This article is from the Australian Property Journal archive

A CHRONIC undersupply of luxury rental homes has seen Sydney’s prestige residential rents continue to climb with the harbour city recording the third highest annual growth globally, behind Singapore and London.

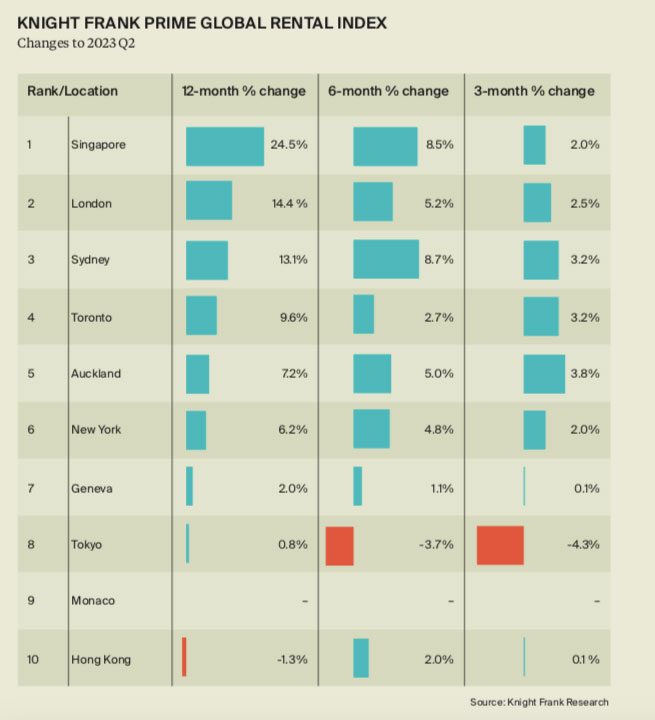

Knight Frank’s latest Prime Global Rental Index (PGRI) Q2 2023 show Sydney’s luxury residential rental growth in the 12 months to the end of June 2023 had surged from 11.7% to 13.1% compared to the previous quarter. Sydney has moved up from sixth place to third, and sits behind Singapore (24.5%) and London (14.4%).

Sydney recorded the largest growth over the past six months of 8.7% and the second largest growth over the past three months at 3.2%. The global PGRI increased 7.5% in the 12 months to June, down from the 8.2% seen in Q1, and lower than the 12.2% growth reached in the first quarter of 2022 – which marked the peak of the post-pandemic rental boom – but current growth remains well above trend.

Pre-pandemic, the 10 years to 2020 saw average annual growth of 2.2%.

Knight Frank head of residential research Michelle Ciesielski said the recovery in rents over the past two years had been remarkable.

“The overall index has risen by 23% from Q1 2021 to date,” she said.

“Growth in specific cities has been even stronger, with New York, Singapore and London seeing rental growth of 56%, 53% and 51% respectively over the same period,” she pointed out.

Ciesielski said key drivers for rental growth are led by strong demand as residents return to cities following lockdowns, the affordability squeeze as some prospective buyers are priced out of sales markets following rate hikes and weak new supply following construction disruption through the pandemic.

“While the rate of growth in many cities will undoubtedly slow, lack of progress on new delivery means tenants will face high rents for the foreseeable future,” she predicted.

Knight Frank head of residential Erin van Tuil said a chronic undersupply of rental homes currently extends to most parts of Sydney at every price point, and this continues to be reflected in the double-digit rental growth for luxury property being recorded.

“In affluent areas, there tends to be at least one home in the street having some type of renovation work done, and many take up a rental home while these works are being carried out. Construction delays over the past few years have meant these prime rental homes are required for double or triple the time than first expected while they wait for tradespeople and prime cost items from around the world to be delivered to finish the job.

“We continue to experience a skills shortage in Sydney, and this extends to the executive level who are most likely going to need a prime residential home provided when lured to work here. Elevated rents are being paid to secure a prime rental home until they settle into the city.

“In the past few months, there has been an increasing number of box office movies being filmed in Australia with actors and production crew using Sydney as their base, placing further pressure on the top end of our rental market.” van Tuil said.