- What Serviced operators are expected to start consolidating

- Why Some owners are looking for an exit whilst others are looking to create economies of scale

- What next WeWork’s IPO and the sale of Spaces will set the agenda for pricing

Landlords and investors alike have been scrambling to stake their claim in the flexible office market over the past few years in a bid not to be left behind by the slow but steady revolution of the workplace.

Very few however have been able to build scale – a factor incredibly important in making the business model of such companies stack up.

This, combined with the pressing need to internationalise as users become ever more fleet of foot and the prospect that some less well-run operators could be at risk if a true downturn does emerge has led experts to predict that M&A activity in the sector will see a significant uptick over the next two years.

What is more, prospective landmark transactions such as the sale of IWG’s Spaces and WeWork’s anticipated $47bn IPO could compel others to cash in.

It will give rise to opportunities for those wanting to buy into the sector for the first time, for the big to get bigger through mergers and for traditional landlords to introduce flexible offices into their businesses by buying firms.

Deals in the offing

“The market is ripe for consolidation and small scale operators that are not as well run might struggle,” says David Marks, co-founder of Brockton Capital, which owns the London-focused, flex office business, Fora.

“Any smaller scale operator in London or the regions dreaming of a WeWork style multiple is going to be sorely disappointed but the WeWork valuation is definitely good news for most business like Fora though.”

WeWork has set the agenda in terms of creating scale as the most active occupier in London and afar and those that cannot utilise the advantages of such a model may struggle, particularly if the market gets tougher.

“If you don’t have scale and only have a small pipeline it is hard and you are going to have to look to sell eventually as the investment in tech and capex needed is huge,” says another senior private equity executive looking to build scale.

Although poorly run operators will more susceptible to any prospective reduction in demand caused by political or economic upheaval the impact on the sector during the las downturn was relatively minimal.

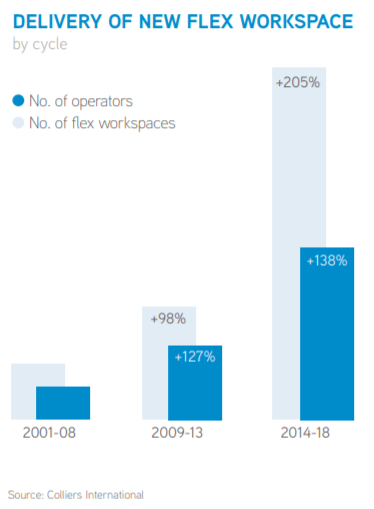

“It feels like we are more towards the top of the cycle in terms of rents and indicators and many operators haven’t been around in a down cycle,” says Tom Sleigh, head of flexible workspace consultancy, EMEA at Colliers International.

“If that does come around, undoubtedly margins are going to come under pressure. That said, the flex sector can react relatively quickly and in the last downturn, when the market was much less sophisticated, only one operator went under, and that was MLS and it was not really because it was poorly run.

“Flex space is also a much more accepted concept than it was 10 years ago, with a broader pool of demand that may look to utilise that flexibility if the market gets tougher. I don’t think there will be any widespread distress.”

Going global

With the international nature of business, particularly amongst corporates that are increasingly large users of flexible office space, the need for a global platform in order to become successful in the sector is becoming more pressing. This may also be a catalyst for consolidation between medium-sized operators.

“There are not that many cross-border operators across EMEA and there are not many in more than one country,” adds Sleigh. “The majority are single city operator and we think there will be cross border consolidation. There are signs that this is already starting to happen with Knotel coming over from the US and buying companies in Paris and Berlin.

“There is a lot of logic in bringing together the best in class operators with say 10 locations each in London, Paris and Germany in terms of economies of scale, marketing and central functions. But from an occupier perspective it is important to provide a consistency of experience and quality when you do so.”

Who is going to make it happen?

So if there is the drive and rationale to consolidate, who will be the consolidators? According to Marks, institutional and REIT investors will be active in buying platforms as they face no other choice than to be involved or be left behind but there is one clear candidate the capability of changing the game, and that is his former employer.

“Those that gain the best valuations are going to be those that have global footprints and the obvious player to bring about some sort of mass consolidation that has the firepower to do so is Blackstone with The Office Group platform.

“But if you think that companies should own their real estate to protect somewhat against any downturn, like us with Fora, as TOG is largely doing and as WeWork is increasingly doing, and you believe, like many are predicting, that 10-15% or even 20-30% of office space should be flex space then there isn’t enough capital on the planet available, even for Blackstone, to mean that the market can be owned by just a few players.”

Ultimately the serviced office market is likely to see the big get bigger, but the small and niche not disappear entirely.

“It will likely follow a similar pattern to the hotel market, where there are lots of different operators and brands, but owners that own several of these, such as Starwood,” says Cal Lee, head of Workthere, Savills’ flexible workspace division.

“IWG already have more than five brands and I think we will see other larger players follow and seek to diversify some of their offer – for example WeWork are already offering WeWork Enterprise and HQ.”

Such a process comes with a health warning however and consolidators must avoid slipping into the trap of creating a homogenous product that puts off consumers.

“Scale is often the answer, but in many cases it is often the downfall. In an increasingly competitive market, providers more than ever need to know their end customer and they need to provide a service that keeps the customer. The providers that lose stickiness with their customers are most exposed to the impact of scaling,” says Lee.

There will no doubt be winners and losers over the next two years as the flexible office space evolves, but one thing is for sure is that there should be plenty of deals to do to keep investment bankers and brokers occupied.