This article is from the Australian Property Journal archive

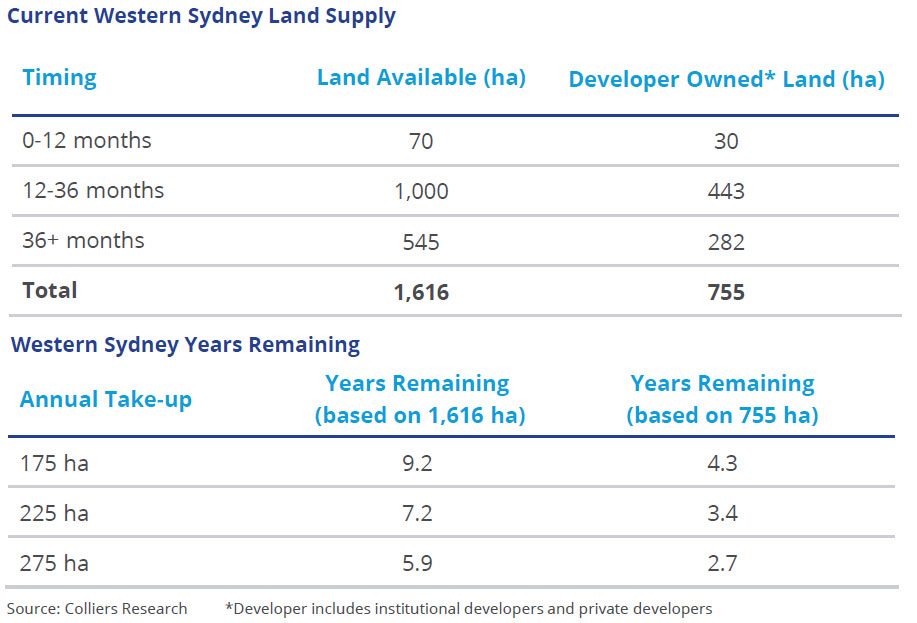

WESTERN Sydney has just 2.7 years’ worth of developable industrial land supply remaining, while demand for the market from occupiers is still coming in at record levels.

According to Colliers’ Western Sydney Industrial Development update for Q1 2023, the market has only 1,615-hectares of zoned industrial land yet to be developed, with only 70 hectares, or 4%, can support the completion of assets over the coming 12 months.

With demand pushing vacancy rates to just 0.2%, land take-up by industrial occupiers was 54% above the five-year average, for a record of almost 290-hectares in 2022.

“Developers control 47% of the total 1,615 hectares of land available for industrial assets, with the balance dominated by private groups who have shown limited urgency to progress development in recent years,” said Gavin Bishop, head of industrial capital markets at Colliers.

“There are also only 70 hectares of land in Western Sydney that are serviced with foundation infrastructure such as roads, enabling the completion of industrial assets this year, but they primarily consist of lots below two hectares, which are not suitable for big box demand.”

By Knight Frank’s numbers, industrial vacancies fall by 31% in 2022, reaching a country low for availability at just 89,129sqm, leading prime rents to grow by grew 12% over Q4 2022 and 29% over the year.

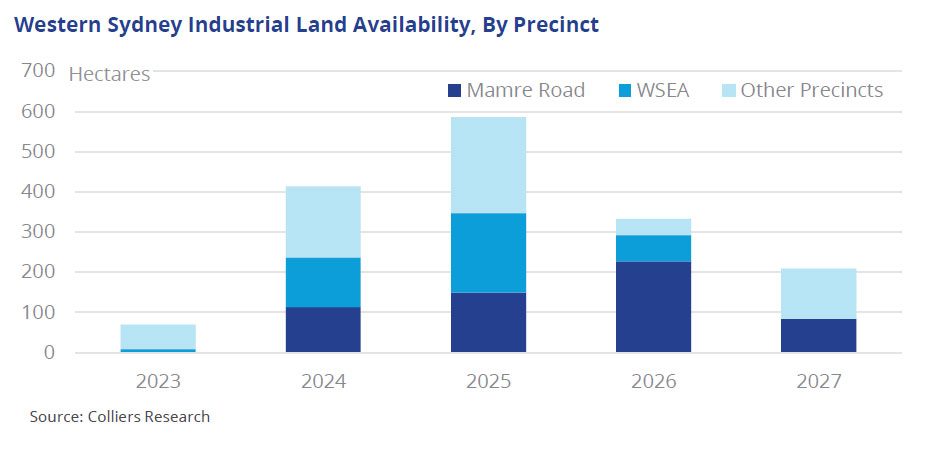

Colliers noted that both the Mamre Road and Western Sydney Employment Area (WSEA) precincts have faced delays over the last 18 months.

