This article is from the Australian Property Journal archive

RETIREMENT living operator Levande has exchanged conditional contracts for its first land acquisition, with plans to develop a new retirement community to house around 400 residents.

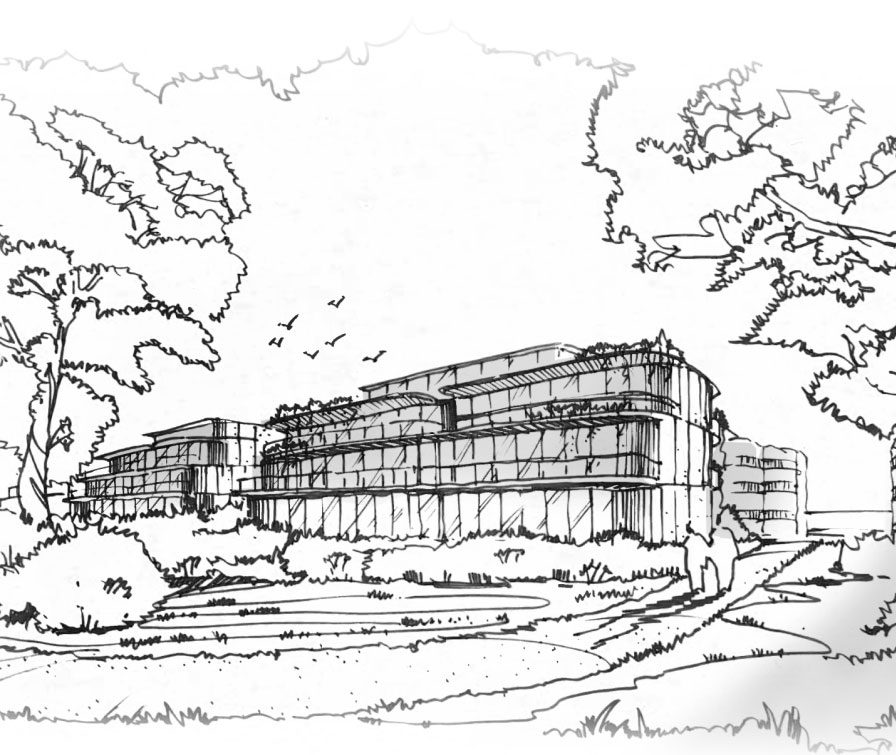

Located in Bentleigh East, around 15km south-east of the Melbourne CBD, the circa 1.75-hectare site is set to be occupied by independent living apartments across four buildings, including a village centre.

“It ticks a lot of boxes for our future residents, most of whom we expect will be local to the area. Being able to stay close to where they’ve lived for years means they’ll be able to keep their social connections, their healthcare providers, and all the other lifestyle features that are familiar and important to them,” said Kevin McCoy, CEO at Levande.

“Many, if not most, of our residents are ‘empty-nesters’ – older couples who are downsizing. When they move into retirement living, it means large homes become available for families who need them.”

Levande’s growth strategy will see the operator acquire assets in prime locations to meet the growing demand for premium retirement living near where prospective residents already live.

The group plans to acquire an additional 20 new sites for retirement villages across the coming three years.

“Our growth plans are ambitious. We hope to make an announcement soon on two other development sites, with a target of acquiring 20 new retirement village sites within the next three years,” added McCoy.

“Across our target markets of Sydney, Melbourne, Brisbane and Adelaide, we aim to build at least 500 new homes a year.”

Charles Bryant, head of acquisitions managed the deal for Levande.

While Trent Hobart, national director of Colliers, and Walter Occhiuto from Dawkins Occhiuto negotiated the sale.

The acquisition follows aged care group Aveo’s divestment of its vacant Queensland retirement villages, with the group netting $18 million plus GST from the sale of the Tweed Fairways facility.