This article is from the Australian Property Journal archive

TENANTS and investors are adapting to the investment climate of ‘lower for longer’, according Dexus Research.

Dexus general manager of research Peter Studley said investors and occupiers are adopting that mentality when it comes to interest rates and economy growth.

The Australian economy is forecast to grow at a subdued rate in FY16, with divergent growth between states and sectors.

Studley said in the short term Victoria and New South Wales will outperform other states, driving national growth.

Queensland is forecast to improve in the next two years whilst Western Australia is likely to lag, following a period of negative activity.

Furthermore, the bias for interest rates is to the downside given downgrades to global growth.

“Risks to current growth assumptions appear to be to the downside. While much focus is on China, the extent of any peaking in the local residential property cycle is of greater importance, given the potential for a slowdown to reduce construction activity and influence confidence and household spending.

“Business and consumer confidence are both subdued and both will be important for the fledgling recovery in occupier markets to be sustained in the short to medium term,” he added.

Despite the subdued outlook for property fundamentals, Studley forecasts strong capital flows to continue.

He said cheap debt and secure property yields would continue to drive competition for investment stock as investors seek the secure income yields provided by well leased property investments.

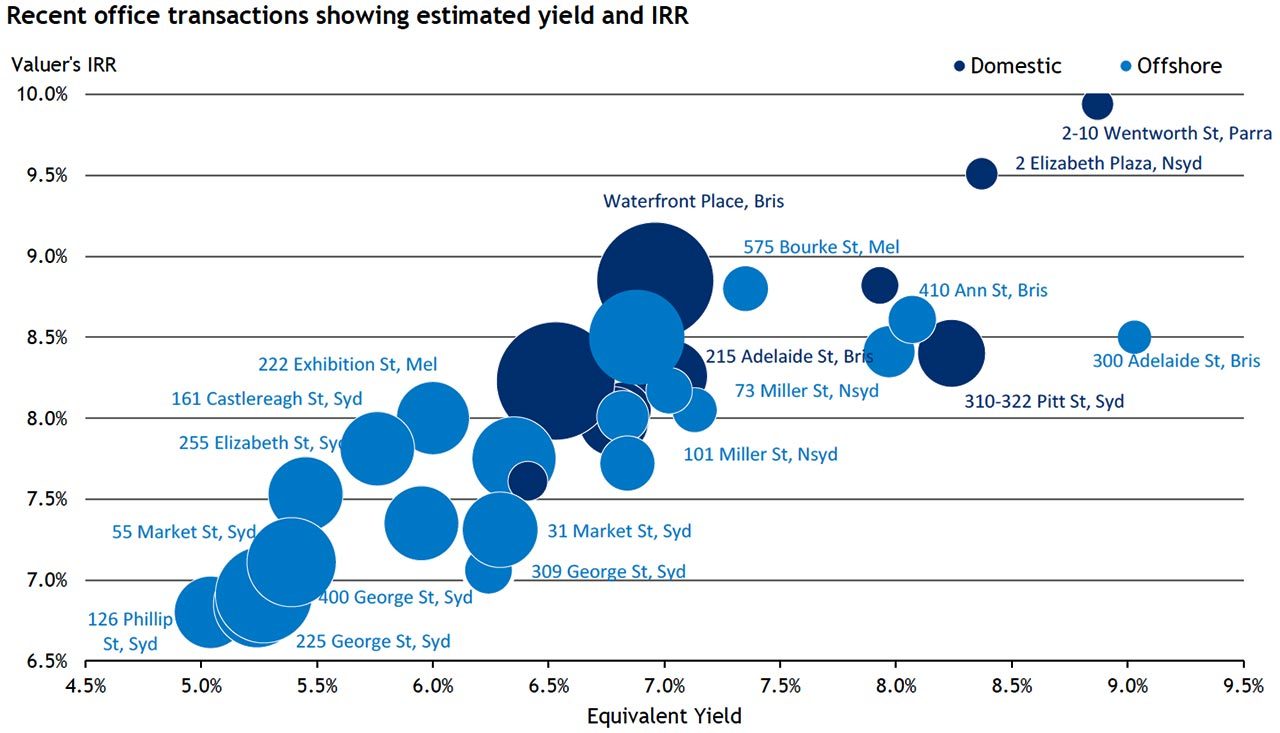

“The volume of commercial property transactions in the year to September 2015 is estimated at $19.7 billion, a strong result buoyed by several portfolio sales.

“Demand from foreign investors remains strong, accounting for 49% of recent transactions. Foreign investors are particularly focussed on high quality core stock.

“Yields are declining, and values are increasing, which is the sign of a maturing investment cycle. However the drivers of investment demand – being low interest rates and search for secure income yield look like staying in place over the next year,” he continued.

Studley said whilst office demand drivers remain broadly positive, the short term outlook for rents is subdued with the outlook for markets varying according to the level of vacancy.

“Office demand is positive in the eastern states. Leasing activity is being driven by growth in the information technology, education, finance and professional service sectors, particularly among small firms.

“Positive absorption of office space in the east coast markets, along with significant withdrawals of older stock is likely to provide a welcome offset to new supply scheduled to complete in FY16,”

“Supply remains a key issue for the year ahead. Sydney, Brisbane and Perth are set to experience a significant rise in prime stock, which will likely outpace demand, leading to a temporary rise in vacancy. Withdrawal of secondary stock and a lack of supply beyond FY16 will play a key role in stabilising the Sydney and Brisbane markets.

“Effective rent growth has varied across the markets, with Perth and Adelaide by far the weakest. There are signs of incentives reducing mildly in Sydney CBD. While new supply is expected in FY16, a more benign supply outlook should allow rents to pick up and incentives recede further in the medium term,”

Meanwhile the growth prospects in the industrial sector is muted.

Studley said industrial leasing conditions look more favourable in Sydney and Melbourne on the back of stronger economic growth in these states, with Brisbane conditions mixed and Perth weak.

Demand has improved slightly in the eastern states and is expected to remain positive in the short term due to tailwinds from construction, retail expenditure and the low interest rate environment.

“Markets most likely to see rental increases in the next 12 months are inner city markets facing land constraints and stock withdrawal as well as some outer suburban markets such as Outer West Sydney where vacancy is falling.

“Industrial assets continue to be highly sought-after, particularly in Sydney and Melbourne where average prime cap rates compressed at least 25bps in all key markets in the last quarter. Some further compression is likely in FY16,”

The outlook for the retail sector is more positive despite economic uncertainty.

Studley said retail sales continue to grow solidly, supported by low interest rates. In the face of domestic and global uncertainty, consumer confidence remains the wildcard and somewhat of a missing link.

“Retail turnover growth at 4.3% for the year to August 2015 remains positive but slightly below the long term average. Discretionary spending growth continues to lead non-discretionary growth, with household goods and clothing, footwear and accessories the best performing categories with reported growth rates of 9.2% and 6.9% respectively for the year to August 2015. Department store sales have also turned positive showing growth of 3.3% for the year.

“Solid retail sales growth is projected for the year ahead, supported by low interest rates on the one hand but constrained by weak wages growth on the other,”

Studley said the next wave of international retailers are likely to be luxury tenants seeking flagship locations in Sydney and Melbourne including Alexander McQueen, Dolce & Gabbana, Dunhill, Givenchy, Tom Ford and Valentino.

Australian Property Journal