With the two precincts accounting for 60% of available land, the incurred planning, servicing, and road infrastructure delays mean the additional 414-hectares won’t reach the market until at least next year.

“Since industrial users have shown a greater desire to accommodate newer, more modern premises, there has been a recent increase in activity from industrial occupiers acquiring Aerotropolis sites, including DHL who obtained 24 hectares for almost $600 per square metre in early 2022,” said Jock Tyson, senior executive of industrial at Colliers.

With Tyson adding that the Aerotropolis could provide an additional 2,920 hectares of gross area from 2025, depending on precinct plans.

Developers are also fast-tracking master plan staging to accommodate speculative development, while also taking advantage of the favourable leasing environment.

With the speculative development pipeline for Western Sydney is up from 270,000sqm in 2022 to 600,000sqm for 2023, while the current market demand for 1.6 million sqm.

“The Outer-West and South-West submarkets will remain the most active for speculative supply this year, with the delivery of major facilities such as the Moorebank Intermodal Terminal (around 100,000 square metres), and the Light Horse Business Hub (around 43,300 square metres),” said Luke Crawford, director of research at Colliers.

“We expect rental rates for new developments will grow by up to 10% in some instances, with pre-commitment rents ranging in the order of $190 to $220 per square metre by end of the year.”

Prime rents are also growing at record levels, increasing by approximately 40% across the Western Sydney market.

With the demand pushing up rents over the last 12 months, largely coming from the retail sector, which accounted for around 40% of land take up.

Meanwhile, investment volumes for Western Sydney land in 2022 hit just over $1.2 billion, down moderately from $1.5 billion.

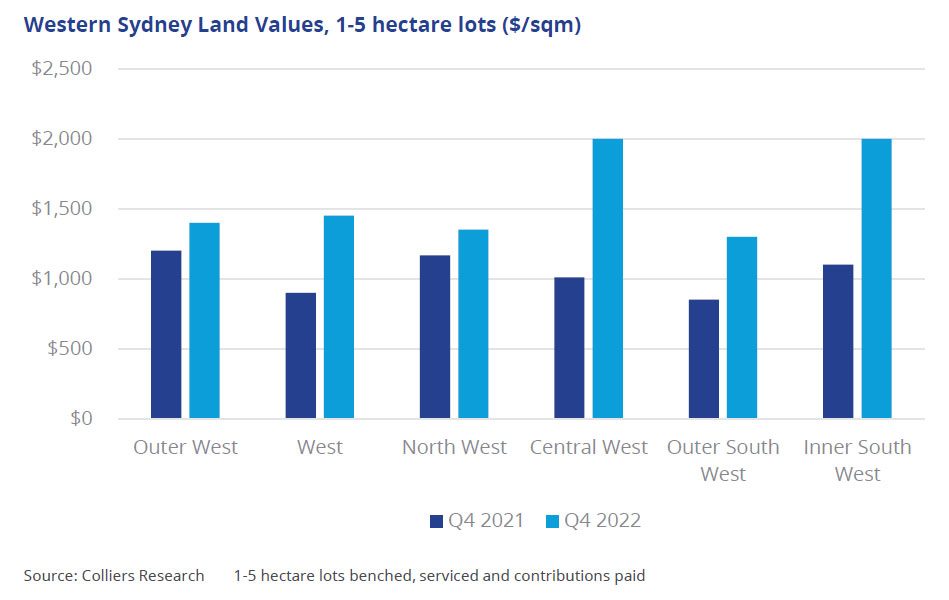

“Following a rise in land values in 2022 by around 27%, there has been a lack of sales evidence this year to demonstrate softening land values in Western Sydney in response to rising yields and elevated construction costs,” added Crawford.

Recent activity in the market saw an industrial facility at Wetherill Park sell to an owner occupier for more than $16 million, for a 5,715sqm the freestanding site at 8 Kellaway Place.