This article is from the Australian Property Journal archive

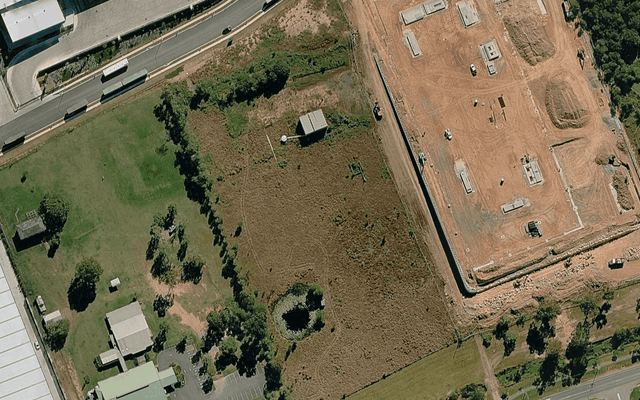

CENTURIA Diversified Property Fund is the latest investor to make a major office play in Brisbane, acquiring an A-grade building in the inner suburb of Bowen Hills for $65.4 million.

The purchase of 25 Montpelier Rd third by the fund this year will take its total assets under management toward $200 million.

Betting company Ladbrokes recently signed a 10-year lease across 3,250 sqm which took the 7,700 sqm building to full occupancy, with a 6.0 year weighted average lease expiry. The property has around 700 sqm of ground floor retail and 115 car parks.

The property is within walking distance of Bowen Hills train station and the Gasworks precinct which has a mix of popular restaurants, bars, shops and green spaces.

“This latest acquisition in Queensland will further diversify the portfolio by adding to our holdings in Brisbane, a market where we expect to see growth ramp up in the next six to twelve months,” Centuria’s joint chief executive officer, Jason Huljich said.

“Vacancy rates are falling, net absorption is up, and this means that effective rental growth is very likely to follow, particularly as infrastructure projects currently in the works start to come online.”

He said the acquisition is in line with the group’s strategy to accelerate AUM growth, and with the fund’s strategy to increase its balance of direct property exposure for investors, following the acquisitions earlier this year of 381 Macarthur Ave in Hamilton for $19.7 million and 10 Moore St in Canberra for $35 million.

“The fund’s strategy is to buy properties that enhance the quality and diversity of its portfolio and contribute to strong distribution returns for its investors.”

Also on the city fringe, a real estate fund managed by Credit Suisse Asset Management recently acquired the Jubilee Place office tower project, at 470 St Pauls Tce in Fortitude Valley, for as much as $200 million from JGL in a forward funding transaction, while further out in the suburbs, Charter Hall Long WALE REIT has settled on the $63.6 million purchase of the Australian Taxation Office building in Upper Mount Gravatt.

Central Brisbane has become a hotbed of investment activity. Shayher Group has just bought the Q&A Centre for $395 million from the Queensland Investment Corporation, shortly after Cromwell settled on its $524.75 million acquisition of the 35-level tower at 400 George St, and AsheMorgan’s $425 million purchase of the trio of buildings known as The Complex.

Brisbane CBD office investment volumes in the year to September were $2.86 billion, around $1 billion higher than 12 months earlier, according to Knight Frank. This was assisted by Oxford Properties’ purchase of former Investa assets last year an allocated $593 million, and their subsequent on-sale for circa $650 million, with the second tranche of this including The Complex.