This article is from the Australian Property Journal archive

AFTER a year and a half on the hunt for new digs, a tech business has nabbed a vacant inner eastern Melbourne building for $9.5 million to be its new home.

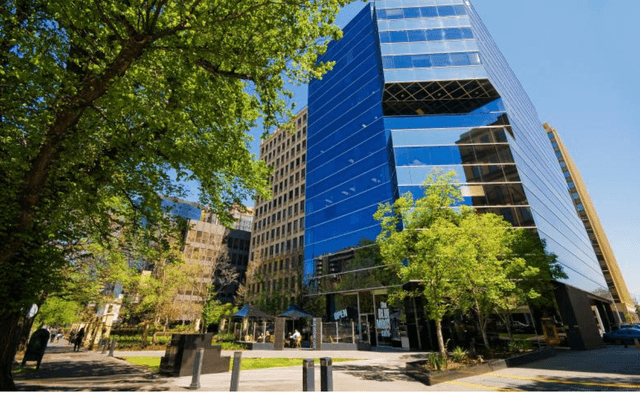

Put to the market with vacant possession, the two-level office building at 15-17 Shierlaw Avenue has a total area of 2,211 sqm and 74 basement car parks. It has a 5-star NABERS rating and was sold with the benefit of full vacant possession.

Colliers’ Ben Baines, Alex Browne, Eddie Foulkes, and James Zhuang managed the sale for a local investor who had owned the property for 13 years.

“The property was purchased by an owner-occupier who had been actively searching the market for approximately 18 months. This transaction highlights the continued strength and activity of owner-occupiers, particularly in Melbourne’s eastern suburbs,” Baines said.

The sale price represented a land rate of $5,536 per sqm.

The building, originally constructed in 1984, features lift access, existing functional fit-outs, outdoor terraces, and outlooks to the adjoining parklands. It sits on a 1,671sqm lot within a favourable Commercial 1 zoning.

“We received over 85 enquiries for this in-demand property, with over 80% coming from onshore investors. The high level of interest underscores the strong demand for suburban office buildings with exceptional car parking and excellent ESG credentials,” Baines added.

Browne said the sale underscores the strong buyer profile of owner-occupiers for older-style buildings, typically under 3,000 sqm.

Colliers data shows that so far in 2024, 50% of all office buildings sold for over $5 million have been purchased by owner-occupiers. Last year, owner-occupiers accounted for 61% of all transactions, significantly higher than the historical average of 30%.

There has been 19 transactions totalling $235 million in the market sub-sector to date this year.

Transaction activity overall is down about 56% year-to-date compared to long-term averages.