This article is from the Australian Property Journal archive

AUSTRALIA’S mortgage market looks set for more growth in 2016 despite regulatory and economic uncertainty, according to Deloitte’s 2016 Australian Mortgage Report.

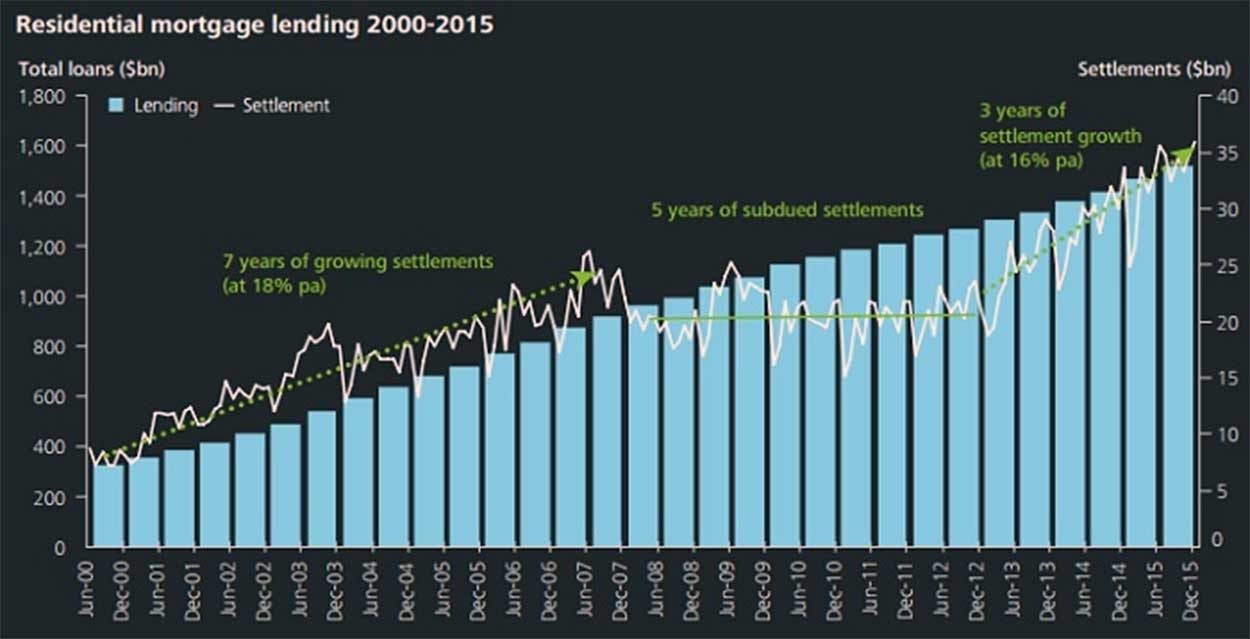

Outstanding residential mortgages hit the $1.5 trillion mark in the final quarter of 2015, and annualised lending grew by more than 7% over the year.

Co-author of the Deloitte Australian Mortgage Report, James Hickey said loan origination is a good gauge of community confidence, and the current market fundamentals support continued growth; including the low official cash rate of 2%, unemployment averaging 6% national and inflation being within the lower end of the Reserve Bank of Australia’s target range of 2-3%.

“These fundamentals indicate the strength of the mortgage market in 2016. While the debt to income ratio has deteriorated, from 125% in 2000 to more than 180% in 2016, this is against a backdrop of interest rates being substantially lower, with the debt burden being disproportionately shared by higher-income households – most able to service the debt,” he said.

However, the report forecast funding challenges and tightening regulatory requirements to pressurise growth.

Deloitte’s financial services partner Graham Mott said the funding market volatility has also meant an increased cost in the funding in the first quarter of 2016, placing further pressure on lenders to balance competitive rates to borrowers with stables returns to shareholders.

On the horizon for the mortgage industry is the digital influence, which Macquarie Bank executive director Frank Ganis said will assist all aspects of the mortgage process, from distribution and manufacturing to servicing and pricing.

“Digitising all these key aspects of the process will assist brokers and other intermediaries to access other ancillary financial products that borrowers now expect and demand. Nevertheless the real focus in the consumers’ mind is on choice, trust and convenience – key features of what intermediaries and brokers offer.

“Again, the report suggested regulatory factors may delay the digital influence on the industry,” Ganis said.

Australian Finance Group executive director Malcolm Watkins said there will be increased competition coming into our market this year, particularly in the small to medium enterprise and non-prime lending markets.

“These will be the first place we will really see a big change in our ability to talk to a customer and offer a product and rate very rapidly, with a very fast approval.

“However, right now the current regulatory and systems environment slows that kind of innovation. That’s why we can’t deliver tomorrow today. Not yet,” Watkins said.

The report tipped brokers to continue to originate more than 50% of new lending for the foreseeable future, but noted that digital distribution would gain increasing relevance.

Watkins said that while there has been a lot of focus on both the regulatory and consumer aspects of lending, he saw the real opportunity in lenders and brokers using digital to gain scale, adding that collaborating and investing in fintechs, particularly “reg-tech” fintecgs, would improve efficiency in the back office and allow brokers and lenders to do “twice as much volume”.

Deloitte financial services partner Chris Wilson said fintech companies will also start to use their algorithmic platforms and predictive analytics to help large companies and banks with their compliance overheads.

“Fintech providers will be able to help identify frontline issues, by applying different or unusual data sets to help with the decision-making. Through carefully-monitored access to internal data, fintechs will assist financial institutions generate more accurate regulatory compliance reporting reducing both cost and risk,” Wilson said.

Hickey said digital has not yet disrupted mortgage cycles, “despite all the hype”.

“Integrating digital into the mortgage process to gain efficiencies achieve scale, and create a more collaborative environment will improve the customer experience and provide a combined opportunity for lenders, technology providers, fintechs and regulators to work together,” Hickey concluded. “The promise holds much more for tomorrow than we are seeing today.”

Australian Property Journal