This article is from the Australian Property Journal archive

CONDITIONS are becoming “truly dire” for Australian businesses, as the value of invoices fell by nearly 50% over the year.

According to the June results for CreditorWatch’s Business Risk Index, the average value of invoices held by businesses was down 49.9% in the year to June, as businesses roll back inventory thanks to high prices and falling demand.

“The combination of declining order values and increasing payment defaults is a major concern as it indicates more businesses are experiencing both cost and demand pressures,” said Patrick Coghlan, CEO at CreditWatch.

“With another rate increase becoming increasingly likely, we expect both metrics to deteriorate even further.”

Invoice payment defaults have also been tending upwards since mid-2021, as businesses struggle to pay their suppliers, even with the lower order values.

“It is small businesses that are hurting the most as they are more vulnerable to adverse economic conditions than larger businesses. They operate on tighter margins and are less able to take measures to cut costs,” added Coghlan.

The business failure rate is also rising, with a 8.8% increase across all industries in the year to June.

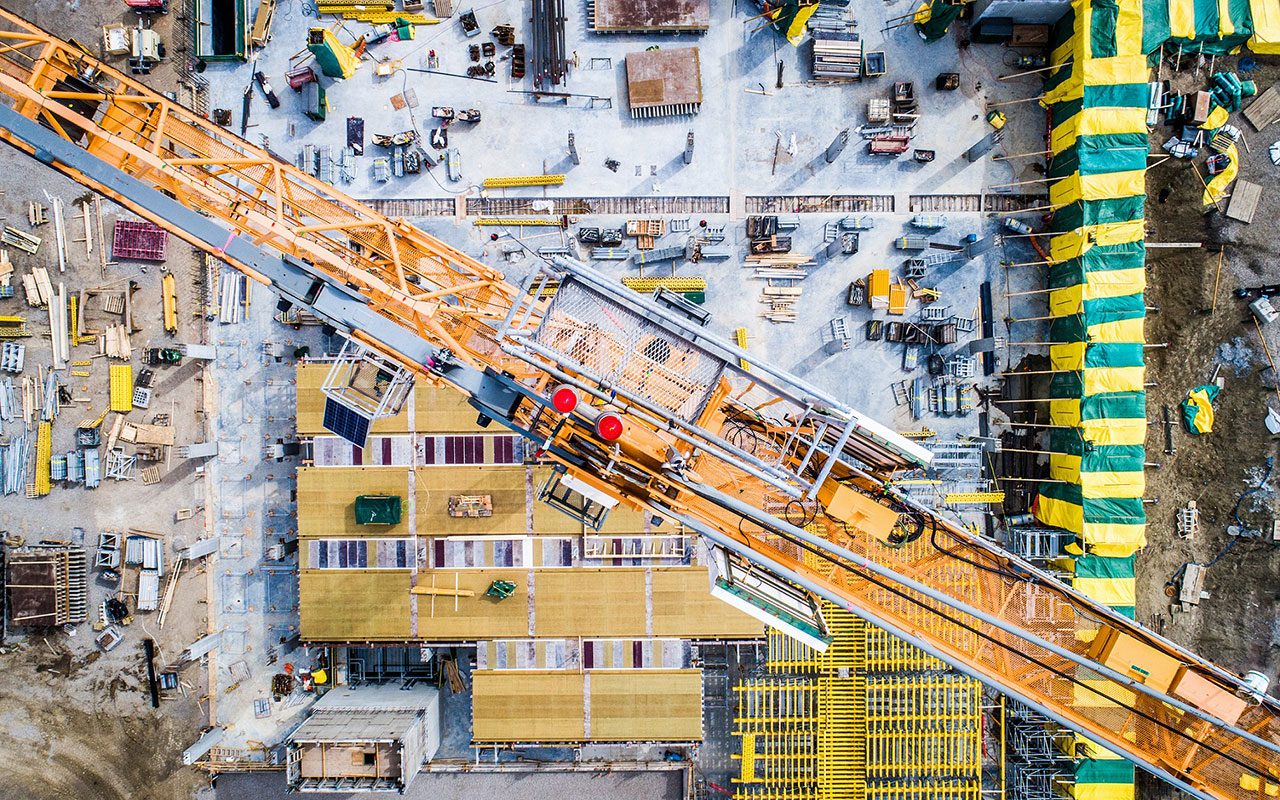

In the construction sector, the business failure rate at 5.15% but set to fall by 0.26% to 4.86% over the next 12 months.

The sector is also ranked second for industries with outstanding ATO tax debts exceeding $100,000, with a rate of 1.18%.

Additionally, court actions are trending up with a 37% increase for the year to June, with credit enquiries dropping over the month but remaining flat over the year.

“The high cost of debt is compounding the problems wrought by inflation, that is still too high in some areas,” said Anneke Thompson, chief economist at CreditorWatch.

“Monetary policy decisions usually lag what is happening in the broader economy, as data takes time to filter through to the RBA, and the RBA also wants to see a few months’ worth of data to be more certain that their decisions taken at board meetings are the correct ones.”

“While this approach is sound theoretically, in practice it means businesses have to endure high interest rates long after consumer demand has plummeted, and discretionary spending has significantly weakened.”

The outlook based on this latest data isn’t optimistic, with monetary policy, rising prices in the services, utilities and insurance sector and record low consumer confidence dragging on Australian businesses.

Areas with younger populations and businesses in the hospitality sector will continue to bear the brunt of the impacts well into 2025.

While low unemployment and positive job security has been one of the only positives for the economy in recent years, these metrics are also set to deteriorate.