This article is from the Australian Property Journal archive

HONG Kong Stock Exchange-listed ESR has expanded further in the Australian industrial and logistics real estate with the $142.5 million acquisition of a western Sydney development site that will have 110,000 sqm of floor space.

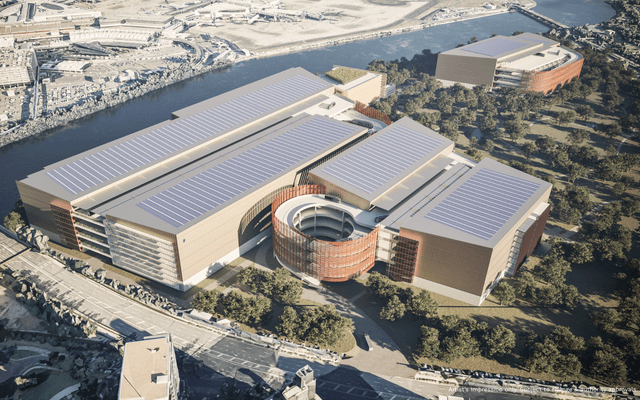

The 20.8 hectare site at 327-335 Burley Road in Horsley Park will be known as ESR Horsley Logistics Park, and is strategically close to major transport links including the M4 and M7 Mwys, and in proximity to the future Western Sydney Airport.

ESR is hoping the park will benefit from infrastructure projects including WestConnex, Sydney Metro, Moorebank Intermodal, as well as the Airport, and population growth throughout western Sydney.

Facilities at the logistics park will be spread across four to six separate warehouses.

Backed by Warburg Pincus, ESR has acquired Propertylink in a $723.4 million takeover and integrated Commercial & Industrial Property Pty Ltd since entering the market and now has a development pipeline of $1.8 billion, and 330,000 sqm of lettable area across 70 hectares.

ESR Australia has exchanged contracts on a number of sites in Sydney, Melbourne and Brisbane.

They include 21.5 hectares at 59-63 Abbotts Rd, Kemps Creek in outer western Sydney, and 8.7 hectares at 186-224 Ingleburn Rd, Leppington in the south west, close to its existing Bringelly Road Business Hub.

Phil Pearce, chief executive officer of ESR Australia said Kemps Creek is earmarked for the next phase of the western Sydney industrial markets, in a prime position to capitalise on diminishing land supply and strong tenant demand in the area’s pre-lease market.

In Melbourne, ESR has bought 6.5 hecares at 45-49 McNaughton Road in the south eastern suburb of Clayton, and within the broader Monash National Employment Cluster, while Brisbane sites include 6.2 hectares at 450 Sherbrooke Rd, Willawong, close to its recently completed Nolans Interstate Transport facility, and a 5.0 hectare property at 98 & 114 Gilmore Road, Berrinba.

Approval from the Foreign Investment Review Board is currently being sought for several of these transactions.

“With the addition of these recent land acquisitions to our existing land bank, we are well- positioned to deliver on our strategic priority of developing premium logistics properties in high demand, low supply locations for our customers,” Pearce said.

In a joint venture with Frasers Property Australia, ESR has just sold off a 4.67 hectare site in Mulgrave that will become the head offices of Nissan, and has also divested a brownfield development opportunity of four hectares in Dingley for $19.75 million.

ESR shares began trading on the Hong Kong Stock Exchange at the beginning of this month, after an oversubscribed initial public offering that raised US$1.6 billion, with OMERS Administration Corporation a cornerstone investor.