This article is from the Australian Property Journal archive

UNIT sales across greater Melbourne plunged by 38% over the year, leading to the cancellation of several marketing campaigns because of insufficient pre-sales. A new report from JLL also found the supply pipeline is shrinking as developers convert existing DA approved residential apartments for alternative uses.

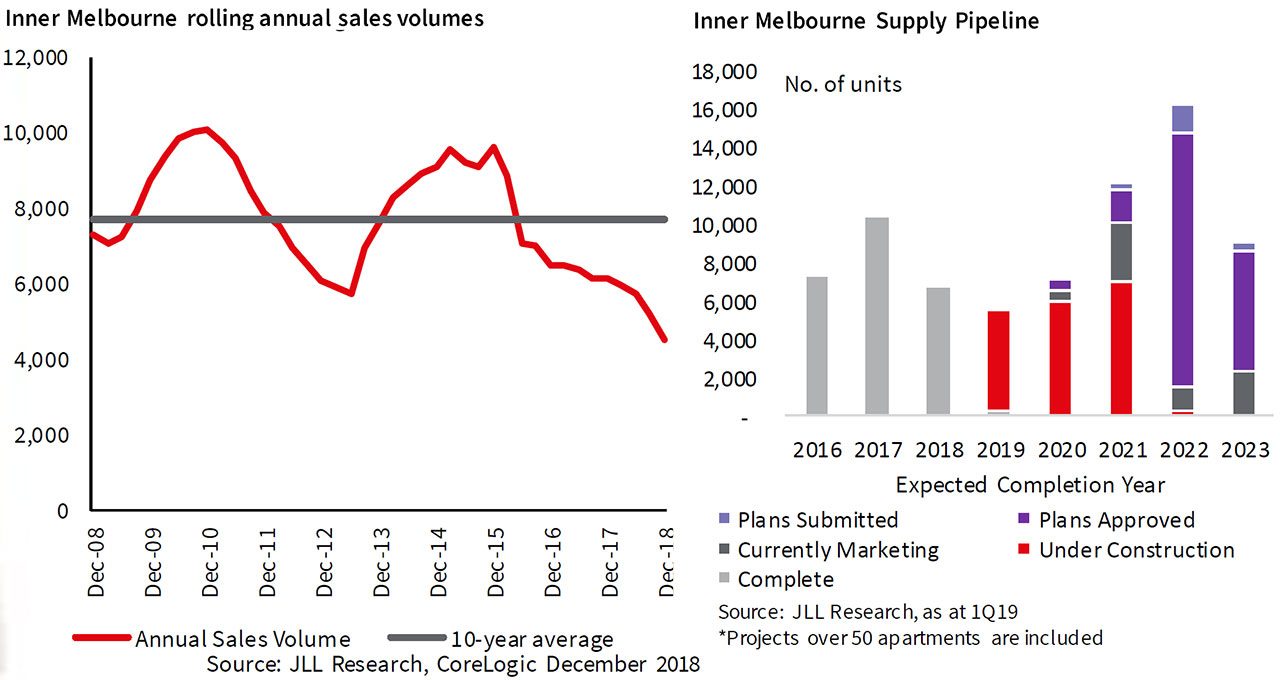

In inner Melbourne, sale volumes declined by 27% to 4,486 units in the year to December and approvals fell 79% to 4,801 units. Greater Melbourne apartment price growth for both new and existing stock fell 1.4% in 4Q18, which is now well below the five-year average of 3.6% – the median now sits at $550,000.

According to JLL, several marketing campaigns were cancelled in 2018 due to insufficient pre-sales, reflecting declining demand for off-the-plan apartments. This trend continued in 1Q19 with one campaign cancelled. Notably, these projects have been located in areas with a high amount of competing supply.

As a result, the supply pipeline has declined with limited new planning submissions and conversion of permitted sites to alternative uses, such as offices, hotels and student accommodation. Recent examples include the office building at 85 Spring St which was earmarked for residential apartments, that project has been shelved and sold, with the existing office likely to be refurbished.

An application for a commercial development has been submitted for 57 Haigh St Southbank to replace the existing permit of 248 units.

Meanwhile the most high-profile site, billionaire James Packer’s Crown Resorts $1.75 billion One Queensbridge, a luxury hotel and apartment project, failed to extend its planning permit after it was unable to obtain financing since gaining approval in February 2017.

As a result, the number of completions going forward has significantly declined over the past 12 months. In 1Q18, 6,250 units were expected to be complete in 2019, now it is 5,500.

A total of 782 apartments across five projects commenced construction, however construction finance remains a key barrier. Annual completions is expected to decline in 2019 but will rise in 2020 and 2021.

Despite the figures, national director Leigh Warner said it is largely Melbourne holding up the national construction numbers, with the number of apartments under construction in inner Melbourne a strong 18,540 (up 15% on a year ago).

Nationally the number of apartments under construction in Australia’s six major capital cities has fallen by around 10% over the past year. However, in an indication of what is to come for construction over the next few years, the number of apartments being marketed has fallen by a massive 48% over the same period.

“Nevertheless, even in Melbourne the number of apartments being marketed fell by 51% over the past year (1Q 2018 – 1Q 2019). Sydney has seen a 24% fall in construction over the past year and a massive 77% reduction in apartments marketed, while Brisbane experienced a 36% reduction in construction and 59% reduction in apartments marketed.

“The decline in the supply pipeline that has been happening for some time now very clearly illustrates how the pre-sales requirements put on developers by financiers in Australia makes our supply pipeline very responsive to prevailing demand conditions.

“We’ve seen quite a few projects that we’ve been tracking for some time be redesigned for other land uses including office, hotels and student accommodation by existing or new owners. This has particularly been the case in Melbourne,”

Warner warns the medium-term danger is clearly that it will take some time for the supply pipeline to get going again.

“And with still very strong levels of national population growth, we could quite easily move into supply shortages over the next few years at the national level. This could result in real pressure on renters in some parts of the country in particular and move us from a housing price affordability crisis into a rental affordability crisis if we are not careful,” he said.

Looking ahead, JLL expects conditions to remain tough in the short-term, with many parts of the country to see further downward pressure on prices and rents before starting to stabilise in late-2019.

“The combination of still tight credit, the federal election and buyers holding off to see where prices will settle in some markets will all remain headwinds in the short-term.

“However, we think the medium-term outlook is very different. We have not significant over-built in aggregate and very low completions over the next few years, along with continued strong population growth, will see us quickly move into an under-provision of space and see rental markets tighten once more.

“The timing of this recovery will differ across the country, but it is likely to be the resource markets of Brisbane and Perth that lead the next cycle as economic and population growth continue to improve in these markets,”

“The excesses of the booms in Sydney and Melbourne mean these markets will take longer for price growth to return, but lower investor activity could mean the turnaround in the rental market in these cities could be much quicker,” Warner concluded.

Australian Property Journal