This article is from the Australian Property Journal archive

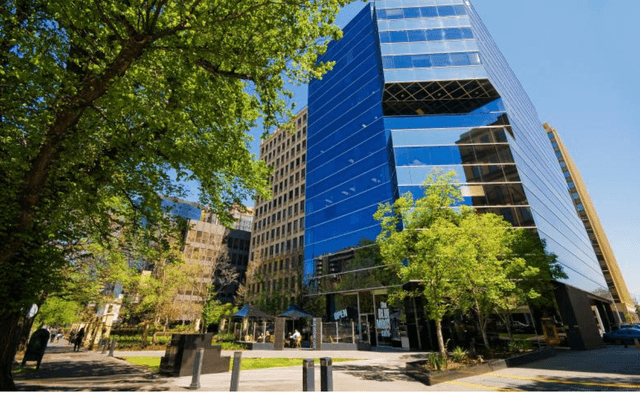

AS Garda sells out of its Melbourne office portfolio, the ASX-listed group has had its last office property, Cairns Corporate Tower downgraded in value by $5.8 million to $82 million, as workplace asset values continue their broad softening.

The capitalisation rate increased 75 basis points to 7.75%.

The 14,758 sqm office property is 94% occupied and has a 3.7-year weighted average lease expiry.

Garda will also independently value the Richlands industrial development upon its practical completion, expected in late December 2023.

Garda had just taken another hit on the sale of a Melbourne office building, offloading a Hawthorn East complex – which it acquired only last year – for $24.1 million, below the $25 million book value, as the ASX-listed company takes another step towards being a pure-play industrial portfolio.

It October it announced it would take a value hit of more than 27% on the sale of a pair of Melbourne city fringe office buildings which it sold for $80 million, as the office market faces an ongoing reckoning of asset values.