This article is from the Australian Property Journal archive

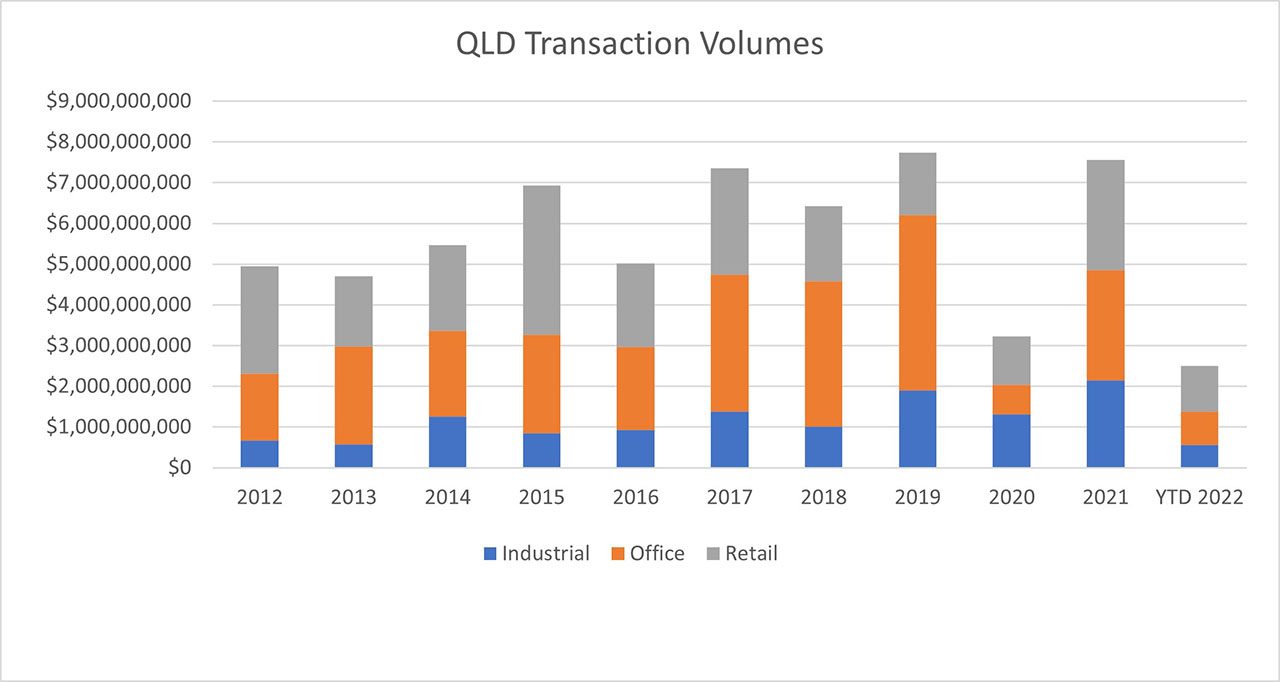

COMMERCIAL property transaction volumes in Queensland have picked up in 2022 where they left off last year, with $5 billion in deals recorded at the halfway mark as the state enjoys population growth and a growing economy, and looks ahead to the 2032 Olympics in Brisbane.

Colliers’ research shows Brisbane’s commercial property sector increased significantly in 2021 compared to 2020, with over $1.4 billion worth of property transacted in the CBD alone.

Following a hiatus in investment activity in 2020, buyer confidence has returned and the Brisbane office market recorded more than $2.78 billion worth of investment sales in 2021. Investment activity within the CBD continued into the first quarter of 2022 with some $679.5 million worth of transactions, largely underpinned by the sale of the Blue Tower at 12 Creek Street for $420 million to Marquette Properties and Lendlease, while Dexus divested its 10 Eagle Street holding.

The office sector experienced a slight tightening of yields across all grades.

“This volume of deal flow is a welcome turn for the office sector after recent struggles reported throughout the pandemic. An overall improvement in key fundamentals and investor confidence suggests the asset class may be on its way back to reclaim its throne from the industrial sector,” Adam Woodward, Colliers head of office capital markets Australia.

Domestic institutional investors dominated the Brisbane office investment market in 2021, accounting for 89% of transactions. An increasing share in offshore investment is expected following the reopening of international borders.

Investment activity may face some hurdles into the future. Further rate rises by the Reserve Bank could impose impediments for private and public investors, and could mean the end of the tightening yield cycle as yields come under pressure from the rising cost of debt.

Since pre-COVID, average secondary grade yields have tightened by 0.25 percentage points to 6.25%, and while premium-grade yield compressions have been a bit more modest at just 0.8 percentage points (to 5.02%), both grades are at record lows. Over 10 years, premium-grade yields have contracted by 2.23 percentage points and secondary yields by 2.6 percentage points. Both grades are seeing their lowest yields since pre-GFC in 2007.

Retail rebound continues

First half sales retail volumes have already reached over $1.45 billion, equating to almost 40% of total retail transactions across the country. That follows some $2.7 billion worth of sales were recorded in the state across all retail categories in 2021, as well as the record-breaking sale of Pacific Fair sold in combination with the Macquarie Centre in NSW across two separate transactions for a combined $2.96 billion. Excluding the Pacific Fair deal, sub-regional and neighbourhood centres accounted for almost 70% of transactions by value.

The weight of capital directed to neighbourhood centres has driven yields to historical lows with Brisbane recording average yield compression of around 175 basis points over the last 12 months. With an increased interest in Neighbourhood assets, investors have been encouraged up the risk curve, and investor interest is growing in sub-regional assets. Two sub-regional centres traded through the start of 2022 totalling $214.7 million, although activity amongst neighbourhood centres remains strong with 12 assets trading for a total of $612.3 million.

Industrial purple patch

In the industrial sector, the past 12 months has seen investment and occupier volumes reach new heights, and yields fall to record lows in all submarkets.

Gavin Bishop, Colliers managing director of industrial, says market conditions for 2022 are forecast to remain strong in Brisbane and will be supported by solid underlying fundamentals which will continue to create a tailwind for occupier and investment demand.

“While existing fundamentals such as e-commerce, infrastructure investment, and automation will remain key drivers for demand, population growth in Queensland is currently the strongest in the country and will amplify demand for warehouse space off the back of growing consumption levels,” Bishop says.

Fewer assets have been brought to market in 2022 which has constrained investment volumes. Queensland was the most active industrial market in the country in 2021 by number of assets to trade, however, Bishop said investors are holding out bringing assets to market in order to capture the forecast uplift in rents.

“Given the upswing in rents, demand for short WALE (weighted average lease expiry) assets in infill markets has been particularly strong as investors target assets that provide short-term positive rental reversions.”

Occupier take-up reached record levels at almost 700,000 sqm in 2021 and the momentum has continued into 2022 with downward pressure on vacancies despite the increase in speculative supply.”

Institutional investors who have historically targeted Sydney and Melbourne see opportunity in Queensland more broadly and Brisbane in particular as rental growth has lagged the southern states over the past year and a period of catch-up is expected over the coming 12 months, Bishop said.

Despite a higher interest rate environment and the increase in funding costs, there is no evidence of a softening in yields, Bishop said, and the pick-up in rents is expected to offset the cap rate expansion that will come with further interest rate rises.