This article is from the Australian Property Journal archive

PRIVATE investors have been leading commercial office transaction over 2024, taking advantage of repricing across the still challenged market.

According to the latest Spotlight National Office Briefing by Savills Australia, private investors have made up 52% of all investments by volume in the first quarter of the year, which is around 2.5x their historical share.

This comes as institutional investors have remained more hesitant, cutting back competition for private buyers.

Private investors in NSW are leading activity out of the states, representing 61% of all office transactions in the first quarter.

“At a national level, private buyers accounted for around half of all investment volumes in Q1, reflecting a shift toward higher risk-return investment styles in line with predominant global trends,” said Chris Naughtin, national director of capital markets research at Savills Australia.

“Institutional investors are generally more cautious and constrained by investment mandates, and often more leveraged.”

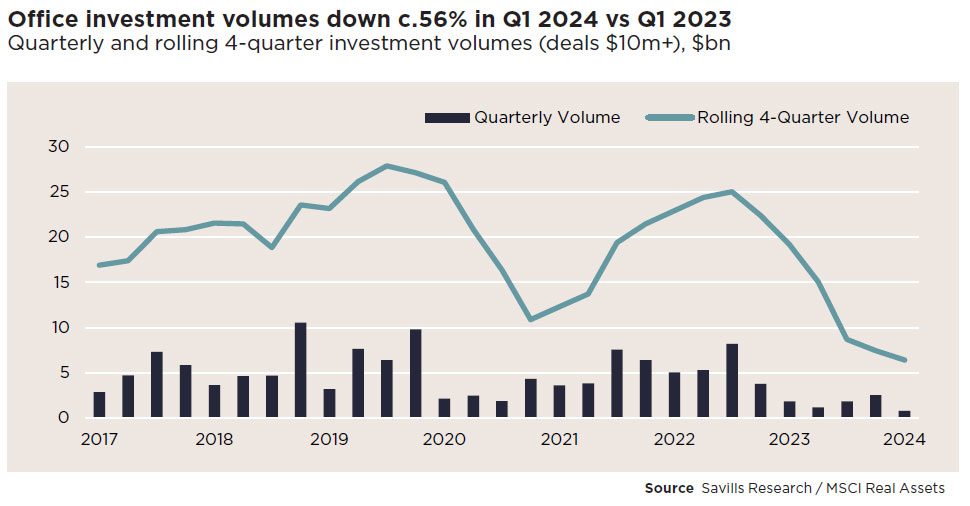

The commercial market saw a 56% decline in office investment volumes compared to the 1Q23, though activity is expected to pick up due to this repricing and investors taking on a counter cyclical approach.

“Pricing will continue to adjust throughout 2024, boosting investor confidence as the year progresses,” said Naughtin.

As secondary office asset acquisitions for repurposing was the largest driver of activity over the period.

Seen in the sale of 82 Sussex Street, Sydney to Sugolena Pty Ltd for $29 million, with the buyer earmarking the site for a mixed-use redevelopment.

“These emerging trends of asset repositioning and countercyclical investment strategies in Australia’s commercial property sector reflect global trends being played out in capital markets around the world,” added Naughtin.

The flight to quality and location trend has continued over the quarter, while the commercial office market is still operating at diverse speeds.

“Australia is forecast to record the second strongest GDP growth among major advanced economies over the five years to 2029. Coupled with our sustained population growth, this is a significant tailwinds for the Australian economy in the medium-term, with potential flow on effects for demand for office space,” concluded Naughtin.