This article is from the Australian Property Journal archive

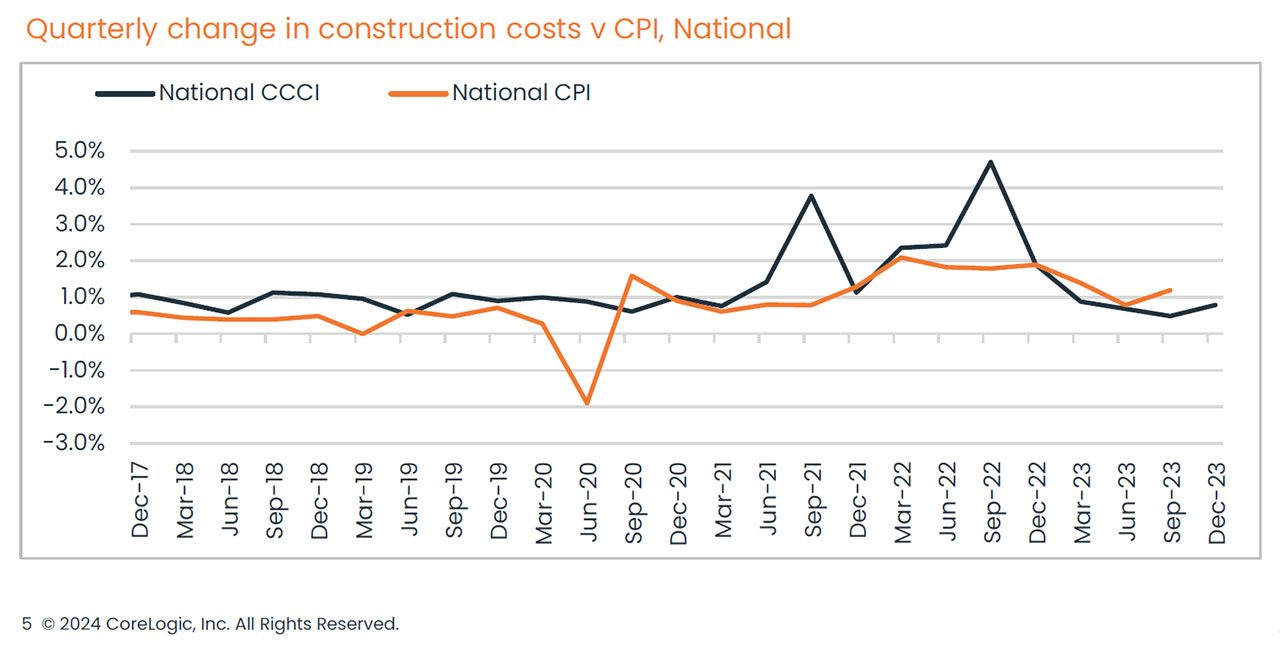

WITH the quarterly pace of growth for national construction costs picking up again, growth rates look to be a return to trend and not a new surge.

According to CoreLogic and the Cordell Construction Cost Index (CCCI), construction cost growth was up at a rate of 0.8% in the three months to December, reflecting a reversal of the easing trend witnessed over the last four quarters.

In the previous four quarters the quarterly CCCI rate fell from 4.7% in Q3 2022 to 0.5%in Q3 2023, with the 2023 calendar year recording a growth rate of 2.9%.

Still, the latest growth rate is sitting 20 basis points below the pre-COVID decade average of 1.0%.

“This suggests that reacceleration is more a return to trend rather than a new surge in construction costs,” said Kaytlin Ezzy, economist at CoreLogic.

“While up over the quarter, the annual change in residential construction costs continued to ease as larger quarterly increases fell out of the annual calculation.”

The latest 12-month increase, at 2.9%, reflects the smallest annual rise in the CCCI since the year to March 2007, when it was 2.7% and is well below the pre-COVID decade average of 4.0%.

“This suggests that growth in construction costs have normalised after recording a recent peak of 11.9% over the 12 months to December 2022, albeit at a higher level,” added Ezzy.

“Although 26.6% higher than at the onset of the pandemic, the recent surge in CCCI is below the increases seen across national house values, with CoreLogic’s Home Value Index rising 36.5% over the same period.”

For NSW, the CCCI was up 1.0% or 40 basis points on the previous quarter, while just 10 basis points above the pre-COVID decade average of 0.9%. With the annual increase softening to 3.1%.

In Victoria, the CCCI was up 1.1% over the quarter, up from 0.3% in the September quarter. While the annual increase eased to 2.9%.

Queensland saw its slightest quarterly rise at just 0.1%, down from 0.8% in the previous quarter. With an annual growth rate of 2.8%.

Construction costs in WA were up 0.7% over the quarter, an increase of 50 basis points on quarter three. With an annual rate of 2.3%.

While in South Australia, the CCCI was up 0.5%, down from 0.6% in Q3, for an annual increase of 2.8%.

“In 2023 there was a bit of uncertainty around what the fallout from the interest rate increases would be and therefore the overall impact on the building industry. While the latest figures show the market has settled down, I don’t think we have seen the slowdown many were expecting,” said John Bennett, construction cost estimation manager at CoreLogic.

“While dwelling approvals are still well below historic averages, there is still an elevated level of projects under construction which is keeping cost pressures high.”

Construction cost forecasts remain uncertain for the coming year, though declines remain unlikely.

“Although national dwelling approvals have risen from a recent low of 12,185 in January, the latest data from the ABS showed that dwelling approvals remained -15.8% below the decade average in November at around 14,500. Although a number of projects are still moving through the construction pipeline, the recent lull in approvals could result in a shortfall in new projects, which would help keep growth in building costs low, due to greater capacity in the construction sector,” said Ezzy.

“However, with the CPI continuing to ease, it’s looking increasingly like we’ll see a cash rate cut in the second half of 2024, which could fuel housing demand for both established and new dwellings. Regardless, the normalisation in CCCI growth will help provide some certainly for builders, insurance companies and homeowners alike.”