $4.1 billion. Office building sales lifted 7% to $5.4 billion while retail deals slumped 28% to $3.0 billion.

Transactions in the period totalled $14.2 billion.

“After such a strong 2021, volumes were likely to normalise in 2022, but the recent economic issues have further impeded activity, particularly at the smaller end of the deal spectrum,” said Benjamin Martin-Henry, head of Pacific Real Assets Research at MSCI.

“Smaller investors are more sensitive to increases in the cost of capital so the recent interest rate rises may have curbed deal flow.” Interest rates, which have quickly risen from 0.1% to 1.35%, are expected to be lifted again when the Reserve Bank of Australia board meets today.

“Whilst there is little doubt the market is slowing down, whether this is merely a normalisation of transaction volumes after a period of significant disruption or the start of a more considerable downturn is perhaps premature to call. However, there are increasing signs of the latter,” the report said.

“Hiking the official interest rate may increase the capital cost for investors, and subsequently, reduce their borrowing ability. The effect may mean fewer buyers in the market and a squeeze on pricing. Increases in the cost of debt impact smaller investors to a greater degree as they have fewer alternative sources of capital compared to larger institutions. This being said, the momentum of larger deals has also slowed down.”

Over the first half of 2022 there was $28.8 billion worth of transactions, a 12% decline on a year earlier, however, the count of unique transactions fell by 32% year-on-year.

Portfolio deals were a factor in the market’s prior surge, particularly in the industrial sector – including GIC and ESR’s record $3.8 billion acquisition of the Milestone Logistics portfolio – but in the first half of this year there were only four such transactions, compared to 17 in the same period in 2021.

“All sectors have seen a reduction in the number of deals done at a greater magnitude than the reduction in volumes, indicating that it is the smaller deals that are drying up, the report said.

“These results could be cause for concern as when larger transactions are the driving force, it tends to mean that the heat is coming out of the market.”

Office deals over the first half were up 4% to $9.6 billion, making it the best performing core sector. Industrial was down 31% to $9.9 billion and retail sector was down 17% to $6 billion.

The quarterly figure is around 5% below the 10-year average, but following the record-breaking March quarter, the first half is 25% above average.

David Green-Morgan, head of real assets research at MSCI, said pockets of the retail sector have seen some robust demand – large format and neighbourhood centres remained the preferred subtype, and there has also been renewed interest in large shopping centres and CBD retail – while overseas investors have leaned much more to the office and industrial markets.

Positives in the market included an 84% rise in hotel sector deal volumes, driven by buyers headquartered outside Australia, while the student housing sector has also seen increased appetite.

Offshore investors acquired nearly $4.7 billion of commercial real estate, marking a 24% drop year-on-year. This was driven by a pullback from investors outside of the Asia Pacific region of 65%, resulting in the lowest second quarter total from this group of investors in a decade.

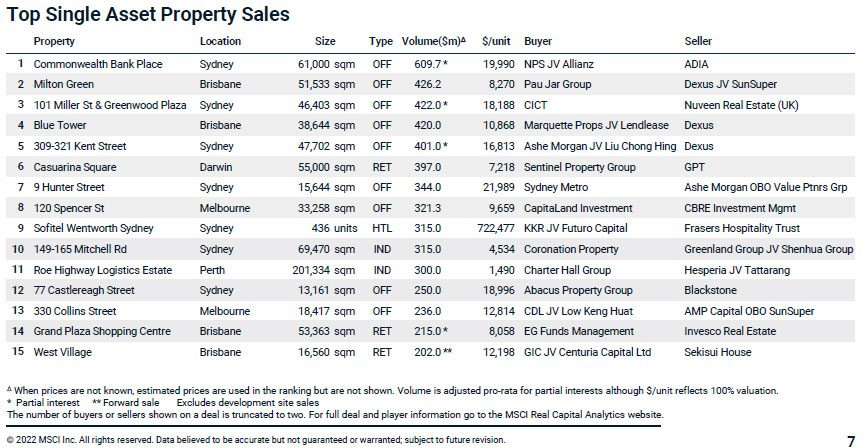

Sydney offices most active

The Sydney office market was the country’s most active for transactions in the first half of 2022, up 14% year on year to over $4.28 billion. That was followed by Sydney industrial (up 18% to $3.6 billion) Melbourne industrial (down 51% to $2.34 billion), Melbourne office (up 17% to over $2 billion) and Brisbane office (up 6% to nearly $1.6 billion).