This article is from the Australian Property Journal archive

DEXUS has secured the 80 Collins Street commercial development in Melbourne from QIC, and has launched a $900 million raising to partially fund the record-breaking $1.476 billion deal that makes it the major player in the city’s Paris end.

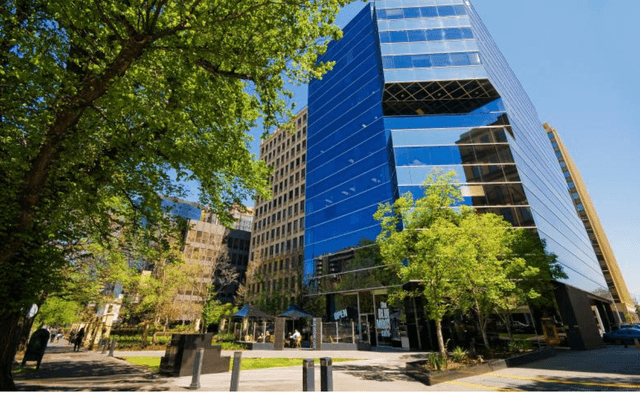

The asset has an existing 47-storey office tower that is flanked by a 43,000 sqm office building of 39 storeys and a 255-room hotel and retail complex, both of which are under construction.

It will have a net lettable area of 105,000 sqm on a 5,169 sqm corner site on completion.

The new office tower will become the new headquarters of Macquarie, while law firm DLA Piper recently signed up for to 4,500 sqm and McKinsey 2,700 sqm, taking pre-commitments to more than 50%. Ashurst is believed to be close to taking around 4,500 sqm.

Dexus paid $230 million last year for the adjoining sites at 52 and 60 Collins Street, across Exhibition Street, on which it will build a 35,000 sqm prime-grade office development with an end value of as much as $650 million.

“Following the acquisition of 52 and 60 Collins Street last year, this acquisition further enhances our scale and presence in the tightly held ‘Paris end’ of the Melbourne CBD, a prime location where our customers want to be,” Dexus chief executive officer, Darren Steinberg said.

Dexus will own or manage circa 20% of the total office stock in the city’s eastern core following what is the largest property transaction struck in Melbourne.

“Importantly, vacancy in the Melbourne CBD office market is nearing an all-time low, supported by strong population growth and significant pre-commitments across the upcoming supply pipeline,” Steinberg added. Melbourne’s vacancy rate firmed from 3.6% to 3.2% over the six months to January, according to the Property Council, while its population growth remains the highest in the country, according to official data.

Acquired at an equivalent yield of 5.3%, ownership of the precinct will be split between Dexus, taking 75%, with 25% going to Dexus Wholesale Property Fund.

QIC will manage the development of the new office tower, retail podium and hotel.

Dexus is expecting “significant” positive rental reversions on the existing tower, which is 41% leased to the Minister of Finance.

Citigroup, JPMorgan and Merrill Lynch are acting are joint lead managers of the placement. Dexus was advised by Citigroup, Deutsche Bank AG, Greenhill & Co. JPMorgan and Merrill Lynch for the acquisition.

As well as the $900 million placement – the largest since the global financial crisis – Dexus will also undertake a $50 million non-underwritten security purchase plan.

Dexus confirmed late in March that it is in due diligence to acquire the asset in Melbourne’s east end from QIC, and is believed to have outlasted major rivals Mirvac and Charter Hall in the bidding.

The 80 Collins Street deal is the second landmark acquisition by Dexus this year, having acquired the remaining share in Sydney’s MLC Centre for $800 million from GPT and subsequently launched $425 million raising through Citigroup, JPMorgan and Merrill Lynch.

Australian Property Journal