This article is from the Australian Property Journal archive

FOR the second year running Melbourne has lead the country with the highest proportion of industrial sales volumes.

According to JLL’s Industrial Investment Review & Outlook 2022, Melbourne recorded a total of $6.87 billion in industrial sales transactions over 2021, accounting for 38% of the national total.

“In 2021 there was a focus from some buyers on increasing exposure to the Melbourne market through scaled acquisitions,” said Adrian Rowse, senior director of capital markets, industrial & logistics at JLL.

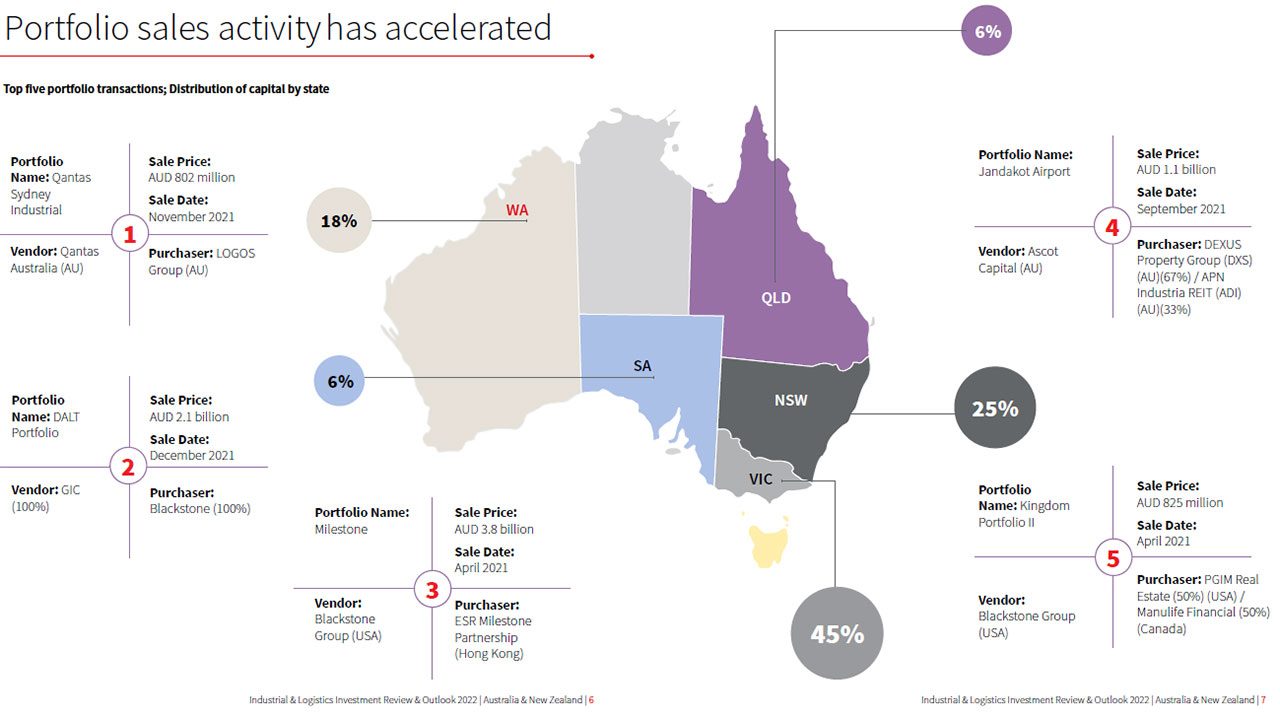

Further, Melbourne accounted for 45% of the capital deployed into the largest five portfolio transaction for 2021, reinforcing the city as a crucial industrial and logistics hub for Australia.

The city was also home to 2021’s largest single-market investment deal, with the $141 million sale & leaseback of two Patties Foods’ food manufacturing facilities in April, acquired on a 30-year sale & leaseback basis by Charter Hall’s Direct Industrial Fund No. 4.

“Melbourne will likely continue to be a leading market in terms of last mile logistics facilities, with the combination of a significant population spread across multiple major urban and suburban centres placing pressure on retail supply chains,” added Rowse.

Melbourne’s prime average yield midpoint tightened to 3.63%, compressing by 94 basis points over the last year in the largest full year compression ever recorded for the market by JLL Research.

This is largely attributed to available suitable stock in the city’s industrial market being outpaced by demand and the volume of capital wanting to deploy, with the market drawing in investor both on and offshore.

“With one of the fastest growing population in Australia for nearly a decade, expectations of returning robust population growth forecasts, record levels of infrastructure investment and a diversified economic base, conditions are supportive for continued tenant demand in the medium to long run,” said Rowse.

The broader investment environment is keeping transaction volumes buoyed, with investors confident in the current state of occupier demand in the industrial market and in its ongoing rental growth.

“Investors are confident in the Melbourne and Sydney occupier demand story with gross take up weighted 42% to Melbourne and 33% to Sydney in 2021. Elevated demand and scarcity of zoned industrial land supports the investment thesis,” concluded Annabel McFarlane, senior director and head of industrial & logistics research at JLL, Australia.