This article is from the Australian Property Journal archive

THE Queensland government will provide tax concessions for build-to-rent developments to encourage investment in affordable housing.

This move comes in response to the outcome of the Queensland Housing Summit and aims to attract investment to deliver new rental supply.

Amongst the measures, the Palaszczuk Government will provide:

- A 50% discount on land tax for build-to-rent developments that include at least 10% affordable housing, payable for up to 20 years;

- A full exemption for the 2% foreign investor land tax surcharge for up to 20 years;

- A full exemption from the Additional Foreign Acquirer Duty for the future transfer of a build-to-rent site;

“We know Build-to-Rent programs create more affordable housing in the areas where it is needed most,” Premier Annastacia Palaszczuk said.

“Driving new investment into social and affordable housing is key to ensuring we get more Queenslanders into the safe, secure homes,” said the premier.

These land tax concessions build on the government’s build-to-rent Pilot Program, which has supported three developments delivering over 1,200 new dwellings, including up to 490 rental homes provided at discounted rent thanks to government subsidies.

The government also recently released an invitation for Expressions of Interest under the $2 billion Housing Investment Fund, targeting proposals for social and affordable housing developments on privately owned sites, including affordable-only proposals.

William Poole, CBRE residential development director, valuation & advisory services, said the requirement to deliver at least 10% of product as affordable housing is also a move in the right direction.

“This announcement brings Queensland up to speed with Victoria, NSW and South Australia in providing land tax relief for eligible BTR developments, under various models.

“As Queensland grapples with significant residential supply shortages and the need for more housing, the emergence of BTR will be a key component to delivering meaningful supply to the market. The requirement to deliver at least 10% of product as affordable housing is also a move in the right direction, noting that other states already have a range of eligibility requirements.” Poole said.

Latest data from SQM Research shows Brisbane has a residential vacancy rate of just 0.8% or only 2,802 properties available.

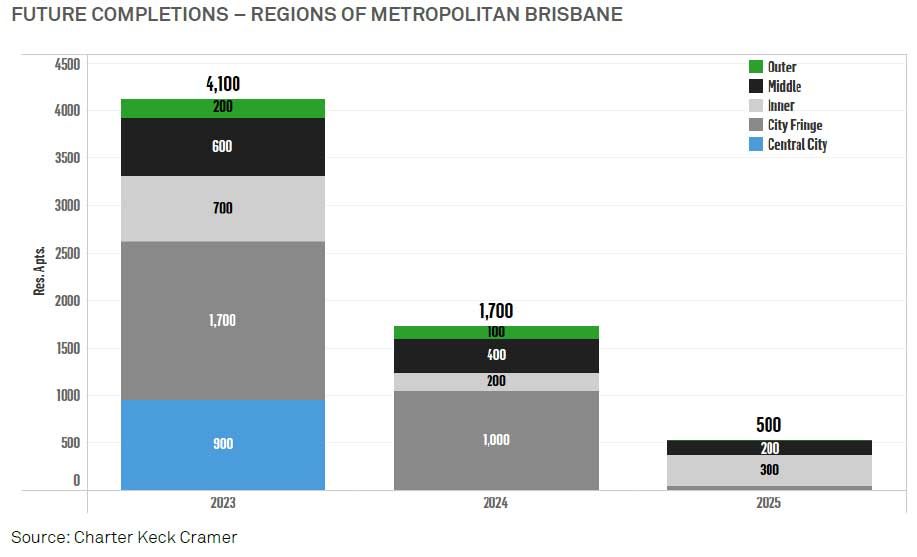

Meanwhile Charter Keck Cramer’s State of the Market report found Brisbane apartment completions and commencements have fallen to long-term lows and the city faces a substantial shortage of supply of apartments in the coming years, as project costs, diminishing purchaser capacity and sentiment all prevent new developments from getting out of the gates.

Richard Temlett, Charter Keck Cramer director, research and strategy, said the fundamentals to support build-to-rent in Brisbane exist and with over 35% of the population renting, there is a substantial opportunity for BTR to supply rental accommodation that will be unable to be supplied by the BTS market in the short to medium-term.

The build-to-rent apartment market is quickly emerging in Brisbane with two projects totalling 289 apartments completed and a further five projects with 1,400 apartments currently under construction.

There is a further 3,500 BTR apartments across 10 projects at the early stages of the development process, however, it continues to be very challenging to get projects to stack up as well as to secure funding for construction, Temlett noted.

A report released this week by Cushman & Wakefield said further tax and planning reforms are the key to bringing build-to-rent to the mass market.

Cushman & Wakefield’s research manager, Sean Ellison, said removing a unique tax impost for the sector can reduce rents without compromising the hurdle rates needed to attract investment.

Currently, build-to-rent investors cannot claim GST rebates already applied to other ‘commercial residential’ assets like hotels, while foreign investors are not eligible for Managed Investment Trust (MIT) concessions that benefit other asset classes, such as offices. Lengthy planning approval processes add to the time and cost.

Labor whilst in opposition under Bill Shorten committed to reform MIT, however Prime Minister Anthony Albanese’s government has not indicated it will pursue those changes.

Cushman & Wakefield’s modelling of a ‘standard’ build-to-rent development in a Sydney fringe suburb, such as Alexandria or Zetland, shows a base case where rents are 20% higher than the median to meet internal yield targets. This is the result of both higher quality development and premium positioning and the taxes applied.

However, if GST and MIT concessions were applied, the rental premium could fall by 5% and still meet investors’ hurdle rates. Based on analysis of household incomes in these suburbs, the rent reduction would mean a one-bedroom unit becomes affordable for more than 20% extra households in these suburbs.

“Although the Australian residential market has been traditionally skewed towards retail investors, tightening yield gaps between residential property and offices is attracting institutional interest.

“However, tax settings remain a challenge for the sector, limiting its market size and restricting overseas operators from bringing their valuable experience onshore. Defining build-to-rent in the tax code as ‘commercial residential’ could attract investment and expertise, and improve project accessibility for more households.” Ellison said.

Cushman & Wakefield’s director, development sites and build-to-rent, Marcus Neill said build-to-rent activity is maturing in Australia. However, there are currently impediments to institutional capital that we simply don’t see in other commercial sectors.

“Unless addressed, this will stunt the maturity of an asset class that’s grown rapidly and meaningfully in the US and UK.

“We acknowledge that build-to-rent isn’t a panacea for Australia’s housing supply issues. However, a larger institutional presence in residential property and build-to-rent development can form an important lever in rebalancing supply and demand over the longer term.” Neill concluded.