This article is from the Australian Property Journal archive

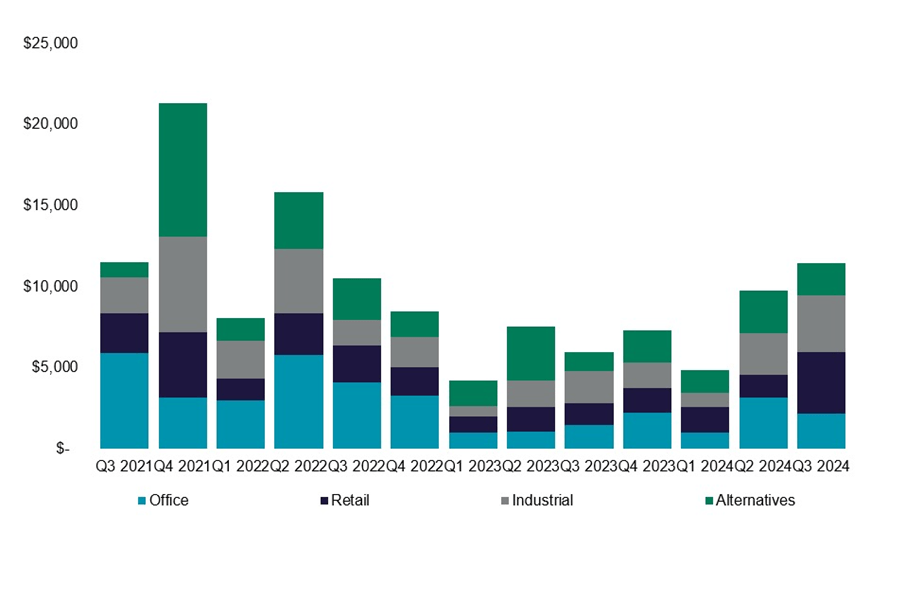

AUSTRALIAN commercial real estate (CRE) investment grew further in three months to the end of September, with $11.5 billion in deals, marking the first two consecutive quarters of growth in transaction volumes since 2020.

The momentum comes after an extended freeze in CRE deals as the sector underwent a post-pandemic period of pricing rediscovery, punctuated by large gaps between the expectations of buyers and sellers.

Cushman & Wakefield’s latest Capital Markets Marketbeat report showed the retail sector led the charge with its strongest performance since 2021, attracting $3.8 billion in investments. This was headlined by Hines and Haben’s joint acquisition Westpoint Shopping Centre in Blacktown for $900 million – the largest standalone retail transaction in Australian history.

Transactions over $100 million comprised nearly two-thirds of retail investment volumes. JY Group has just expanded its Australian shopping centre portfolio with the purchase of 50% interest in Sydney’s Warriewood Square for $135.5 million.

Other major deals included 50% shares changes hands in each of Westfield West Lakes ($174.75 million, Westfield Tea Tree ($308 million), Claremont Quarter ($207 million), Lakeside Joondalup ($420 million) and Westfield Whitford City ($195 million).

The logistics and industrial sector followed with a recorded $3.5 billion, up from $2.6 billion in the June period, as low vacancy and sustained rental growth continue to drive investment activity.

Despite slightly subdued activity in the office market, several significant transactions totalling $2.2 billion for the quarter showed vendor and buyer price expectations narrowing and signs that the pricing cycle is reaching its lowest point, especially for core prime assets – although MSCI has warned some further repricing could be on the way.

Sale included 333 George Street in Sydney to Deka Immobilien for $392 million and PAG (ASIA)’s purchase of 367 Collins Street in Melbourne for $315 million, the latter of which came at a 20% discount to peak book value.

Recent modelling from Cushman & Wakefield showing CRE asset values overall had bottomed, with a multi-year rebound taking shape.

Cushman & Wakefield Capital Markets Marketbeat Q3 2024

Investment Volume Chart Data

| Office | Retail | Industrial | Alternatives | |

| Q3 2021 | $ 5,907 | $ 2,476 | $ 2,182 | $ 936 |

| Q4 2021 | $ 3,151 | $ 4,079 | $ 5,898 | $ 8,181 |

| Q1 2022 | $ 2,987 | $ 1,365 | $ 2,345 | $ 1,392 |

| Q2 2022 | $ 5,788 | $ 2,576 | $ 3,978 | $ 3,498 |

| Q3 2022 | $ 4,128 | $ 2,282 | $ 1,553 | $ 2,556 |

| Q4 2022 | $ 3,294 | $ 1,726 | $ 1,916 | $ 1,543 |

| Q1 2023 | $ 1,005 | $ 1,026 | $ 637 | $ 1,546 |

| Q2 2023 | $ 1,074 | $ 1,546 | $ 1,629 | $ 3,302 |

| Q3 2023 | $ 1,462 | $ 1,349 | $ 1,985 | $ 1,158 |

| Q4 2023 | $ 2,252 | $ 1,487 | $ 1,585 | $ 1,975 |

| Q1 2024 | $ 1,011 | $ 1,592 | $ 878 | $ 1,389 |

| Q2 2024 | $ 3,173 | $ 1,407 | $ 2,583 | $ 2,616 |

| Q3 2024 | $ 2,199 | $ 3,805 | $ 3,490 | $ 1,981 |

The alternatives sector, including care, accommodation, mixed-use, service and storage assets, continued its upward momentum in the quarter, posting $2 billion as it performs in line with five-year averages.

“The sector’s steady growth demonstrates rising investor interest across various sub-sectors, particularly the living and care sectors,” Cushman & Wakefield said.

Foreign investors are looking to take advantage of countercyclical opportunities, with significant interest from pockets of core capital that have been dormant for the past 24 months, Cushman & Wakefield said.

Despite being below the long-term average proportional to domestic investment, there was $2.8 billion in offshore capital, including significant inflows from the USA, Japan and Germany.

Japanese investors in particular have made their presence known with a string of recent high-profile deals. Nippon Steel Kowa Real Estate has just partnered with Lendlease on a $500 million build-to-rent apartment project in Melbourne’s Docklands, and Hankyu Hanshin Properties joined forces with a Malaysian partner to invest $536 million in a portfolio of logistics properties across the country.

Cushman & Wakefield’s national head of research, Dominic Brown, said the rise in transactions highlights the re-entry of capital as pricing and economic conditions improve.

“Greater clarity of the interest rate environment, with anticipated cuts next year, has seen the investment market take significant steps toward recovery,” he said.